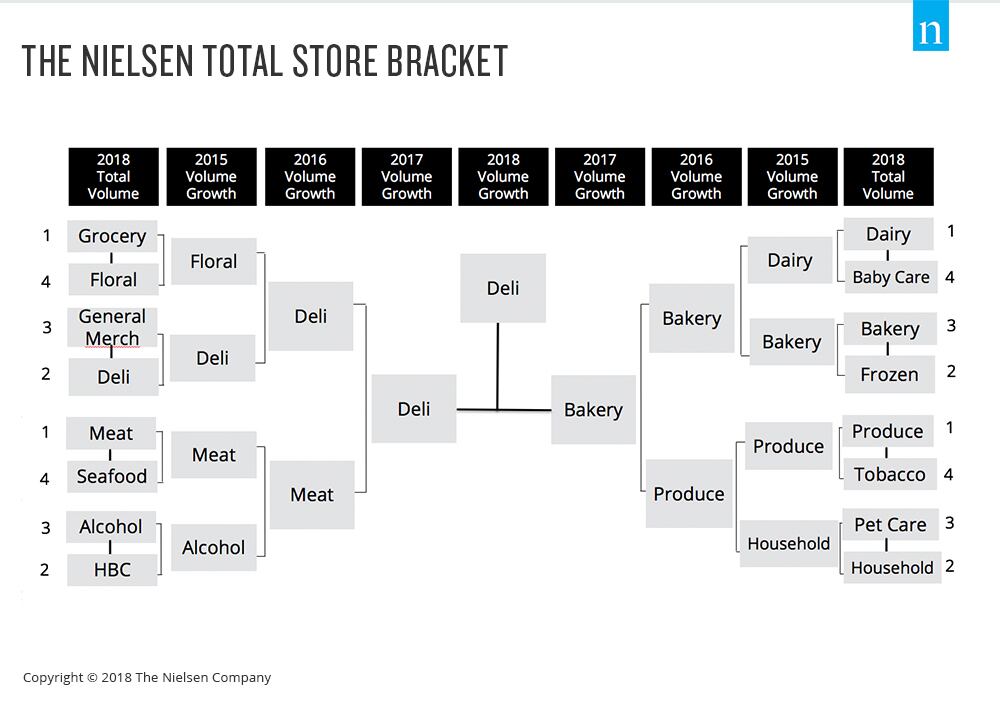

Nielsen created its own bracket tracking the annual growth of the 16 different areas of the store (keeping with the theme of the NCAA basketball tournament, which saw with 70 million Americans completing their own brackets, according to ESPN).

Nielsen created a 'Total Store Bracket,' ranking each department of the store by 2018 annual sales in the first round. Departments advanced through each round based on higher year-over-year volume growth beginning with comparing 2015 department sales annual growth in the second round (and then 2016 annual sales for the third or "semi-finals" round and 2017 annual sales for the finals round). **see bracket chart below**

Deli advanced through each round emerging as the champion of consistent store growth, according to Nielsen.

While all fresh departments (produce, meat, and bakery) won at least one round in Nielsen's bracket, the deli department emerged as the champion of the figurative bracket and "consistent source of store growth," noted Nielsen.

Breaking it down, the last department standing in its grocery store bracket by annual sales growth was the deli section, which had a higher volume growth than general merchandise, floral, and meat departments in each round it "competed". For the latest 52 weeks ended Feb. 23, 2019, the deli section generated $36.6bn in sales.

"Once heralded as a go-to for fried chicken or pizza, this department has avoided stagnancy with substantial growth in recent years from product groups that hit on our continually changing needs," noted Nielsen.

"Through its prepared foods section, deli has managed to satisfy the increased demand for convenient meal options."

Consumers are responding to the increased healthier prepared food options such as sushi and "innovative salads," as well as products that make snacking and entertaining easier including freshly made dips, according to Nielsen.

Meal kits gaining ground at retail

A relatively new feature of the store perimeter, meal kits are gaining ground and a spot in grocery carts. According to Nielsen, retailers' investment in in-store meal kits (e.g. Costco & Blue Apron and Kroger & Home Chef) is paying off: in-store meal kits buyers accounted for 60% of meal kit growth in 2018.

Mini pies

Runner-up to the deli and prepared foods section is in-store bakery, Nielsen found.

"The in-store bakery department gave a valiant effort, finishing a somewhat surprising runner-up. Despite the growing demand for health and wellness offerings, people still like to indulge. This $13.2bn department has capitalized on the continued demand for smaller products that meet the needs of today’s smaller households.

"Mini pies in particular have been the catalyst for surging sales within this department," said Nielsen.