A report sponsored by Perfect Bar and independently researched and written by Mintel in collaboration with SPINS reveals that over the past three years, the health and wellness snacking category has grown by 6% in dollar size, reaching $20bn. The category is being driven by rising demand for fresh snack offerings (+8%) and better-for-you shelf-stable snack products ( +5%), according to SPINS sales data for the 52 weeks ending April 22, 2018 vs previous years.

In contrast, the conventional snacking category declined 2% over the same period.

How did ‘fresh snacking’ emerge as its own category?

Fresh snacking as a concept began to accelerate roughly 10 years ago as smaller brands experimenting with different formats, whole-food ingredients, and portable packaging, started to gain traction, said Mintel.

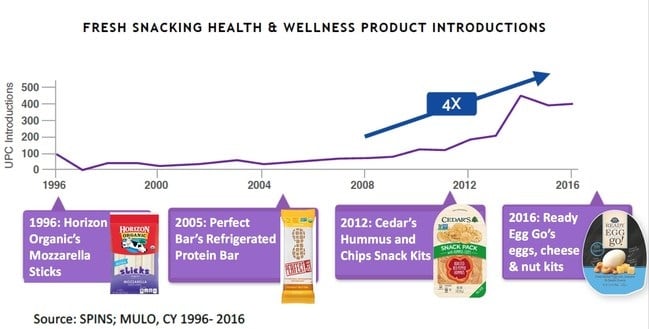

Fresh snacking product launches in the US increased by about four times compared to period prior, between 2008 and 2016 across six main segments (drinkable soup, refrigerated bars, RTD smoothies, snack packs, yogurt, and hummus or guacamole dips with crackers/chips), SPINS data showed.

Brands such as Perfect Bar, nomi (formerly Fresh Bar), and Bright Foods, are all appealing to consumer demand for convenient fresh snack products made with whole ingredients such as fruits, vegetables, seeds, and nuts.

“We've watched as consumers' adoption of a 'fresher-is-better' mindset has driven more brands to the perimeter of the store and, in turn, shifted the retail layout to focus on making the fridge set a prominent shopping destination," Bill Keith, founder and CEO of Perfect Bar, said.

According to the report, while 48% of shoppers regularly buy the same items from the store perimeter, 32% are specifically looking for new foods in outer store edges and 25% say it is where they buy impulsively.

"With the fresh perimeter growing at a rate of 2.1x the center of the store, we are able to validate the viability of 'fresh' as a continued focus for our retail partners across the nation," added Keith.

E-commerce hasn’t cracked the fresh snacking code yet

Consumers' demand for fresh products has generated an omnichannel macro trend, but inefficiencies in the e-commerce cold-supply chain have prompted traditional retailers to capitalize on consumers' desire to buy ‘fresh’ as they place importance on quality, price and impulse purchases.

The go-to place for consumers looking for fresh snacking options remains in brick & mortar retail, with 96% of perimeter shoppers saying they don’t purchase fresh online due to uncertainty of freshness and quality.

The economics of online retailers selling fresh packaged food online is still quite high due to complex cold-supply chains as refrigerated/perishable products require additional packaging and insulation in addition to expedited shopping.

However, the retail landscape of buying fresh is shifting with an increasing number of retailers offering ‘click & collect’ services and the expansion of refrigerated offerings beyond traditional grocery and into new channels including airports, gas stations, and coffee shops.

Fresh items are also breaking into center-store aisles – Kroger has starting placing fridges in baby food aisles to house chilled baby food brands such as Once Upon a Farm.

According to the report, retailers will continue to carve out space for fresh on-the-go food and beverage items as more consumers incorporate the trend into their day-to-day routines.