AgFunder added that once all investment deals from 2020 come to light, it expects the global investment figure to be more than $30bn.

In the US, startups raised $15.45bn in 2020, a 56% year-over-year increase and 30% year-over-yaer rise in number of deals.

Much of the increase in investment came from investors doubling down on their existing portfolio and first wave of agrifoodtech investments. Impossible Foods, for example, completed $500m and $200m rounds last year.

From a high level, OVID-19 highlighted the importance of efficient supply chains and alternative ways of growing, processing, transporting, and selling food to consumers, noted Louisa Burwood-Taylor, editor and head of media & research at AgFunder, in the report.

"Innovations in the midstream – between farmer and retailer – got a much-needed investment boost. Food delivery gained new ground for obvious reasons, especially e-grocery, and we saw more investment activity in Cloud Retail technologies supporting at-home dining," wrote Burwood-Taylor.

Protein food alternatives also continued to gain investment across the board this year as consumers continue to ask more questions about the origins of their food, she added.

Upstream technologies gain ground

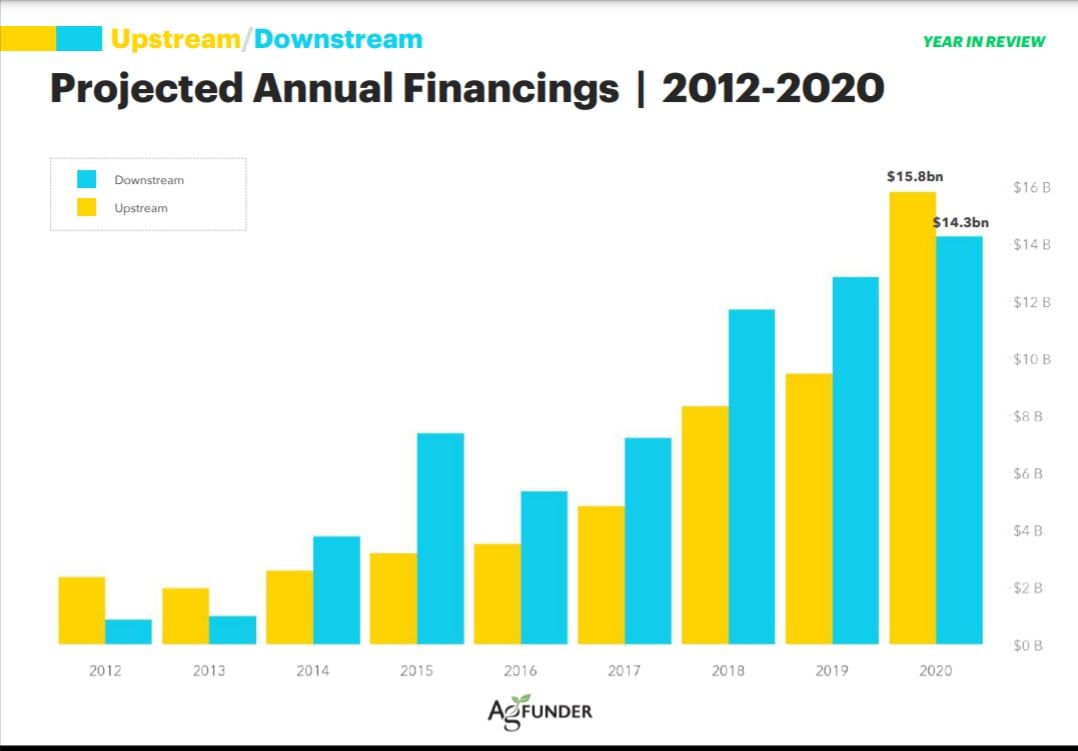

While mega investment deals in finished product brands may have attracted a lot of mainstream attention, upstream (i.e. closer to the farm) startups and companies had a stand-out year in 2020 closing 30% more deals and 50% more investment dollars year-over-year.

According to AgFunder, upstream food startups -- which includes companies working in ag biotech, farm management software, farm robotics & equipment bioenergy & biomaterials, novel farming firms -- attracted $15.8bn in investment last year, a 68% increase over 2019.

Of the 1,950 upstream individual investments AgFunder recorded in 2020, cold chain tech company, Lineage Logistics, was by far the largest with a $1.6bn deal.

Ag biotech firms lost some market share in 2020, but still raised 60% more investment last year (compared to 2019) dominated by investments in gene editing technology.

By comparison, downstream investments (e.g. in-store restaurant & retail, online restaurants & meal kits, e-grocery, restaurant marketplaces, home & cooking) drew $14.3bn in investment in 2020.

"While investors continued to support important downstream categories such as e-grocery, they became more comfortable with upstream food production categories, many of which had COVID-19-related appeal," said AgFunder.

No longer an early-stage industry

As the first wave of investments in the agrifoodtech space are maturing, larger blockbuster deals are expected in 2021 and beyond, said AgFunder.

According to the report, the median deal size for growth and late-stage rounds increased 29% and 17% respectively year-over-year.

“Agrifoodtech early-stage activity increases is no longer a niche, experimental and risky sector. Median deal-size growth signals maturity of first wave innovation," said AgFunder.

"The fact that Impossible Foods was able to quickly raise $500m at the very start of the pandemic when uncertainty was high indicates the strength of investor conviction in the category. It also points to how the breadth of capital available to food tech startups has evolved."

2021 predictions

While the new year still brings a lot of uncertainty for the sector, AgFunder does predict a trend of early-stage businesses going public creating an incentivized environment for startups.

"This will drive early stage investment, create incentives for innovation and entrepreneurship, and further accelerate the demise of the incumbent food companies," the report noted.

Speaking of specific consumer trends, AgFunder also noted, "e-grocery continues to upend traditional retail. And phones will overtake store shelves as the primary mode for new product discovery by consumers. The power of traditional brands will diminish as consumers discover and favor smaller, startup brands."