For much of March, many consumers were in an ‘extreme buying’ stage as they panic-shopped for shelf-stable baking ingredients and disinfectant wipes. For the first time, items such as toilet paper and soap were ranked among the top 20 purchased items in the week ending March 14, 2020, reported NCSolutions (NCS), a CPG advertising data firm.

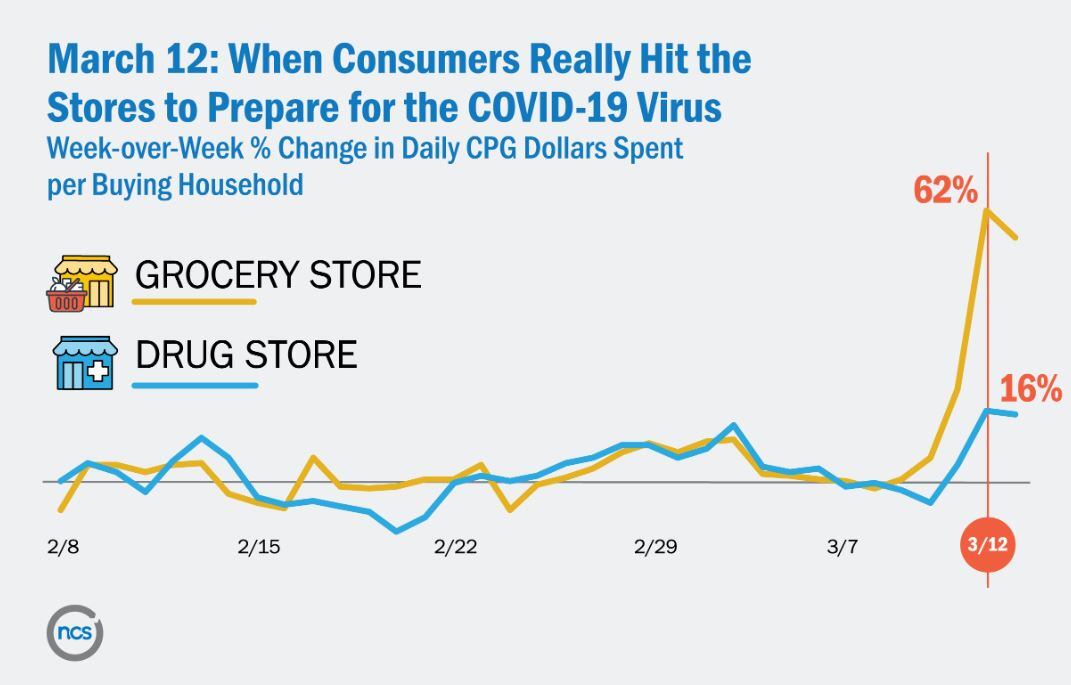

According to NCS, bulk buying really hit a tipping point on Thursday, March 12– after a series of unprecedented quarantine measures were announced. (e.g. suspending all national sports games and Broadway theatre productions). On March 12, US consumers increased their spend at grocery stores 62% compared to the week prior and more than doubled the number of items they typically purchased.

“March 11 through 12 had such concentrated news that suddenly it resonated with all parts of the public – suddenly, the coronavirus was very real. And people responded by mobilizing their shopping carts to get supplies,” said Linda Dupree, CEO of NCS.

That frenzied behavior may be beginning to lift, according to NCS, as consumers shift to shopping behaviors more reminiscent of a pre-COVID-19 world.

NCSolutions: Five stages of COVID-19 shopping behavior:

- Pre-COVID-19 Buying (prior to February 24): "Business-as-usual" non-seasonal grocery and OTC buying prior to February 24.

- Preparedness Buying (February 24 - March 10): As news about the novel coronavirus appears, there is a noticeable uptick in CPG purchasing at the end of February—a 2% increase in average household spending. Hand sanitizer and household cleaner purchases start to take off the last week of February, peaking on February 29, when toilet paper sales start to build.

- Extreme Buying (March 11 - 21): March 11 becomes the inflection point as consumers spend heavily to stock their pantries:During this stage, consumers clear out shelves and CPG retailers experience shortages of some items.

- Home-Confined Buying (March 22 and onward): "Social distancing" mandates limited visits to stores and average household spend dips compared to the 'extreme buying' stage

- New Normal Buying: The period after the pandemic (yet to be seen in the US)

“At NCS we’re seeing some emerging consumer behavior stages during COVID-19. There will probably be even more stages than this as we come to a new normal,” commented Dupree.

Consumers ease up on bulk buying

Unlike the extreme buying stage which had shoppers stocking up on as much toilet paper and cleaning supplies as possible causing supply and inventory issues at many retailers, home-confined buying means fewer trips to the store as consumers practice social distancing and follow new safety guidelines at retailers.

Beginning the week of March 22, average household spend dipped 9% compared to the extreme buying stage (March 11 -21), reported NCS.

"This pandemic is altering consumer purchasing behavior, although it's too early to tell if the change will be permanent," said Dupree.

In this home-confined shopping stage, consumers continue to shop and buy at levels 23% higher than before the pandemic hit, NCS noted.

Less essentials, more indulgence and convenience

In the home-confined stage, US consumers shifted their spending to buying fewer paper products and household cleaning items to purchasing more non-essential food items such as cookies, chocolate, and ice cream.

NCS reported that chocolate, which fell to #18 during the ‘extreme buying’ stage, climbed to #12 during the week ending March 28 (likely boosted by the anticipation of Easter), and ice cream and cookies joined the ranks, taking #14 and #5 spots respectively, higher than two weeks prior.

During the home-confined buying stage, shoppers are filling their grocery baskets with higher quantities of frozen meals, cheese, and lunchmeat, according to NCS.

Cheese reached #4 in the week ending March 21, up from #6 during the same period last year, and continues to climb, especially after many US schools shifted to remote learning programs with kids now eating lunch at home. At the same time, lunchmeat jumped to #32—up from #42 during the same period last year, and bread climbed from #7 to #5 between March 8 and 28.

Craving variety

“You crave variety when you’re so confined,” said Dupree.

"We expect Americans will adjust to a wider variety of the consumer products they're used to buying—not only of brands, but also of types, flavors and styles. They may try cavatelli pasta or cherry-flavored yogurt for the first time because their usual is out of stock and end up discovering a new favorite."

It remains to be seen when US grocery spending will get back to a “new normal," said Dupree. It will likely take some time after shelter-in-place mandates and other emergency measures are lifted before consumers feel more comfortable returning to stores, said NCS.