Private label sales have surpassed $143bn in sales over the past year (52 weeks ended May 25, 2019 vs. one year ago), an increase of $14bn since 2015, according to Nielsen's Total Consumer Report.

The rise in sales of private label products is clear and, so too, are consumers favorable attitudes towards generic products with many stating that the quality of private label is as good, or better, than name brand products.

Sales of name brand products may grew by 2% sales in the past year but growth has been dragged down by changing consumer spending intentions, according to Nielsen.

"Store brand sentiment in this case has seen substantial improvement from 2014," said Nielsen. "Today, consumers are much more willing to splurge for store brands than they would for name brands. Forty-percent of surveyed Americans say they would pay the same or more for the right store branded product, while only 26% of those surveyed feel that name brands are worth the extra price."

By comparison, 40% of consumers in 2019 (vs. 34% in 2014) surveyed that if they like a store brand product, they are willing to pay the same if not more for it than the name brand equivalent.

Premiumization of private label

Store brands are leaving behind their generic stigma with many retailers introducing higher-end versions of private label. For instance, Target unveiled its new private label food line Good & Gather earlier this month, which will include more than 2,000 items and"trend-forward" products that don't cut corners on quality or taste, the retailer said.

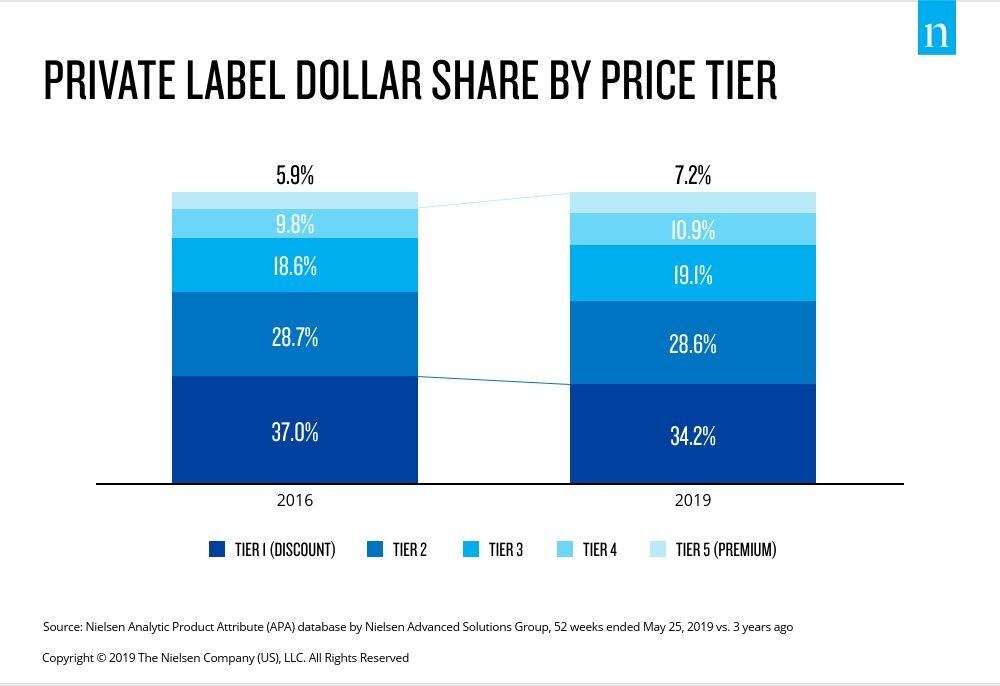

"The rise of higher-end store brand products has come hand-in-hand with consumers’ inclination to spend more on store brands. The premiumization of private label really comes to life when we look at products by price tier," noted Nielsen.

Nielsen created five-tier price distribution from analyzing UPC price points that separates the most premium private label brands from discount, value-positioned products (chart below).

While discount products still represent the majority of store brand sales in America they have fallen three share points in the last three years. Premium tiers of private-label products have grown in this time, now representing over 19% of sales, according to Nielsen data.

"Consumers are more willing than ever to foot the bill for the right store branded products," said Nielsen.

US value grocery stores take a hit in private label sales

When looking at the premiumization of private label, an interesting trend emerged. Discount, value private label retailers, including ALDI and Lidl, have collectively seen a 4% decline in private label share of wallet.

"Meanwhile, stores with premium products, such as premier fresh grocery stores like Whole Foods, Sprouts and Fresh Market, have continued to see lifts in private-label sales," noted Nielsen.

In premier fresh grocery, sales of private label products increased by 11%, +11% in mass merch & supers, +4% in warehouse club, and +3% in conventional grocery.

Conversely, name brands are seeing renewed consumer interest in discount, value retailers such as drug and dollar store, according to Nielsen.

"And though discount retailers have historically focused on store brands (or, private labels as we often refer to them), many have a renewed interest in name brands amid demand for premiumization. It’s an exciting time for all where private labels descend on mainstream retail and name brands resurge as mainstays to discount retail strategy," Nielsen added.