At first, these may seem odd to compare. After all, one trend is about eating plants while the other is about avoiding certain plants. Nevertheless, the comparison is ultimately helpful as both movements tap into longstanding markets and broaden them beyond their traditional bases.

A brief history of gluten-free

Very few phrases in the food world are more polarizing than gluten-free. Long the begrudgingly accepted diet of people with celiac disease, gluten-free is now embraced by millions who swear by it, even though 72% of them don’t have a negative reaction to gluten. Some praise the gluten-free movement as a healthy choice while others decry it as a potentially harmful fad.

Regardless of your view on the gluten-free movement, it has had a tremendous impact on food brands and created a major financial opportunity for brands quick enough to capitalize on it.

Brands quickly began creating new gluten-free products and even started slapping gluten-free labels on products that were always gluten-free just to cash in on the trend. Gluten-free retails sales saw an estimated increase of 6% in 2016, although this is down from an 11% increase in 2015, indicating that growth, while still positive, is slowing.

The gluten-free market in the U.S. has been valued at around $1.7 billion just counting traditionally grain-based products that are gluten-free. If you were to include everything with a gluten-free label on it, the market would be much larger.

"The sales of plant-based food and beverages rose 8.1% to $3.1 billion over the past year, but the sales of products with vegetarian or vegan labels flatlined last year."

Here come the plants…

Plant-based products are nothing new, but brands proudly describing themselves as 'plant-based' are new. Lots of brands previously looked at the plant-based market as a limited opportunity with a low ceiling. After all, there are only so many vegans in the US.

The vegan products that did exist lived in a limbo world where they were made from plants but unwilling to talk about themselves that way. Look at the labeling of something like Boca Burgers over the years and you’ll see them describe themselves as vegan, vegetarian, or meatless, but never plant-based.

This positioning may work fine for customers who are specifically looking for vegan food, but other consumers looking for healthy plant-based products may actually be turned off by the labeling. The sales of plant-based food and beverages rose 8.1% to $3.1 billion over the past year, but the sales of products with vegetarian or vegan labels flatlined last year.

Brands have caught onto this. In May 2016, Beyond Meat’s plant-based burger, proudly self-described as made from plants, became the first non-meat burger to be sold in the meat section of a grocery store. This past summer also saw huge coverage of the Impossible Burger, another meatless burger created in Silicon Valley marketed as plant-based and indistinguishable from beef. Although these companies are two of the most well-known brands in the plant-based movement, they certainly aren’t alone.

Using CircleUp’s machine learning platform Helio, we analyzed 23,000 different food brands to determine what key words these brands used to describe themselves. There are 267 food companies that have 'plant-based' as a primary attribute.

This is small in the grand scheme of brands, and the attribute is still less common than 'gluten-free,' as seen below. Nevertheless, it’s significant given the youth of the trend and that we’re just looking at food products here.

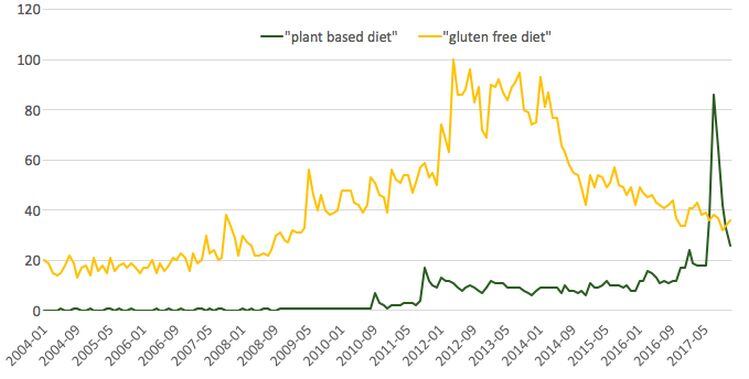

This is on par with the interest from the general public in plant-based products. As can be seen below, Google searches for 'plant based diet' spiked over the past year while searches for 'gluten-free diet' have gradually declined since their peak in the beginning of 2012.

The massive spike in plant-based searches in July was likely due to the publicity surrounding the Impossible Burger, but even before that spike, the search term was on the rise.

What happens next?

I expect the plant-based movement to parallel the gluten-free movement in a few important aspects and eventually surpass it in terms of brand adoption (it’s already surpassed it in terms of profit).

CPG companies will ramp up their manufacturing of plant-based products because ultimately, this presents an even bigger opportunity than gluten-free. The meat and dairy markets are worth hundreds of billions of dollars, so there’s basically no ceiling here. Additionally, brands will slap plant-based labels on products that were always plant-based to cash in on the trend.

"Google searches for 'plant based diet' spiked over the past year while searches for 'gluten-free diet' have gradually declined since their peak in the beginning of 2012."

While I don’t think consumers will react negatively to the plant-based movement, established industry players resistant to change are already wary.

Incumbents see that plant-based products are cutting into their market share and are fighting back. Members of the dairy community have been trying to pass the Dairy Pride Act which would forbid plant-based products from using terms like 'milk' or 'cheese' on their labels.

Meanwhile, big CPG companies have been taking the less political route of simply buying up plant-based brands to tap into their success.

In the meantime, expect to see more plant-based products on your store shelves, more plant-based stickers placed on products that always were plants, and more plant-based news about burgers that you just can’t believe aren’t beef.

"Brands will slap plant-based labels on products that were always plant-based to cash in on the trend..."

William Dowling is research manager at CircleUp, which provides capital and resources to early-stage consumer brands.