A recent Nielsen survey of consumers from over 70 countries shows that 79% of Canadians and 71% of Americans expect the spread and intensity of local COVID-19 impact in their country to increase.

According to the survey, 58% of those surveyed believe COVID-19 will last for at least four months in Canada and the US. More than a quarter (28%) of US consumers and (27%) Canadians are preparing for another six months of COVID-19 impacts.

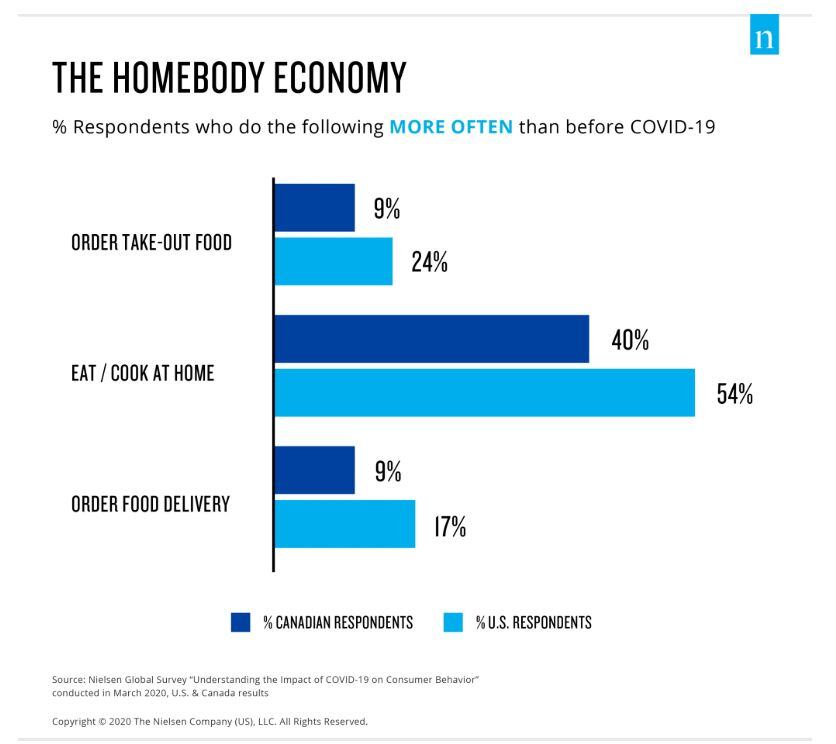

'The homebody economy'

Many North American consumer have settled into home-confinement habits and have adjust their behaviors accordingly, reports Nielsen.

Four in 10 Canadians, and five in 10 Americans indicate they cook or eat at home more often now than before the COVID-19 outbreak. Nearly a quarter (24%) of US consumers say there are ordering take-out food more often.

As a result of the increased product needs at home, sales of CPG items have exceeded 2019 levels. In the year-to-date period ended March 28, total CPG sales were up nearly $23.7bn in the US and $2.7bn in Canada compared with a year-ago.

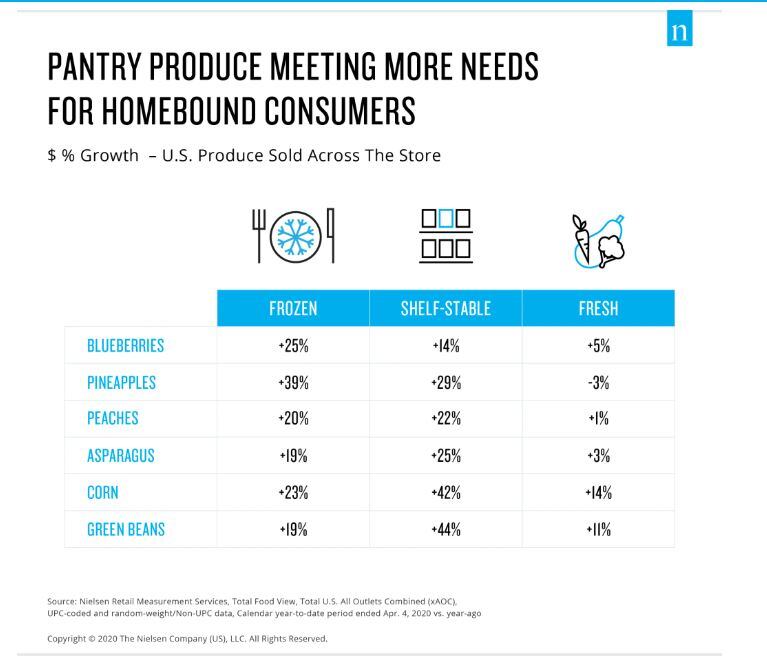

Embracing produce across the store

Sales of center-store products have exceeded those from the perimeter of the store as consumers balance health with practicality of extended shelf life items.

For instance, consumers are actively buying canned, bottled, or frozen varieties of fruit and vegetables and report that ‘pantry produce’ is meeting more of their home confinement needs than fresh produce currently. This shifting consumer attitude is reflected in sales figures as in both Canada and the US, purchases of frozen and shelf-stable fruit grew at three to five times the rate of fresh fruit in the year-to-date period ended April 4.

However, fresh produce suppliers will need to remain aligned with consumer needs during this period, noted Nielsen, which predicts rising demand for fresh products of local origin.

For at least 15% of surveyed Americans and 14% of surveyed Canadians, buying local products (products from within Canada or the U.S.) has been something they’ve actively done more often than before COVID-19.

“The more that growers and suppliers of produce can promote the specifics of which country, state, and even farm or neighborhood their product originates from, they can provide complete transparency to consumers who may fear the risks associated with products that have had too many global touchpoints,” said Nielsen.