According to its report, fresh categories have driven 49% of all dollar growth in brick-and-mortar retail registering $1.7bn in sales for the 52 weeks ending May 5, 2018 with frozen, dairy, and grocery aisles accounting for nearly two times the dollars spent across all fresh departments.

“Consumers don’t always have ample pantry space for extensive stock-ups, and some are seeking a fresh alternative,” Nielsen said.

Take soup for example, the shelf-stable canned varieties have increased sales by 1% to $1.7bn over the past year, but chilled soups found on the perimeter of the store are quickly rising in the ranks.

More than $1 in $4 spent on ready-to-eat soup occurs within the deli-prepared perimeter of the store with annual deli-prepared soup sales exceeding $500m. According to Nielsen, deli soup sales grew by 16% this year.

“Manufacturers and retailers should be actively monitoring all avenues for growth with soup consumers,” added Nielsen

According to Nielsen, knowing exactly where consumer interest is shifting within frozen, dairy, and packaged grocery categories can help brands differentiate themselves and minimize cannibalization of sales from fresh foods.

‘Shoppers don’t shop departments. They shop needs.’

And it hasn’t been a complete migration to the perimeter-of-the-store as can be seen by the popularity of salty snacks, which saw nearly $1bn of year-over-year growth.

“Although Americans would rank eating more fruits and vegetables as the top factor for healthy eating, they’re not flocking to on-the-go fresh produce offerings as much as they are to other snack options,” Nielsen stated.

In fact, total produce sales grew by less than 1% this past year.

“Salty snacks are proof that consumers are seeking indulgence in their snacking purchases, too.”

Gradually introducing fresh and “clean” ingredients to traditional snacking categories has been a route to growth for some snack brands.

The chilled bar space and on-the-go 'adultified' snack packs with various fresh and pantry items such as nuts, chocolate, cheese, and veggies have been popping more and more as a way to meet consumer needs for fresh, convenient, and satisfying food items.

Opportunity in prepared, ready-made foods

Consumers continue to look for convenient meal solutions giving rise to fresh prepared meal kits and protein-centered dishes, fueling growth in the prepared foods section of the store.

“The allure of having an entire meal occasion taken care of, seems to be driving performance here,” Nielsen said.

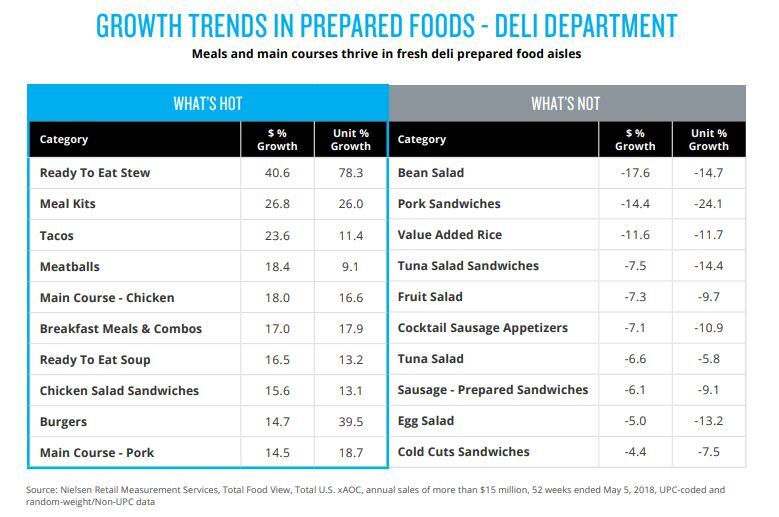

Ready-to-eat stews, meal kits, and tacos were the top three performing items of the $15m fresh prepared food category.

Not all prepared items have performed well, however, and traditional deli case dishes have lagged in growth. Protein-rich salads containing beans, tuna or eggs have seen steep sales declines, while ready-to-eat soups and stews remain among the top-performing deli prepared foods.

“We’ve seen struggling performance among many dishes that could be considered as sides or supplementary to a greater meal occasion,” Nielsen

continued.

“Consumers are seeking to fulfill an entire meal occasion in many cases. Therefore, converting that purchase may come down to whether a dish can appear elevated enough to warrant the tradeoff of purchasing it pre-prepared, in exchange for time-savings and convenience of an in-home effort.”

Nielsen added that prepared foods aren’t limited to fresh prepared offerings and there are opportunities to expand the definition of ready-made food items to adjacent categories including center-store edibles.

Lentil pasta meal kit brand, Modern Table, has tapped into the consumer’s need to leave the store with a full meal in tow with its pantry pasta kits that also encourages the addition of fresh ingredients.

“Expanding the prepared foods definition in this way, to center of store edibles, the category amassed over $43bn in the last year. But there’s still room to expand the boundaries of this playing field.”