Speaking on Oatly’s Q2 earnings call after posting a $59.1m net loss on net revenues up 53% to $146m in the second quarter, CEO Toni Petersson said: “Global demand for Oatly products continued to outpace our supply, with capacity constraining our growth in the second quarter, and certain COVID-19 and start-up manufacturing headwinds impacted our revenue by approximately $12-14m.”

However, any losses in US market share flagged up in the recent report from activist investor Spruce Point Capital were likely “temporary,” he insisted.

“Our brand is so strong, we are regaining every single time when we are off shelf and get back again because we are playing a different game than competitors.

“Having Ogden [its new plant in Utah] on board here producing commercial product brings a lot of confidence… going forward... Just improving our fill rates alone will generate substantial incremental revenue for our business.

‘Long term, we expect to generate gross margin greater than 40% [vs 26.4% in Q2, 2021]’

When it comes to gross margins, which were down to 26.4% in Q2, 2021, Oatly said it anticipated they would increase to 40%+ over [an unspecified amount of] time as the company produced more of its products in-house and built more localized manufacturing models.

In the first half of 2021, for example, self-manufacturing [where Oatly makes its own oat base and finished products onsite] accounted for “20% of Oatly’s total volumes compared to co-packing at 53%, and hybrid at 27% [in the hybrid model, Oatly transports its oat base through pipelines to an adjacent plant operated by a 3rd party partner for filling and mixing],” explained COO Peter Bergh.

“Our long-term goal is to have 50-60% of our total volume to come from self-manufacturing, reducing co-packing to 10% to 20%, with 30% to 40% from hybrid manufacturing.”

CFO Christian Hanke added: “Long term, we expect to generate gross margin greater than 40% and an adjusted EBITDA margin approaching 20% as we benefit from a much larger self-manufacturing footprint globally, greater economies of scale and continued strong revenue growth.”

That said, Oatly will continue to speculate to accumulate in the short to medium term, said Petersson, who expects revenue in fiscal year 2021 to exceed $690m (+ 64%+ vs 2020): “We continue to prioritize growth investments over profitability in the next few years to best position Oatly to serve customers and consumers alike.”

Asked about inflation, Hanke said freight costs were rising but that longer term, more localized manufacturing would help to offset these costs. The price of rapeseed oil - which accounts for 3 to 4 percentage points of Oatly’s total cost of goods sold – will “continue to increase during the second half of 2021, offset by other anticipated cost efficiencies,” he predicted.

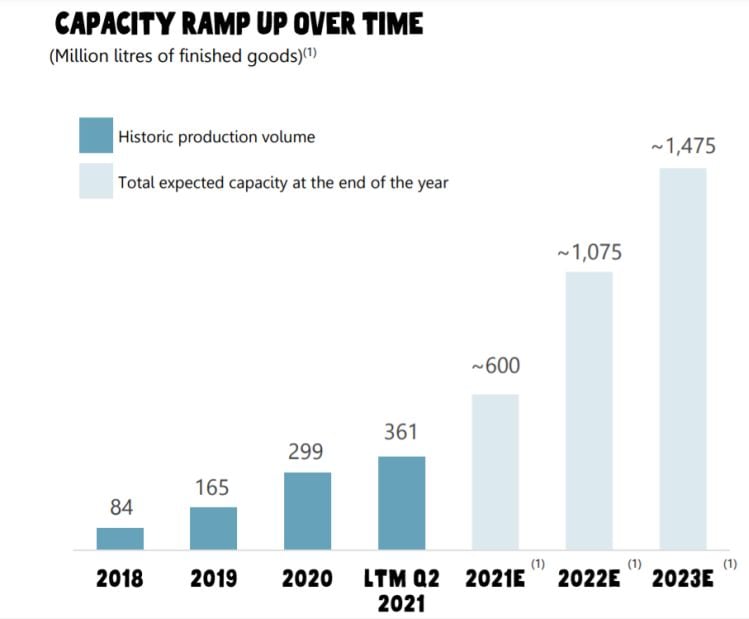

Capacity expansion from 299m liters in 2020 to 1.475bn by end of 2023

Much of the call focused on the manufacturing plans at Oatly, which has been capacity-constrained for some time. In the US, the New Jersey plant is being expanded, the Utah plant is ramping up, and a new plant in Texas will come online in 2023.

Elsewhere, new plants in the Netherlands and Singapore (hybrids) are ramping up; while a second manufacturing facility in Asia will open later this year in Maanashan, China (self-manufacturing); with additional plants opening in China and the UK in 2023; said Petersson, who said annual production capacity – at 299m liters of finished goods by the end of 2020 – should increase to 1.475bn liters by the end of 2023.

‘Nearly 70% of plant-based milk consumers have joined the category in the last two years in our key markets’

As to Oatly’s performance and addressable market, Petersson claimed that “35% to 40% of the adult population is now purchasing dairy milk alternatives in our key markets,” and that the market is changing very rapidly: “Nearly 70% of plant-based milk consumers have joined the category in the last two years in our key markets [according to an Oatly consumer survey].

“We believe a majority of the market is wide open for the taking, and at Oatly, we're approaching major tipping point of conversion to plant-based alternatives.”

‘Oatly is one of the most profitable brands for retailers in plant-based milk’

In the US market, which Oatly entered in late 2016, Oatly is the number two player in oatmilk “as a direct result of our supply constraint,” claimed Petersson, who said a special committee of Oatly's independent Board of Directors had reviewed the report from Spruce Point Capital - which has prompted a series of shareholder lawsuits - with the help of independent legal counsel and said the company "fully stands by the accuracy and efficacy of our reporting.”

“In the US, Oatly has the highest velocity SKU and highest dollar per TDP, or total distribution points, of all brands in the total dairy category, including cow's milk, according to Nielsen xAOC for the last 12-week period ended June 19, 2021, excluding private label.”

“Any recent pressures on our market share velocity measured channel is expected and directly correlated with the capacity constraints.”

As for productivity on shelf, he added: “Oatly is one of the most profitable brands for retailers in plant-based milk with a winning combination of premium price point and velocity, according to Nielsen in total U.S. xAOC data for the 12-week period ended June 19, 2021.”

As of June 30, 2021, Oatly’s products were available across 65,000 retail doors from Target to Tesco; and 60,000+ foodservice locations, from independent coffee shops to Starbucks; along with e-commerce channels such as Alibaba's Tmall, said Oatly.

The tie up with Starbucks: 'Growth of Oatly and oatmilk has exceeded both of our expectations to date'

Oatly CEO Toni Petersson said the company is "very pleased with our successful launch and growth in Starbucks as their exclusive oatmilk brand partner [in the US]. Growth of Oatly and oatmilk has exceeded both of our expectations to date. For example, we aligned on an estimated volume per month and have consistently been shipping double the original projection."

Given Oatly's well-publicized capacity constraints, it is only currently providing about two thirds of Starbucks’ oatmilk volumes, he said: "Starbucks is leveraging private label to deliver on oatmilk demand that far exceeded everyone's expectations…. It's temporary... we're the exclusive oatmilk brand."

CFO Christian Hanke added: "Starbucks is definitely performing much better than our expectations and accounted for approximately 27% of our sales in the second quarter."

Oatly recently expanded a partnership with McDonald's in mainland China, and launched partnership with K COFFEE in KFC, said CEO Toni Petersson: “We have built a new generation of plant-based milk consumers in Asia by converting traditional dairy milk drinkers to Oatly and by attracting new drinkers to the category altogether…”