The firm – which has hired former Red Bull executive Alexandre Ruberti to spearhead its US expansion following a successful debut in Brazil and several other markets including Chile, Mexico, the UK, Germany, and the Netherlands - will also use the funding to progress towards its goal of 100% plant-based packaging from sugar cane.

“In order to change the way the world eats, by making slaughterhouses and animal-protein products obsolete, we will continue bringing consumers into the category with quality, variety and flavor, and delivering joy and deliciousness to the experience of plant-based eating,” said founder Marcos Leta.

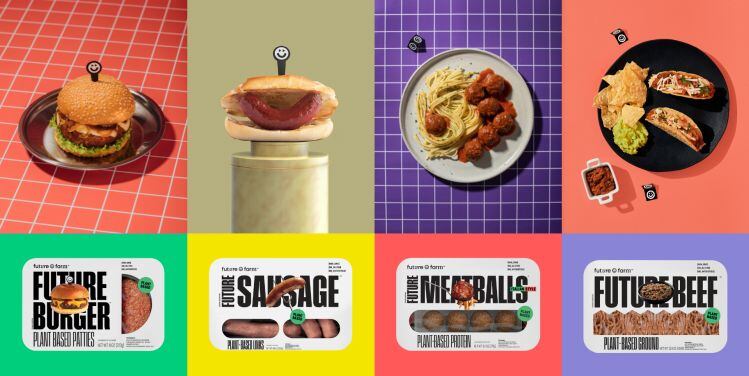

Future Farm – which launched in the US this summer with Future Burger, Future Sausage, Future Beef and Future Meatballs – is gearing up to launch Future Tuna and Future Chick’n, and down the road, also has plans to enter the plant-based beverages and dairy segments in Europe and North America.

More fiber, less sodium

Launched in Brazil in 2019 by Leta and business partner Alfredo Strechinsky, Future Farm has teamed up with California-based Superior Foods to handle frozen distribution to retail and foodservice markets in the US for its wares, which utilize a base of non-GMO soy protein, pea protein, and chickpea flour; coupled with coconut and canola oil; natural flavor, methylcellulose, salt, and beet powder for color.

The US Future Burger (SRP $5.29 – which is competitive with Beyond Meat and Impossible Foods) has more fiber (6g), less sodium (250g) and fewer calories (220) than most US rivals, although it has slightly more saturated fat (11g vs 8g for the Impossible Burger and 5g for the Beyond Burger) and slightly less protein (16g vs a more typical 19-20g).

However, later iterations currently under development will have less saturated fat, said Ruberti. "The key is reducing fat without [negatively] affecting flavor and texture, but we are almost there."

US plant-based meat growth decelerating

US retail sales of refrigerated plant-based meat alternatives were down -3.1% in Q3 2021 compared with the same period in 2020, but were still up 74% vs the same period in 2019, according to IRI data for the 13 weeks to September 26.

That said, the “gains are decelerating,” said Anne-Marie Roerink, president at 210 Analytics, in a briefing note issued last month as Beyond Meat released updated guidance predicting slower than expected sales in Q3.

“In the first quarter of 2021, gains versus 2019 were still 156.5% versus the first quarter of 2019,” said Roerink. “Growth dropped to 115.7% in the second quarter [vs 2019] and 74% in the third quarter [vs 2019].”