This partly reflects an upswing experienced by many packaged food brands during the coronavirus pandemic as food consumption has switched towards the home, acknowledged Nasoya’s Korean parent company Pulmuone, which says its US retail sales of tofu surged 25% year-on-year in May and 43% in June.

But the upward trend started well before COVID-19 hit, reflecting growing interest in plant-based protein, enthusiasm for Asian-inspired dishes, a wave of innovation designed to make tofu more accessible and convenient, and a desire for less processed and more nutritious options in the plant-based category, claimed Jay Toscano, EVP sales at Pulmuone, which acquired Nasoya in 2016.

"Some of these new meat analogs are great but they are highly engineered with a lot of ingredients. Tofu is the simplest form of plant-based protein on the market. What you see is what you get, it's soy, salt, and water, and that's it [it is also very low in saturated fat]."

He added: “US household penetration for tofu was stuck around 5% or 6% for years, and if Nasoya [which was launched in the late 1970s in California] did 2-3% growth [in a given year], we’d be high-fiving each other. But in the last two or three years, we started to grow in double digits, and national retail partners have been telling us that household penetration has reached 16-17%.”

‘It came down to the fact that we had to make products that were craveable and accessible’

The key to expanding the audience, he said, was a realization that most people don’t know what to do with tofu, and that traditional packaging formats needed refreshing.

Put another way, giving people recipe ideas and expecting them to come up with inspiring tofu dishes is one thing, but doing the work for them and creating ready-made, enticing and convenient products is probably a better bet, he said.

“It came down to the fact that we had to make products that were craveable and accessible. People know what to do with a Beyond Meat burger. Most people don’t know what to do with water-packed tofu. It’s way too much work.

“So that’s what we’ve been doing with vacuum-packed tofu, baked tofu, pre-marinated tofu, skillet meals, and toss’ables [pre-seasoned tofu cubes ready to be thrown into a salad, pasta, grains, or stir-fry].”

The Nasoya brand was launched in the late 1970s in Massachusetts and acquired by Korean firm Pulmuone in 2016. In recent years, the brand has expanded beyond tofu and also offers Asian style noodles, wraps, dumplings, kimchi, skillet meals, and microwaveable bowls.

Plantspired

Nasoya’s new ‘plantspired’ brand – launching later this year - will include its baked tofu products, marinated toss’able products and recently-launched meal solutions combining tofu crumbles with other ingredients such as cauliflower rice, veggies, and sauces, plus some new innovations.

“There will always be a market for tofu as an ingredient,” said Toscano, “but we believe the growth opportunity we believe is by driving these plantspired items that make tofu craveable, accessible, and convenient. So we’ll also be coming out with hors d'oeuvres and appetizers as well.”

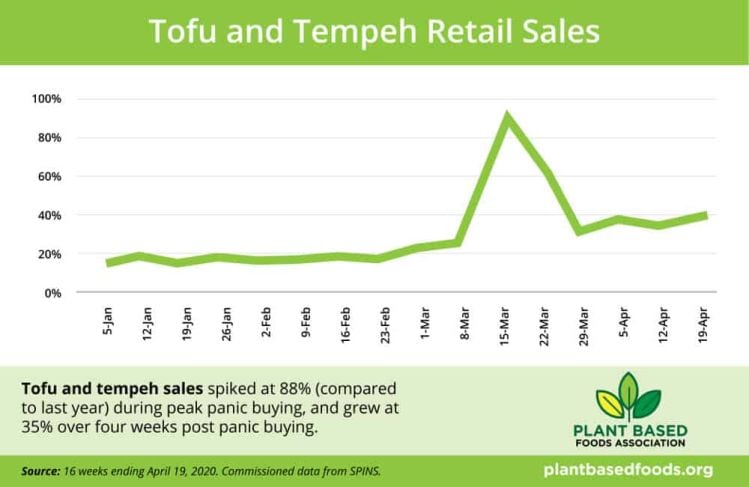

According to SPINS data shared by The Good Food Institute and the Plant Based Foods Association, US retail sales of tofu and tempeh rose 7.8% to $128m in 2019.

According to Nielsen data (total US in-store measured channels), sales of 'products that contain tofu protein' rose 4.6% to $294.6m in 2019, but surged 42% year-on-year in the 21 weeks to July 25, 2020.