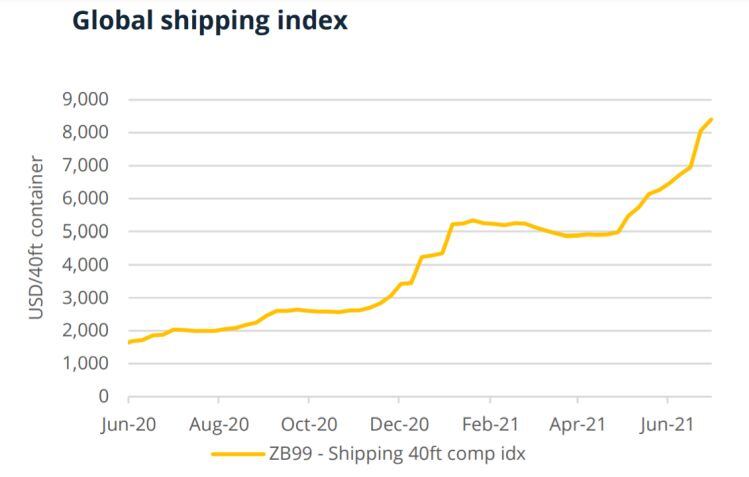

The latest data from Drewry, an independent provider of research and consulting services to the maritime and shipping industry, shows further rises in July and August, with its composite World Container index reaching $9,613.28 per 40ft container in mid August.

The surging freight costs - driven in part by pandemic-related transport disruptions resulting in tight container availability out of East Asia – were “recently exacerbated by interrupted operations in China’s Guangdong province, home to some of the world’s largest shipping ports, due to lockdowns imposed in response to re-escalating COVID-19 cases,” said Mintec in a new report entitled, ‘Logistical issues continue with no end in sight…’

By mid-June 2021, Danish-based Maersk, the world’s largest container operator, told customers to expect up to 16-day port delays in southern China, noted Mintec, which tracks global commodity prices. “This has had continued knock-on effects on seaborne trade costs across the world, particularly along East-West hemisphere routes.

“The freight backlogs in the Suez Canal caused by the large container ship Ever Given blocking the waterway in March 2021, compounded the logistical backdrop.”

“The bottlenecks in the supply chains continue to cause enormous strains and inefficiencies for all market participants... We do not believe that the situation will return to normal any time soon – despite all the efforts made and the additional container box capacity that is being injected. We currently expect the market situation only to ease in the first quarter of 2022 at the earliest.”

Rolf Habben Jansen, CEO, global shipping company Hapag-Lloyd (statement on first half results, 2021)

"The current historically high freight rates are caused by the fact that there is unmet demand... there's simply not enough capacity."

Soren Skou, CEO, global shipping company Maersk (during Q2 earnings call August 8)

High fuel costs, a lack of port workers

High fuel costs, a lack of port workers and a sustained rally in the demand for commodities have also driven up freight costs, noted Mintec.

“Shipping rates are poised to remain elevated for the foreseeable future. Bimco, the world’s largest international shipping association, expects firm prices to prevail through Q4 2021 at least, and most likely through H1 2022, stating that high freight costs are still being priced into contracts for the next 6-12 months.

“Additionally, experts predict that it could take at least until late Q4 2021 to clear the port backlog at some of the key trade hubs. This scenario presents upside price risk, particularly for goods moving from Asia to Europe and the Americas, such as coffee, prawns, mangoes and rice."

Inflation: Packaging (metal, aluminum, paper)

The Mintec Global Packaging Index, meanwhile, has continued on an upward trajectory, rising by 3.2% month on month to 126.4 points in July, an increase of 62% vs July 2020, primarily driven by a significant rise in plastic and metal prices.

The US steel hot-rolled coil steel price on the Chicago Mercantile Exchange hit a record high again in July, up 4.5% month on month, and an increase of 237.5% year on year to a monthly average price of $1,914/MT, as global demand continues to outstrip supply.

The LME aluminum (3-month) price rose to a new high of $2,504/MT, up 2.4% month on month and 49.7% year on year, supported by global supply tightness and steady demand. The introduction of an export duty tax on primary aluminum by the Russian government, together with flood reports in China, also supported global prices, said Mintec.

The global paper packaging market remained stable in July, rising by 0.7% vs June.

US food prices

US consumer spending has continued its upward momentum, with the Consumer Price Index (CPI) up by 5.4% year on year in July, the largest increase in consumer prices since mid-2008.

According to USDA ERS data, the consumer index for food items rose by 3.4% year on year in July, mainly driven by the food away from home category, which rose by 4.6% year on year during the reported period.

The US dollar, meanwhile, is likely to continue appreciating against a basket of key currencies, predicted Mintec: “This implies that US exports could be less competitive on the global market. The US is one of the largest exporters of cotton, pork, beef, chicken, and almonds.”