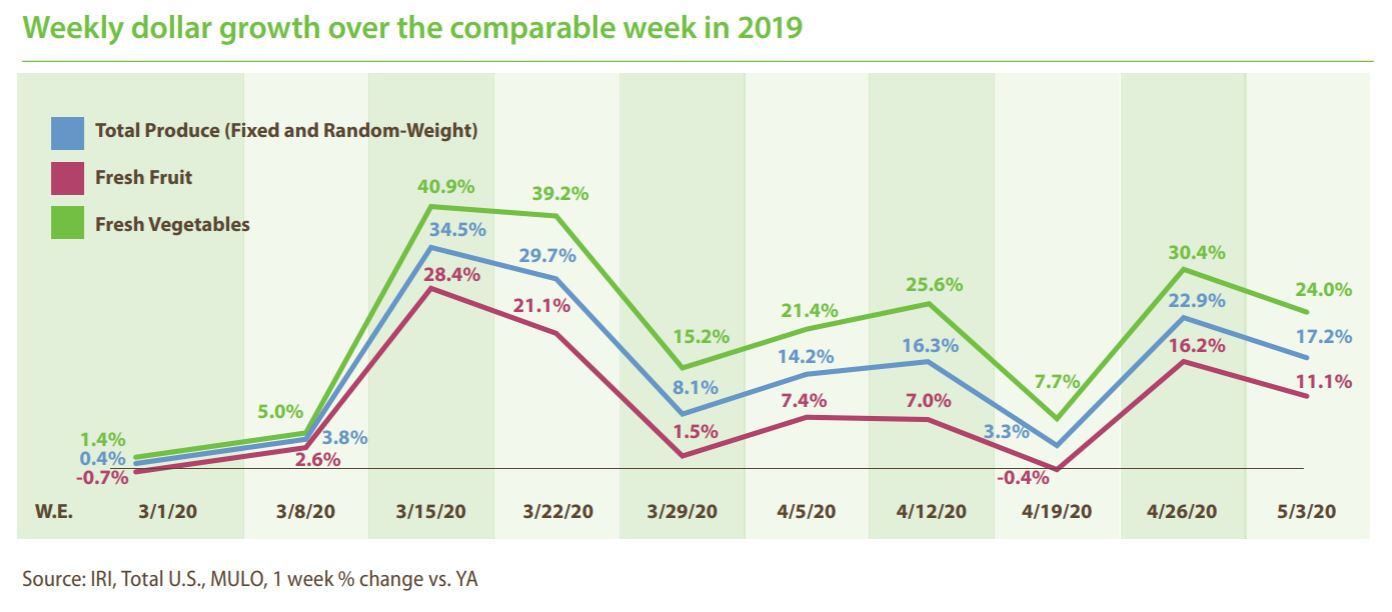

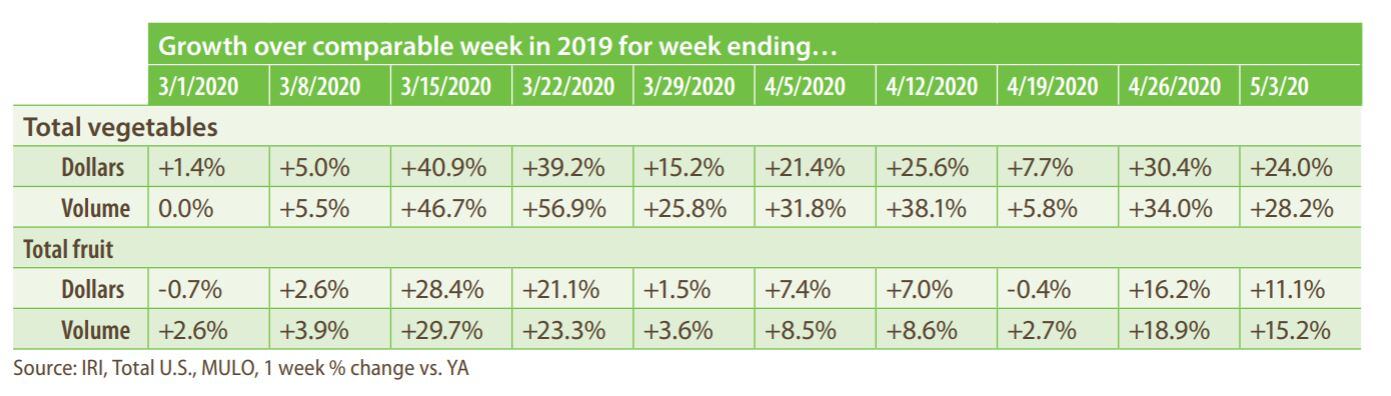

Fresh vegetables and fresh fruit have consistently achieved double digit sales growth over the past two months. Sales of fresh vegetables were +24% above 2019 levels for the week ending May 3, 2020 while fresh fruit saw an 11.1% increase in sales compared to the same week last year. Total fresh produce sales were up 17.2% compared to 2019.

The top three growth items in terms of absolute dollar gains over the same week in 2019 were berries (+$30m), potatoes (+$23m) and lettuce (+$18m), according to the report.

“Excellent and prolonged gains in items like lettuce, potatoes, peppers and onions can only mean one thing: America is cooking. And that will have positive impacts for a long time to come,” said Jonna Parker, Team Lead, Fresh for IRI.

Fresh foods e-commerce at 2025 levels

Meanwhile, e-commerce grocery sales of fresh produce – a category consumers have slowly been embracing – have been at an all-time high.

“After a few years of stagnant engagement, grocery e-commerce jumped years ahead on its growth trajectory. In a way, it is 2025, now,” said Parker.

Since the week of March 15, fresh e-commerce gains versus last year did not drop below +68% and peaked as high as +105%.

“The gains in fresh foods e-commerce are accelerating, driven by two factors. First, many retailers and third-party grocery delivery companies had to very quickly ramp up their online capacity, which resulted in great pressure on slot availability early on during the pandemic. Second, there are many shoppers who ordered online for the first time as a result of the pandemic,” Parker added.

“They may have started off with smaller baskets and avoided fresh. But as their comfort with online ordering grows, it is very likely we will see order frequency, basket size and inclusion of fresh items, grow along with it.”

Volume/dollar gaps

Despite the strong sales gains and strong consumer demand for fresh produce, the report noted that at the category level, big differences continued to exist between dollars and volume, driven by deflationary pressure.

Both vegetables and fruit saw volume tracking ahead of dollars the week of April 26 versus the comparable week in 2019. The gap for vegetables was slightly bigger, at 3.6 percentage points.

“On the fruit side, we saw significant difference in dollar growth versus volume growth for items such as pineapples (30 percentage point gap), avocados (18 points) and melons (11 points) this week,” said Joe Watson, VP of Membership and Engagement for PMA.

“By and large, these gaps are driven by deflationary pressure on the price per volume. Thinking about entering watermelon season, it is great to see strong demand, up nearly 22% over last year, but the price per volume being down nearly 10% over last year is affecting dollar gains.”

Within the top 10 growth items in absolute dollars, significant volume/dollar gaps remain for items, such as peppers, onions, and melons.

On the vegetable side, onions had a strong 28.9% boost in dollars, but volume sales were up 40.6%, with the retail price per volume down more than 8%, according to the report.

Looking ahead

Despite deflationary pressure being felt across the fresh product category, the upcoming summer fruit season will still provide a strong boost to fresh food sales.

“I am very encouraged with the early May fresh produce performance going into the summer months,” said Watson.

“As an industry we are working hard to keep the supply moving, putting employee safety and food safety front and center, and consumers are rewarding our efforts with their dollars. With summer fruit beginning to arrive we should experience a strong bump in fruit demand providing retailers are aggressive with their merchandising strategies into mid and late May.

"Additionally, foodservice trucks loaded with fresh produce hitting the roads once more was a very welcome sight this week and I am confident we will see strengthened overall produce demand in weeks to come.”

* Source: IRI, Total US, MULO, % growth vs. year ago week