“The growth will come back because the underlying dynamics are still there, even as the market has become more fragmented and the consumer seeks more variety," Pankaj Sharma told FoodNavigator-USA.

"Consumers are still looking for fresh and chilled products at the store perimeter and we know that genuine innovation in the yogurt category drives long-term growth."

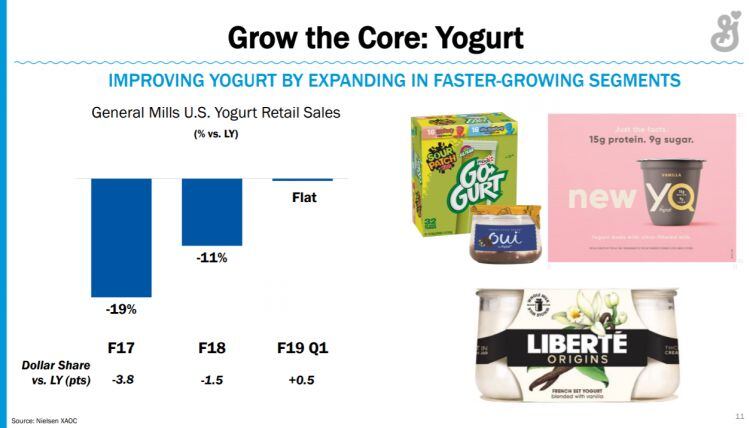

While the topline data from General Mills’ yogurt business has made for grim reading in recent years, things have changed significantly over the past year as declines in the core Yoplait brand have stabilized and the company has introduced two major new product lines (Oui and YQ), Pankaj Sharma told FoodNavigator-USA.

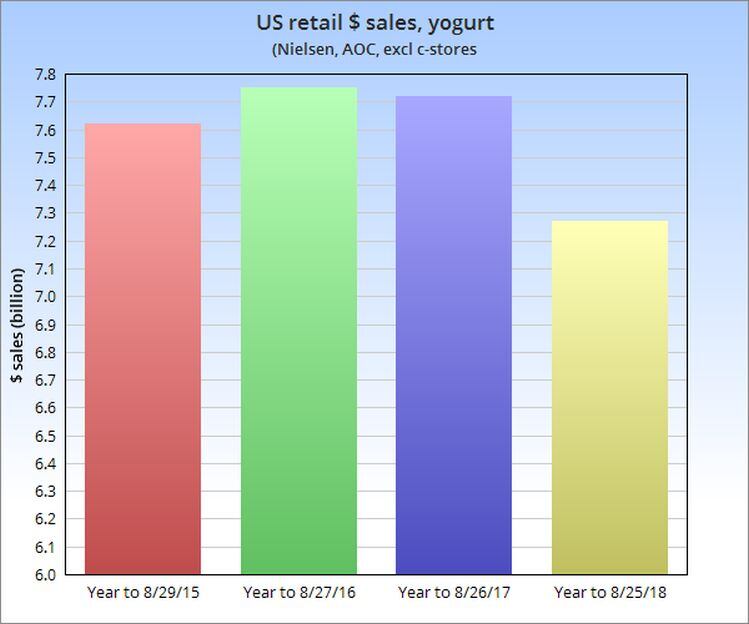

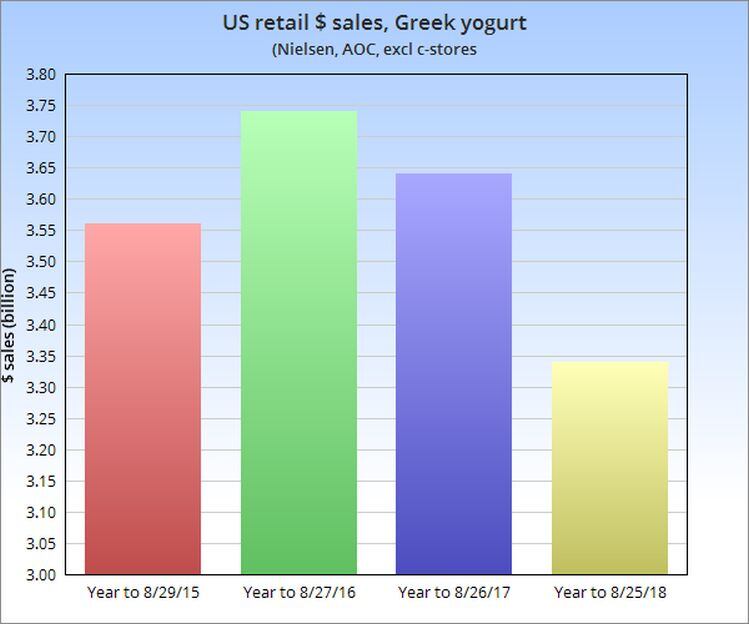

“A lot of the category declines over the past 12 months are really driven by declines in Greek yogurt, which is down nearly 10% [units, 52 weeks to Aug 25, Nielsen xAOC].

“Consumers are switching out of Greek and the market is moving towards consumers seeking indulgence or simplified health,” added Sharma, who moved rapidly up the ranks at Unilever before heading to General Mills, where he most recently served as VP marketing in Europe and Australia before taking the helm at the US yogurt business in May.

‘We know our strategy is working’

If you look at General Mills’ yogurt business, meanwhile, he said, “We were down -19% in full year 2017, -11% in full year 2018, and now we are nearly flat [-2% in Q1 2019] and we are growing share in the category, which is a really good place to be in; we know our strategy is working.

“We improved our fruit content in our classic red cup by 10% and we’re really pleased by how that’s gone, it’s a key part of our business stabilization. We’re also evaluating how we improve the creaminess and texture and thickness.

"On Go Gurt, we made the tubes easier to open and we launched Sour Patch flavors and we’re very pleased with how that’s doing.”

He added: “We’ve got a long tail of products with Yoplait, but the work with Yoplait original is critical. It’s a value everyday product you can eat throughout the day and we want to take it back to its roots. I think we need to bring the love and the emotion back to the category and to bring thought leadership back. Pricing is down in the category, but we’re not the ones that are driving it..."

“US yogurt net sales were down 2% as declines on Greek and Light were partially offset by Oui and YQ innovations in our simply better segment, and solid performance from Go-Gurt and original style yogurt.

"Retail sales results for yogurt were stronger with Nielsen measured takeaway nearly flat in the quarter.”

Donal Mulligan, CFO, General Mills, Q1 2019 earnings call, Sept 18, 2018

“As yogurt consumers increasingly shift away from Greek, we’ve seen considerable improvement for Yoplait Original, including growth on our single unit cup business.

"We’re also growing our largest kids’ yogurt business Go-Gurt behind fun news and engaging brand messaging.

Jeff Harmening, CEO, General Mills, Q1 2019 earnings call, Sept 18, 2018

Space allocation in the yogurt category

He added: “Space is coming down in yogurt as the category is declining… and retailers are trying to figure out where the space needs to go. So Walmart is experimenting with chilled snacking and others are expanding space towards what we call ‘simply better health’ with things like plant-based, probiotics, and drinks; and what we call ‘simply better taste’ with desserts and more indulgent yogurts and other products."

Oui above $100m in retail sales

Launched in July 2017, French-style set yogurt Oui – which fits into the latter category – has been a hit straight out of the blocks, claimed Sharma.

“I couldn’t be any more pleased. It was the single biggest launch in the yogurt category in the last five years with above $100m in retail sales and it continues to go from strength to strength; the glass jar equity, the fact we’re building a French dairy brand in the US, we were an IRI rising star.”

Oui Petites - a line of smaller 3.5oz jars with more indulgent flavors such as caramelized apple, chocolate with shavings, dark chocolate raspberry and sea salt caramel - has also created incremental growth for the category by “appealing to the snacking occasion,” said Sharma.

“Yogurt consumption in the US is still largely [at] breakfast but we wanted to create incremental occasions around snacking, late afternoon, pre-dinner.”

YQ: Some really strong consumer data

YQ by Yoplait, a 99% lactose-free high-protein yogurt made with ultra-filtered milk (milk filtered to concentrate the protein and reduce the lactose/milk sugar) that claims to ‘deliver big on protein with an intentionally less sweet taste’ has made a promising start following its launch this summer, he said.

“I must say I’m really pleased with how it’s started. There’s really nothing like this in the market, and we’re seeing some really strong consumer data coming through.”

Annie’s yogurt: ‘It didn’t really play out the way we hoped’

However, Annie’s first foray into the yogurt aisle, where it debuted in 2016 with organic whole milk yogurts, has not been as successful as the company originally hoped, conceded Sharma.

“Honestly it was an initiative that didn’t really work. Annie’s equity is where it can come in and de-junk foods, like mac & cheese, but yogurt is generally perceived as being healthy already by the consumer, so there was nothing really to de-junk. Still, l think it was right to try it, although it didn’t really play out the way we hoped.

“We’ll keep it at select customers, where it continues to attract a shopper base and we’ll continue to work with those customers, but it won’t be a national play for us.”

But he added: “we have an organic play with Liberté and it’s doing very well for us both in terms of sales and share.”