"I believe that there is tremendous value left in this brand," said Sebastiani, who was speaking to FoodNavigator-USA after Sonoma Brands announced the completion of a deal to buy KRAVE for an undisclosed sum (lower than the previous price tag, although he won't say by how much).

"We have access to talent of all disciplines - finance, supply, sales, and marketing - at Sonoma Brands. But we've already hired several people [dedicated to KRAVE] and our approach is to build a Navy Seal type team that's extremely lean; we believe we can re-establish the brand's prominence without throwing too many bodies at it."

Under the deal, KRAVE will be part of a new holding company called Double Peak based in Sonoma, California, and led by Sonoma Brands managing director Kevin Murphy as executive chairman, with a new CEO to be brought in as the brand ramps up again.

Sales dropped to $20m in latest 12 months... from peak of $125m in 2016

So what happened to KRAVE after it was acquired by Hershey, a CPG giant with real R&D muscle, a ‘best in class’ supply chain, and merchandising and distribution ‘horsepower’ that Sebastiani said at the time would enable the brand to rapidly accelerate its growth trajectory?

Initially, KRAVE stayed in Sonoma, operating as a standalone business within Hershey North America under Sebastiani's leadership for the first year, doubling sales to $70m, said Sebastiani, who worked in the family wine business in Sonoma before turning his entrepreneurial talents to meat snacks in 2009. Sebastiani spent the next five years on a mission to turn jerky – a leathery gas station staple – into a premium snack every bit as enticing as a good wine via the KRAVE brand.

The following year (2016) Shane Chambers was brought in as general manager, with sales increasing to $125m before he left in 2017.

'Its numbers fell and more retailers discontinued it'

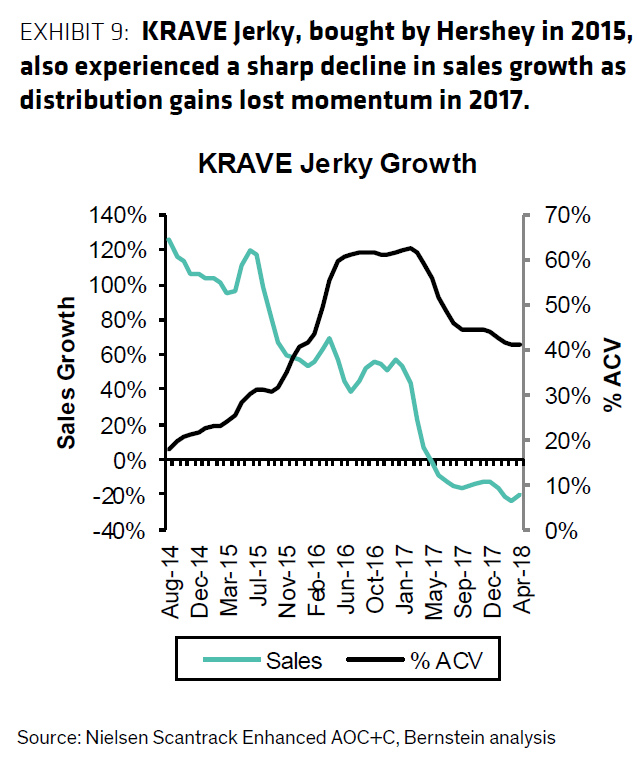

Distribution peaked in early 2017 but then steadily declined over the course of the year, while sales growth also dropped steadily, moving into negative territory in May 2017 (see chart). In 2018, KRAVE was brought into the fold of newly-acquired snack business Amplify Snacks Brands (SkinnyPop, Paqui, Pirate's Booty) and moved to Austin, Texas.

Sales over the last 12 months dropped to $20m, said Sebastiani.

“In any organization without a clear leader, the focus begins to drift. Fundamentally KRAVE's very DNA was an innovative force that drove new users to the category, opening up the jerky market to fitness enthusiasts, to women, and really premiumizing this commodity-based sector.

"But there wasn't strict management and oversight, and quality began to drift. There was no innovation and less attention given to the brand in the marketplace given all this new competition and it began to lose distribution. Its numbers fell and more retailers discontinued it, and when this happens, it becomes a self-fulfilling prophecy."

'We may be a consolidator'

So what gives Sebastiani the confidence that KRAVE can regain its former glory, given that it is now competing with a flurry of premium players - from Chef's Cut and Perky Jerky to Country Archer, New Primal, Duke's, and Oberto - all jostling for space in a category he helped create?

"KRAVE is still the #1 brand in consumers' eyes as a premium jerky, and premium is still driving the growth in the meat snacks category, which is still growing faster than most other snacks categories," he said.

"The competition has intensified, but every great brand has to question the status quo every single day and we absolutely believe that we will re-establish KRAVE as an innovator, and we also understand that execution is essential. But we have to follow a new playbook, so I'm interested in partnerships and I do believe that there will be consolidation in this space... and we may be a consolidator."

'Tons of opportunity' to re-build distribution

Looking forward, he said, there is "tons of opportunity" to re-build distribution in grocery and expand KRAVE's presence in e-commerce channels.

"I think the distribution losses weren't a function of brand failure," he said, but reflective of the fact that "the brand was kind of orphaned inside a larger organization. KRAVE was in a very different category [than Hershey's other brands in confectionery and salty snacks]."

New products: 'We know this brand has permission to play in different sandboxes'

So what’s coming up next on the product development front for KRAVE, which has recently expanded into a couple of new areas under Hershey’s ownership, including pork rinds and plant-based jerky?

"Candidly, we do not believe there is much distribution [for these new lines] yet, but I applaud Hershey for introducing a plant-based line and we will build on this," said Sebastiani. "The pork rinds, we'll take a deeper look into."

He added: "KRAVE was always a wellness snack brand and we had intentionally thought through SKU extensions beyond a core meat offering and we do anticipate extensions that will include meat, some that will take a plant-based approach, and some that will take a non-jerky approach to snacking, as we know this brand has permission to play in different sandboxes."

The end game?

As for his end game, he said: “KRAVE would be a very attractive asset in any snack organization's portfolio.

"There will be an M&A transaction here, I can't predict when, although I don't think it will be a marathon, but first we have a lot of work to do to fix the brand and re-establish its premium position in the marketplace."

"Our learnings from recent acquisitions have underscored the importance of assets scale and margin profile. We are obsessed with scale assets closer to $100m, with high margins that enable brand investment to drive growth. These are great brands [KRAVE, Dagoba, Scharffen Berger] that continue to resonate with consumers, but they require a different go-to-market model that we believe is better supported by other owners.”

Michele Buck, CEO, Hershey, Q1, 2020 earnings call, April 23

Launched by Jon Sebastiani in 2016, incubation and investment vehicle Sonoma Brands has thus far invested in brands including healthy snacks brand Dang Foods, upmarket chocolate brand Hu, bakery brand Milk Bar, yerba mate beverage brand Guayaki, and kids’ direct to consumer brand Yumble; and developed three ‘incubated’ concepts of its own: SMASHMALLOW, Medlie, and PECKISH.

“KRAVE is a great brand with a loyal fanbase who appreciate its innovative gourmet flavors and culinary roots tracing back to its origins in Sonoma, California. We look forward to its success with a different go-to-market model under the guidance of founder Jon Sebastiani.”

Hector de la Barreda, president, Amplify Snack Brands (Hershey)