Nestlé Waters North America has a consumer reach of 40 million households and one-third of households that purchased a sparkling water item also purchased a regional sparkling water, according to Sam Martin, brand business director, Nestlé Waters North America.

“We don’t want to stop until we’ve managed to get that 100% overlap,” Martin told FoodNavigator-USA.

When the company launched its revamped sparkling water portfolio, which included a complete overhaul of its packaging, flavor formulation, and nationwide media campaign, its goal was to convert its still water consumer into a regular sparkling water buyer.

“The promise when we had looked to launch this, which was really building incrementality to the sparkling water category, has really come to fruition in the first six months,” Martin said.

Its marketing approach did not entail converting Perrier and S. Pellegrino consumers to trade down in their sparkling water purchases, and instead focused on filling a gap in the market with a mainstream sparkling water brand from a spring water source.

“It was very easy to see how we could play in this space without stepping on the toes of Perrier and S. Pellegrino – We want to double, triple, quadruple the size of this category,” Martin said.

“We had said from the beginning if this was simply stealing share from an existing player type of effort it just wouldn’t be worth from our standpoint or the retailer standpoint.”

Where will growth come from?

The $2.2bn sparkling water has been on a hot streak for the past several years, generating $49m in sales over the course of one week this summer (Nielsen sales data for the week ended Aug. 18, 2018), a 22% sales increase from the same period last year.

However, according to Martin, there’s still a lot more room for growth despite rapid growth.

“When you still look at the household penetration, it’s still barely bigger than energy drinks,” he said. “There’s a lot of runway for the category.”

Along with category sales growth, competition has heated up, but Nestlé Waters North America believes its spring water sourcing will help set itself apart from other brands that use different water such as filtered and purified water.

“Spring [water] really is a differentiator that really allows to play meaningfully in a way our competitors just aren’t today,” Martin said.

Martin added that added a full offering of can sparkling water products has helped fuel a lot of the growth as many consumers are “incredibly format loyal.”

“Within the sparkling water segment so we see north of 70% of consumers are loyal to one particular format,” Martin said. “Until recently, we had no real meaningful can offering.”

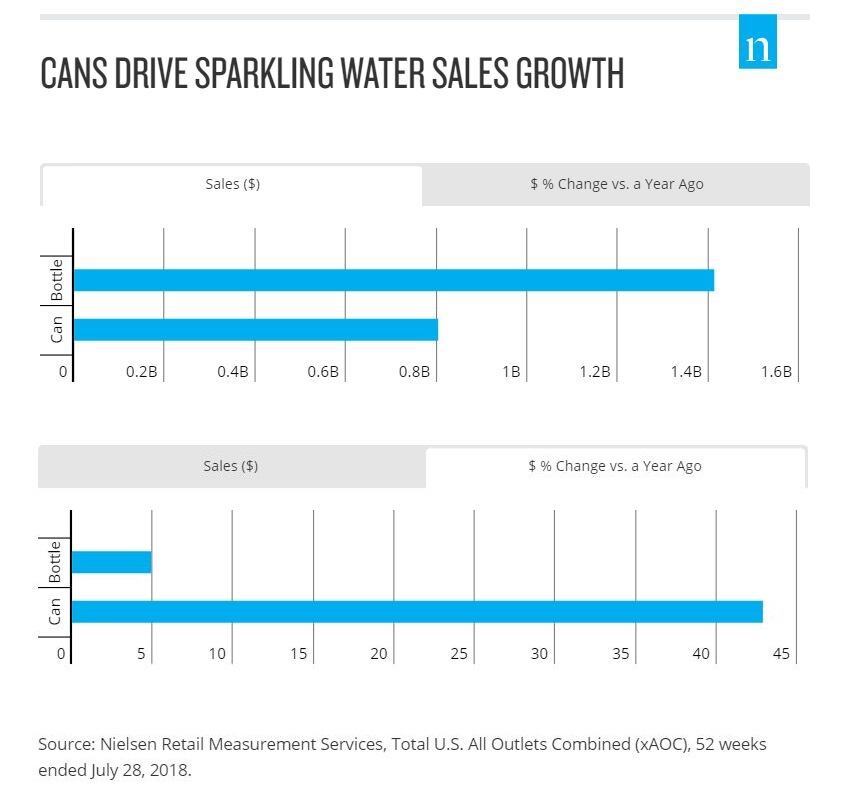

Cans hold a particularly significant meaning and are growing at faster clip than bottled sparkling water, Nielsen data showed.

According to Nielsen, bottled sparkling water commands the majority of dollar sales (64% of all sparkling water sales were from bottled varieties), but canned sparkling water sales increased 43% from last year to reach sales of over $803m. Within the category, Nestlé Waters North America outpaced the competition growing 52% in sales (compared to 29.7% of the overall sparkling water category) over the past four weeks ending July 14, 2018.

“When you look at where the vast majority of sparkling water consumers are defecting from, it tends to be from CSDs (carbonated soft drinks), both diet and regular. There’s definitely an experience tied into cans that is either evocative of sodas.

There’s just a different experience that you tend to associate with cans. Cans tend to be a much more social.”

‘We don’t plan to take the foot off the gas’

Encouraged by the growth its seen in less than a year, Nestlé Waters North America will be continuing launching five new flavors and expanding its advertising and marketing investment.

“Our incremental growth is well over our expectations of bringing consumers to the category,” Martin added.

“We don’t plan to take the foot off the gas in any way, shape, or form, with tremendous amounts of media and in store commitments. This is a commitment for the long term. We really do believe sparkling water will be as big as still water someday.”