In the 12 months ending June 2016, growth in premium products – those marketed for at least 20% more than the average price for the category – outpaced total FMCG growth in every market across Latin America except Mexico and Venezuela, according to the research firm.

A survey of 3,583 Latin Americans conducted by Nielsen as part of a wider study showed that 55% of Latin American consumers were spending more on groceries than five years ago; this was up to 72% for Argentina. This increased spending, it said, was happening despite “tight economic conditions”.

“Inflation is causing consumers to be more strategic with their spending, while manufacturers are searching for ways to grow their profits. Despite the economic terrain, however, consumers are still seeking out the best products for their money, which highlights opportunity in the premium and health and wellness categories,” Nielsen said.

In its report 'Pockets of Growth – Latin America', Nielsen said 79% of consumers were open to buying newer products if they met key concerns and demands. It said there were a number of drivers, including growth of the middle class as well as a desire to be more health conscious among consumers.

“This openness is good news for the premium product sector, which is seeing higher sales growth than the overall market. But, while the opportunities are there, manufacturers need to have a better understanding of potential premium consumers in order to successfully develop and market to them,” it said.

It's about trust...

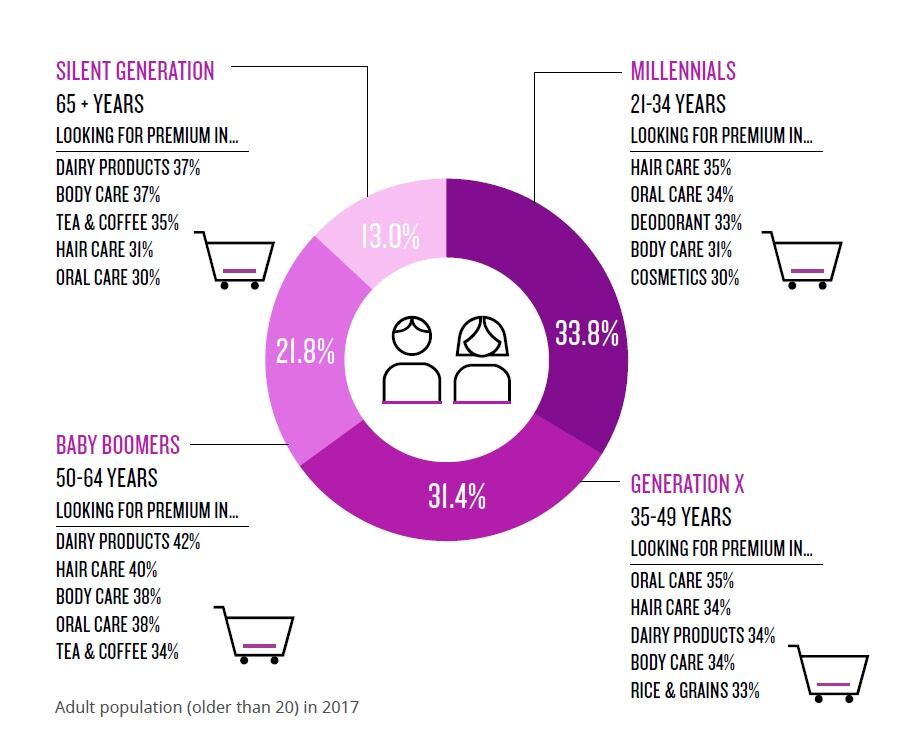

Among all consumer groups in Latin America, Nielsen survey data showed dairy was a category where premium was particularly important.

For the 'silent generation' (aged 65+ y ears), for example, premium dairy products were a priority, along with body care, with 37% actively looking for better dairy products. For baby boomers (aged 50-64 years), 42% were looking for premium dairy items and 34% of generation X (aged 35-49 years) were doing the same.

Facundo Aragon, industry leader at Nielsen Argentina, said it was clear that interest in premium dairy was a cross-generational trend, primarily driven by trust issues around fresh products.

“People do not trust low-price brands when buying fresh products. They believe that a premium brand or product can assure them on the quality and freshness,” he told FoodNavigator-LATAM.

According to the Nielsen global survey, 55% of LATAM consumers were willing to pay a premium for products that ensured high-quality and safety standards.

“...Considering an Argentinean consumer, people do not trust low-price brands when we talk about dairy – a very sensitive category – and security is key,” Aragon said.

What 'premium' dairy?

The majority of LATAM consumers (62%) considered premium products those made using 'high quality materials or ingredients'; 53% said a premium product was one which offered a 'superior function or performance', according to Nielsen.

Monica Espejo, food industry leader for Nielsen Chile, said in the dairy category, consumers were specifically looking for premium products that were natural, additive-free, functional but also indulgent.

“Refrigerated desserts and indulgence yogurt, plus new products like the launch of shakissimo (similar to a Starbucks coffee), have garnered interest,” she said.

Functional powdered milks were also increasingly popular among older generations in Chile, she added.