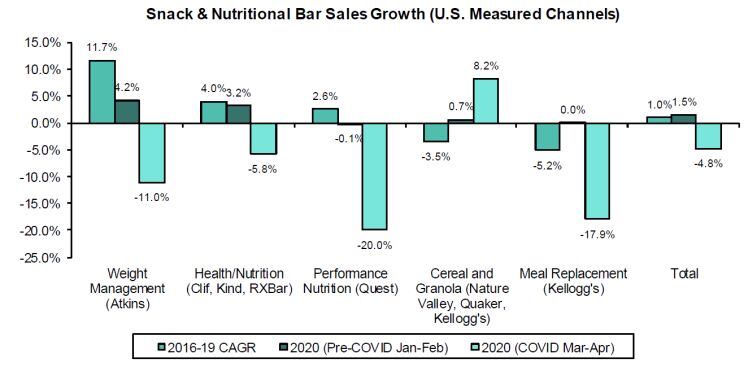

Cereal and granola bars – a category that has been in negative territory in recent years - bucked the trend with sharp growth in March, although sales declined again in April, said the report.

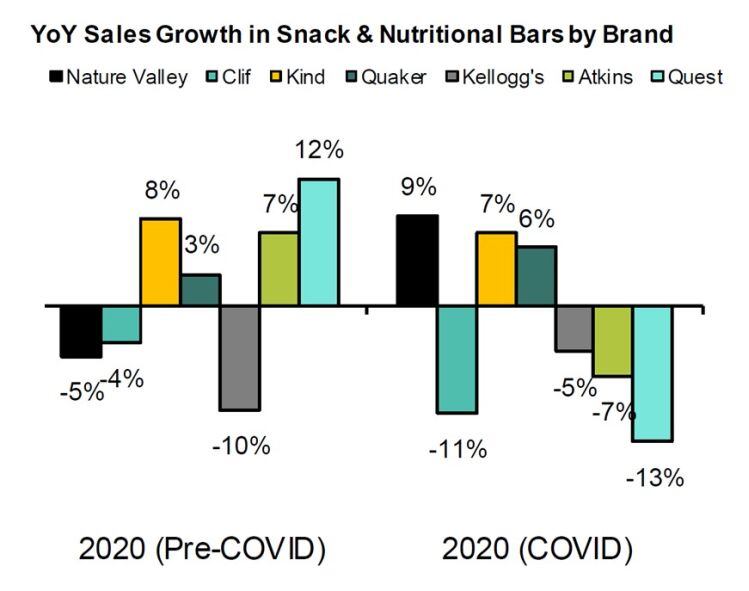

“Nature Valley generated strong sales growth of +32.5% in March on the back of coronavirus-led pantry loading, although sales growth has since turned negative.”

Nature Valley, Kind, and Quaker gained share during the coronavirus outbreak, “likely benefitting from their scale and ability to ramp up production,” said Bernstein, which says a recession could drive a shake-out of smaller brands in a weaker financial condition.

“Conversely, Clif lost share as its products are linked to sports nutrition. Atkins and Quest also lost share as most Atkins' products and some Quest's products are placed in the beauty/supplement aisle of the store, where there is less traffic now that people are trying to get in and out of the store as quickly as possible.”

However, the overall category should return to growth, “supported by mega dietary trends such as wholesome/natural and high protein/low carb,” predicted Bernstein, which believes Quest Nutrition and Atkins in particular are well placed for a rebound, having enjoyed double-digit sales growth with strong share gains in recent years.