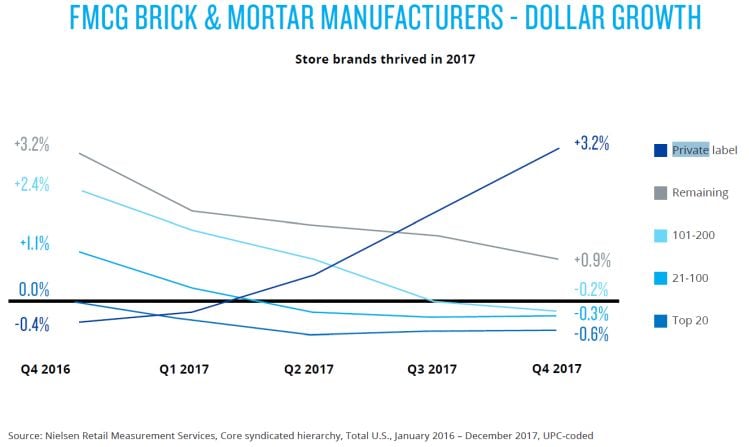

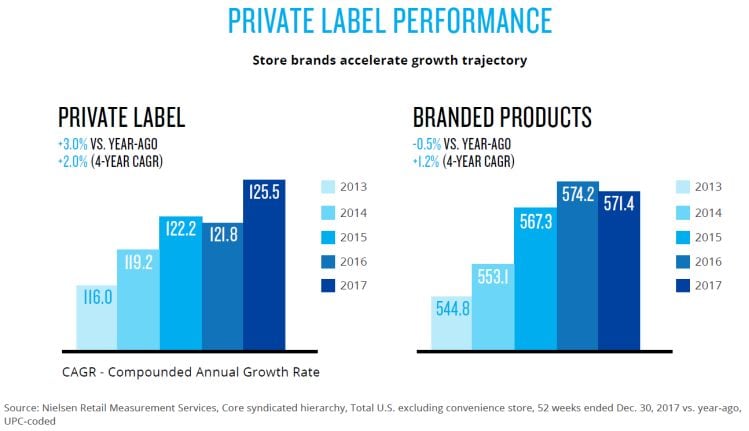

According to Nielsen's latest Total Consumer Report, store brands were trading negatively in the last quarter of 2016 but started to outpace national brands in 2017, and by the last quarter of 2017, they were “posting dollar growth of more than three times the rate of branded products.”

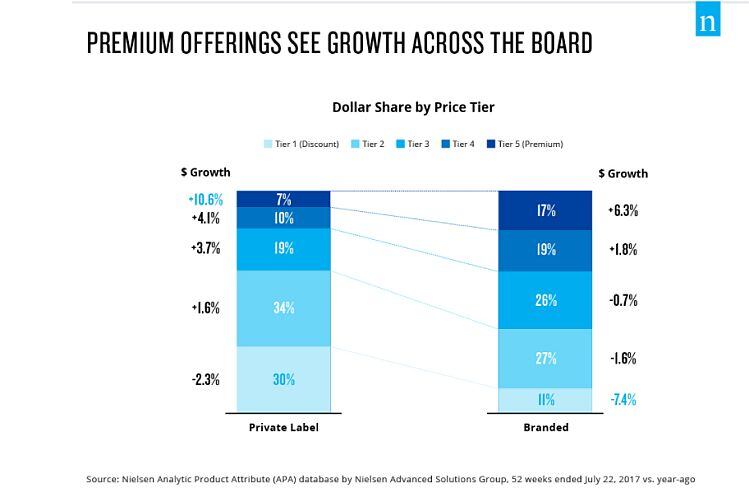

A deeper dive suggests that most of the growth is coming from premium private label, with the most premium products (which Nielsen classifies as tier 5) accounting for 7% of dollar sales but growing at 10.6% in the 52 weeks to July 22, 2017; while at the other end of the spectrum, discount products (tier 1) accounted for 30% of dollar sales but declined by 2.3%.

Similar dynamics are evident in the branded space, with tier five premium products accounting for 17% of dollar sales and growing at 6.3% YoY, but tier 2 and tier 1 products accounting for 27% and 11% of dollar sales but posting declines of 1.6% and 7.4% respectively.

Aspirational private label

So what’s the future for private label?

Matt Sargent, SVP Retail, at consultant Frank N. Magid Associates, told FoodNavigator-USA that private label penetration rates would likely increase "dramatically" over the next three to five years as retailers recognized the role store brands could play in boosting profitability, differentiating themselves and improving consumer loyalty at a time when traffic levels are down.

"You don't differentiate yourself by selling the same things as everyone else is selling. This growth will be driven less by demand than by the supply side need retailers have to differentiate themselves."

But true differentiation will require more unique and innovative products and packaging that give retailers a real point of difference in the marketplace, as we've seen from retailers such as Trader Joe's, he said. In other words, retailers will need to sell more private label products you can't buy anywhere else, not just cheaper versions of national brands.

He added: "I'm talking about premium products, aspirational private label brands. Any retailer that doesn't have a premium private label brand is in danger going forward."

Trust, taste, differentiation

But how will online platforms such as Thrive Market and Amazon – which have both outlined aggressive private label growth strategies – change the game? And will the growth of voice ordering platforms such as Alexa change the dynamic?

It all depends who owns the conversation, and which products are given top billing when a consumer doesn't specify a brand, said Sargent: The best seller? Amazon's Choice? Amazon's private label? Whole Foods 365?

While Amazon was quick to introduce Whole Foods 365 private label products onto its online platform, it has also been investing a lot in developing its own private label over the past couple of years, he added, and while not everything has been a success, it has the money and the patience to try things out and learn from its mistakes.

More curated platforms such as Thrive Market meanwhile, have also been very quick to capitalize on the private label opportunity, developing ranges that have quickly generated significant volumes and helped to make it an online destination for people looking for natural and organic products, he said.

"The branding is really good as well; it's all about meeting the needs of their core customer base."

In Q4 2017, Kroger's private label brands accounted for 26% of dollar sales, said CEO Rodney McMullen on a March 8 earnings call:

In 2018, he said: "We will be particularly focused on our top brands, Kroger private selection and Simple Truth... The data is clear. Customers love our brands better than the national brands and better than other private-label offerings. Our brands outperformed even the private-label brands you immediately think of as best-in-class."

"Private label remains a top priority. Our revenue growth in private label has been 30% or greater for the past seven years, and we believe private label can grow into the mid-teens penetration in the near to mid-term from 12% today.

"Our consumer insights are showing tremendous results from customers around private label, particularly in the areas of trust, taste, and differentiation. In 2018, we'll be introducing more unique items rooted in health, taste, and attributes across the store."

Amin Maredia, CEO Sprouts Farmers Markets, Feb 22, 2018 (Q4 earnings call)

“Private label is a core part of our strategy and it’s accretive, so it doesn’t cannibalize sales of the brands we offer.

“We’ve released more than 350 [private label] products in the last 12-24 months and they now account for around 17-18% of sales, whereas at Whole Foods, private label accounts for less than 10% and it’s taken them 20 years.

“It’s a very fast area of growth for us and when we launch a product in a category, almost overnight that category grows by 25-50% and we will become the number one selling product in that category in the first 3-6 months.”

Gunnar Lovelace, co-founder, Thrive Market

According to One Click Retail, there are three stages in the launch of an Amazon private brand: First, Amazon will release sample products, then it will monitor performance for 6-18 months, and finally the highest performing product lines will receive a full category release supported by strong advertising, including AMS, AMG, email campaigns, front page advertising and promotions.

“2017 was a game-changing year for Amazon private brands. The company has experimented with private brands for years, and has finally refined its strategy, leveraged its brand, and launched over 30 new brand names in highly competitive categories.”