In the report – The Premium Opportunity - IRI notes that eight months into the coronavirus pandemic, both high- and low-income shoppers are trading up in many categories, including food and beverage, cleaning and personal care, and spending more on meal kits; premium wine, beer, and liquor; specialty coffee products; and premium or specialty food to recreate restaurant experiences at home.

‘Elevating the at-home dining experience’

According to US retail sales data for the 12 weeks to October 4, 2020, premium priced products* have gained more than 5.2 points of share in pasta sauce vs the same period a year ago, 4.6 points in spirits/liquor, 3.6 points in Frankfurters, 3.2 points in beer/ale/cider, 3.1 points in Mexican foods, 2.9 points in energy drinks, and 2 points in frozen breakfast.

“In pasta sauce, Rao’s and other premium brands [IRI cites Michaels of Brooklyn and Primal Kitchen] saw accelerated share performance during COVID-19, a nod to elevating the at-home dining experience.”

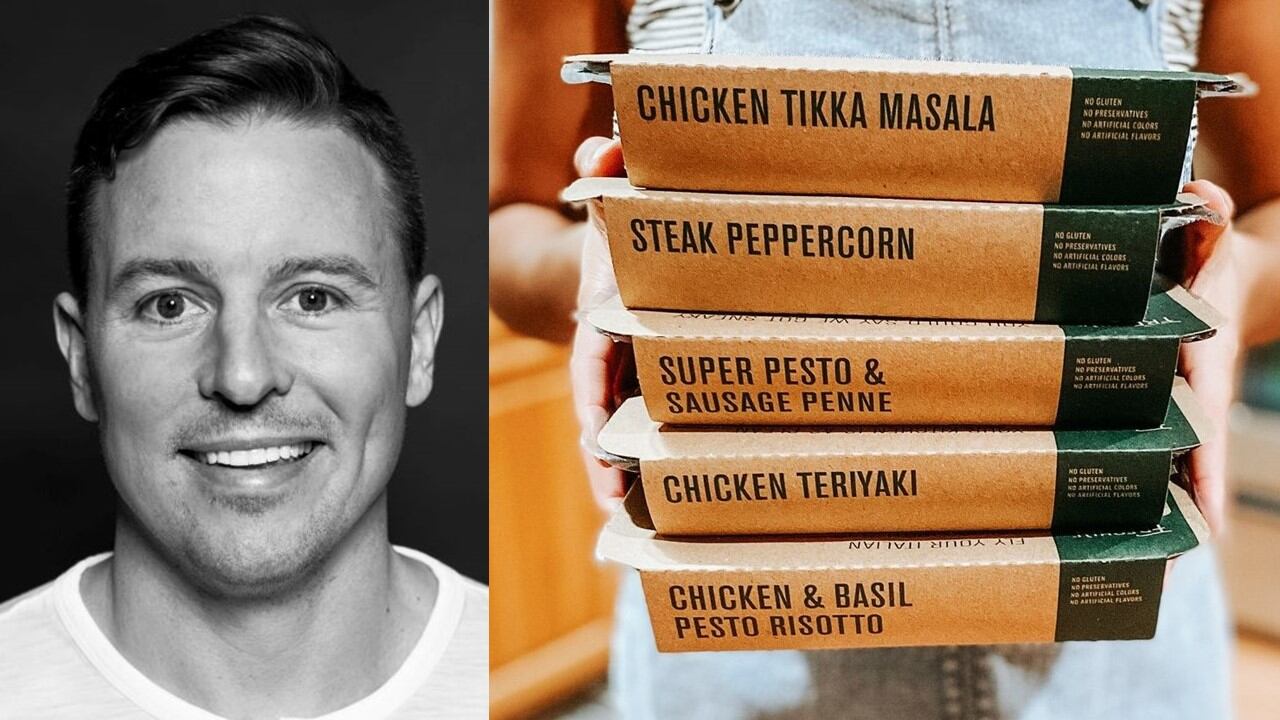

In frozen dinners, brands such as Amy’s and Saffron Road were also punching above their weight, said IRI, while in chocolate candy, “the affordable luxury of premium brands such as Lindt and Ghirardelli saw accelerated share performance during COVID-19.”

"Beyond Pelotons and backyard living spaces, consumers of all income levels look to find joy and elevated experiences with premium CPG products..." IRI

"Customers are looking to replicate their favorite meal or experience from restaurants with food at home…

"Also, we see indulgent moments becoming important as people are coming home and having an adult beverage, or if they’re at home, having that adult beverage with a significant other. Also recipes — perfecting that banana bread.

"These indulgent moments are where we see changes in customer behavior and needs that we’re looking to fulfill in unique and different ways."

Stuart Aitken, chief merchant and marketing officer, Kroger, IRI c-suite interview, September 2020

Health and wellness, immunity, hygiene, indulgence, and convenience

More broadly, claimed IRI, “Shoppers are trading up in grocery and other large format channels, with premium and super premium products gaining share at the expense of value tier and private label.

“Beyond Pelotons and backyard living spaces, consumers of all income levels look to find joy and elevated experiences with premium CPG products,” added IRI, which urged brands to “promote relevant attributes that mark a product as premium, such as health and wellness, immunity, hygiene, indulgence, and convenience.”

"We’re in a lot of mainstream snacking segments, but we elevate the experience for consumers.

"Whether it’s potato chips where we’re bringing kettle chips; whether it’s pretzels where we’ve got a lot of different forms, but also pretzel crisps; whether it’s tortilla chips that we’re bringing organic through Late July or cookies with Farmhouse and Milano, which are certainly upscale, more premium offerings.

"As people are replacing a lot of out-of-the-home social experiences with in-home social experiences, there is a desire to upweight or elevate those experiences."

Mark Clouse, CEO, Campbell Soup, IRI c-suite interview, October 2020

A word of caution…

But young brands – which tend to have a more premium positioning – should be careful not to read too much into the numbers, cautioned Dr James Richardson, a cultural anthropologist-turned business consultant to emerging CPG brands.

“It's true that premium-priced brands have grown slightly faster than mainstream priced ones during the pandemic so far,” he told FoodNavigator-USA.

“But this is easy to overstate in high-level analysis. Per IRI's own analysis, up to 50% of the growth in many categories was related to the cessation of TPRs [promotions] and to retailers increasing pricing in grocery. [Although premium products still gained share in several categories, regardless of price increases across the board, as IRI defines ‘premium’ and ‘super premium’ products based on their price relative to the overall category average.]

Stress-relieving indulgence, immunity, hygiene

“Furthermore,” stressed Dr Richardson, “most of this growth, in absolute dollar terms, is occurring in a specific set of categories oriented to three pandemic-sensitive demand drivers: stress-relieving indulgence, immunity, and hygiene.

“Alcohol and supplements are driving a large chunk of it all as SPINS has alluded to. What's not clear is how much of the premium brand growth is related to permanent household penetration gains [he points out that many premium brands may have made temporary gains because preferred mainstream brands are out-of-stock] or to increased buy rate among existing premium brand buyers because they're just eating more at home.”

Which premium brands are winning?

Finally, he added, most of the premium market share increases have gone to “nine-figure businesses which already had large fan bases and double-digit household awareness or more before the pandemic struck.”

Without household penetration increases driving the near-term dollar share increase, the “long-term deceleration in premium CPG annual growth rates” will continue, starting next year, he predicted.

‘This is a minor surge, not a trend'

The last thing entrepreneurs should take away from this analysis “is that there is some long-term, premium growth tailwind you can ride like the 1990s and early 2000s,” argued Dr Richardson. “This is a minor surge, not a trend at all.

“If you're a young CPG brand, you need a phenomenal innovation and strategy, not just a premium price to scale.”

*According to IRI, ‘Super Premium’ products have a price tag at more than 50% above the subcategory average, while ‘Premium’ products are priced at 25% to 50% above the subcategory average.