Speaking to FoodNavigator-USA after publishing a white paper with One Click Retail, Clavis CMO Danny Silverman said that even consumers with no intention of buying anything from Amazon still visit the platform to learn more about products, compare prices, and read reviews, which may inform their purchases through other channels, both offline and online.

“When shopping online, most people begin their search on Amazon… It’s no longer as important whether the conversion happens on Amazon, it’s about getting in front of consumers,” said Silverman, adding: “Smart brands understand that Amazon is more than a retailer platform or a commerce play, it’s truly a media and marketing platform.”

However, given that more than two thirds of Amazon shoppers never scroll past the first page, items on which typically experience more than three times the traffic of those on the second page, it is critical to optimize your profile to reach your target consumers, he said.

Keywords: Most people don’t search for brands such as ‘iPad’ or ‘Cheez-its

One of the most effective things you can do to give your brands greater exposure on the virtual shelf is to include search terms consumers are actually using in any given category (‘organic cat food’… ‘eco friendly laundry detergent’) in product titles, and keep them updated to tap into trends or seasonable opportunities (‘keto snacks,’ ‘Halloween candy’) he said.

“Most people don’t search for brands such as ‘iPad’ or ‘Cheez-its.’ Instead they use generic terms such as ‘tablets’ and ‘cheese crackers.’”

On Google, by contrast, users often search for a problem, while on Amazon they search for a solution, he said. “People having trouble sleeping will search Google for ‘insomnia’ and ‘sleep apnea,’ whereas on Amazon, they are more targeted, and search for ‘sleep aid’ or ‘melatonin.’” Amazon does provide insights into what consumers are searching for in a given category for a fee, he added.

However, looking at Google analytics can help provide some clues as to what keywords to use in product titles if you don’t have the cash to get the Amazon data, he said. “There are some insights that can be gleaned.”

The minimum for a product to be competitive is 21 reviews

Given that Amazon’s algorithms factor in the quality and quantity of reviews, strong reviews are critical to boosting your traffic and conversion rates, said Silverman, who noted that brands can deploy numerous tactics for driving review volume, such as using Amazon’s Vine program or a third-party review program such as Influenster to encourage customers to write reviews.

“The sweet spot for driving consumer confidence is an average customer rating of 4 stars or higher,” said Silverman. “When a product breaks the 4 stars threshold, conversion improves by 1.5 times on average, with diminishing returns beyond that point.”

As for the total number of reviews, “the minimum for a product to be competitive is 21 reviews,” he said.

Reviews can boost conversion by over 50%

When it comes to translating traffic into sales, reviews can boost conversion by over 50% and increase traffic by up to 25% – and this impact goes well beyond Amazon, he added.

But optimizing page content can also boost conversion by up to 36%, he added. “Images, bullet points, and ratings and reviews are the most impactful: over 95% of buyers look at images and content above the fold before completing the purchase.”

Why out of stocks on Amazon are a bigger deal than you think

Another factor that can be overlooked is the importance of being in stock, not just for the obvious reasons (if your product is not available, shoppers will go elsewhere), but because Amazon often penalizes items even after they return to stock, he explained.

“Clavis has observed items not returning to pre-out-of-stock organic search levels for weeks. Manufacturers that do not take stock management seriously can face both short-term and long-term discoverability issues.”

If an item is out-of-stock, Amazon will hide it from search results or switch the Buy Box to a third-party seller if available, he added. “Either way, the brand loses sales.”

Alexa is not a great interface for shopping in general, but having a screen is a step forward

Alexa voice shopping (which can be used to order Prime-eligible products sold or fulfilled by Amazon) will in the first instance recommend something you’ve already bought before, and if you’re a first time user, will recommend the Amazon’s Choice product in that category. If that is rejected or not available, it will recommend the top ranking Prime offer for the supplied keyword phrase, said Silverman.

While devices such as the Alexa-powered Echo Show - a WiFi-enabled device with a seven-inch screen – may change the equation, however, voice is not an ideal platform for shopping in that you can’t very easily compare prices and browse, he said.

“Voice is fine for re-ordering office supplies or subscription type services, but it’s not a great interface for shopping in general. Having a screen is a step forward, and if you look at the other things Amazon is testing with virtual and augmented reality, voice may take a more prominent role in future.”

Paid tactics: AMS and AMG

With Amazon Marketing Services (AMS), manufacturers can bid on competitive search terms such as ‘hand soap,’ allowing items to appear higher than they may organically, which is useful for newer items attempting to gain traction in Amazon’s algorithm against entrenched products where you want to get your brand in front of people who are not loyal to a specific brand, says Clavis.

Amazon Media Group (AMG) is better suited for targeting customers “at the top of the funnel,” says Clavis. “This allows ads to reach beyond Amazon.com. For example an AMG ad could target consumers searching for vegan recipes in order to promote the launch of a new food processor.”

Searching for soda on Amazon.com?

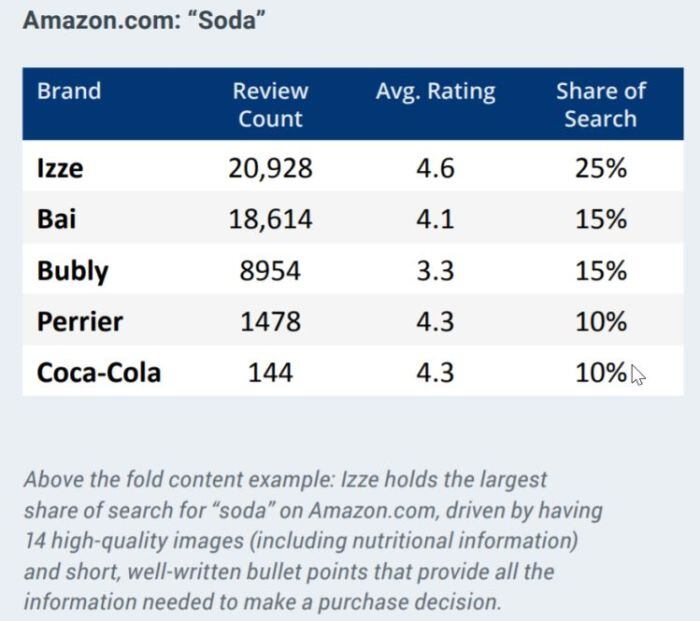

Considering PepsiCo-owned Bubly is a new brand, the number of reviews it has accrued is impressive, says Clavis , although the average rating is only 3.3 stars, “well below the threshold to produce strong conversion rates.”

Bubly’s higher review count does however, help it control a larger share of search than Perrier or Coca-Cola, “both of which hold a higher average rating of 4.3 stars but too low of a review count to drive the same level of traffic and conversion.”