Speaking on Oatly’s Q3 earnings call after posting a $41.2m net loss on net revenues up 49.2% to $171.06m in the third quarter, CEO Toni Petersson said: “We are continuing to prioritize growth investments over profitability.”

Gross margins were 26.2% in Q3, 2021, although Oatly anticipates they will increase to 40%+ over an unspecified amount of time as it produces more of its products in-house and builds more localized manufacturing models.

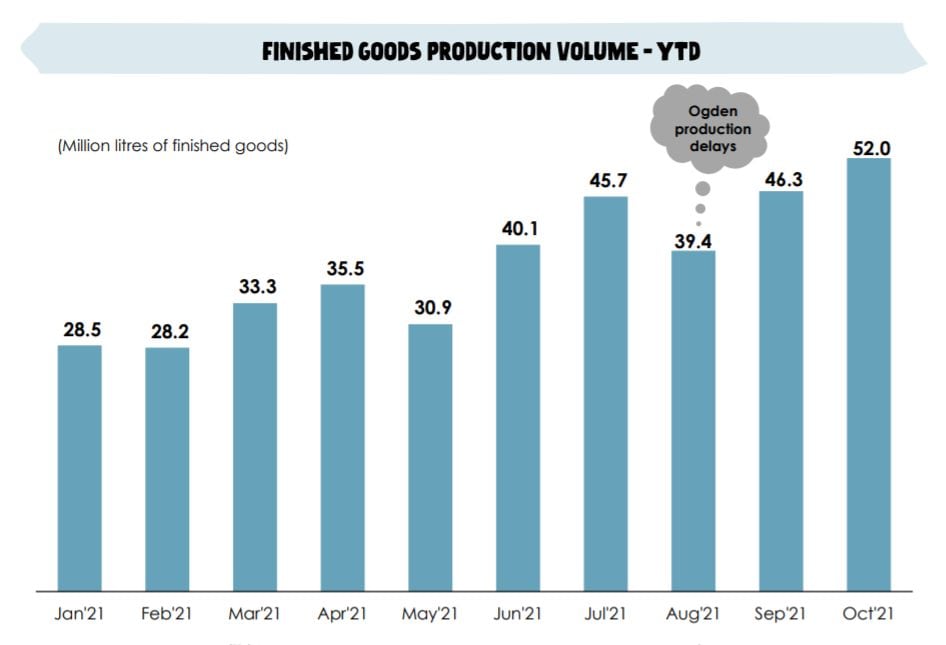

Third quarter production volumes were below expectations due to a slower-than-expected ramp up at Oatly’s new plant in Ogden, Utah, which experienced “a temporary setback” in August due to “mechanical and automation issues,” but is expected to ramp up to full utilization in the first half of 2022, said Petersson.

“Most companies would be thrilled with this level of growth and execution in any operating environment. But we hold ourselves to a higher standard.” That said, he added, “We expect these key factors that delayed even stronger growth in the third quarter will abate as we head into 2022.”

'In Walmart, Oatly original is the number one velocity oatmilk SKU'

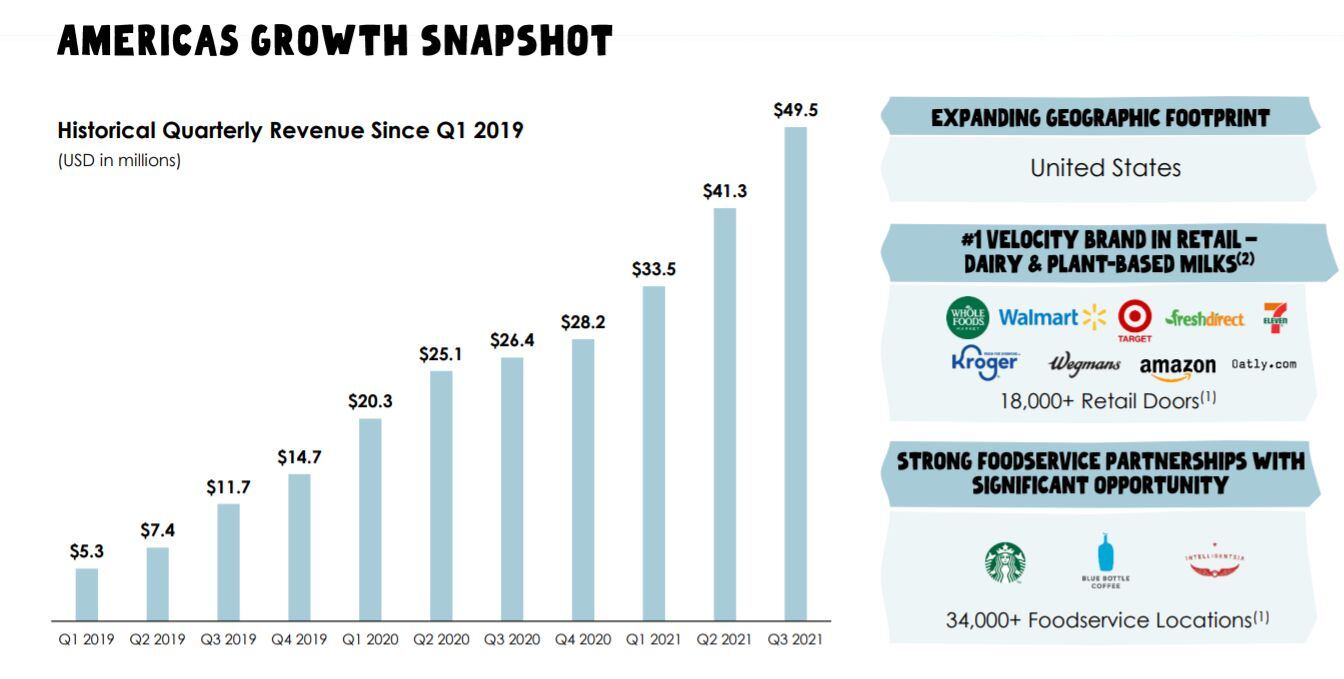

In the US market, which Oatly entered in late 2016, Oatly revenues rose 87.3% to $49.5m in Q3, and demand for Oatly is “incredibly strong,” claimed Petersson.

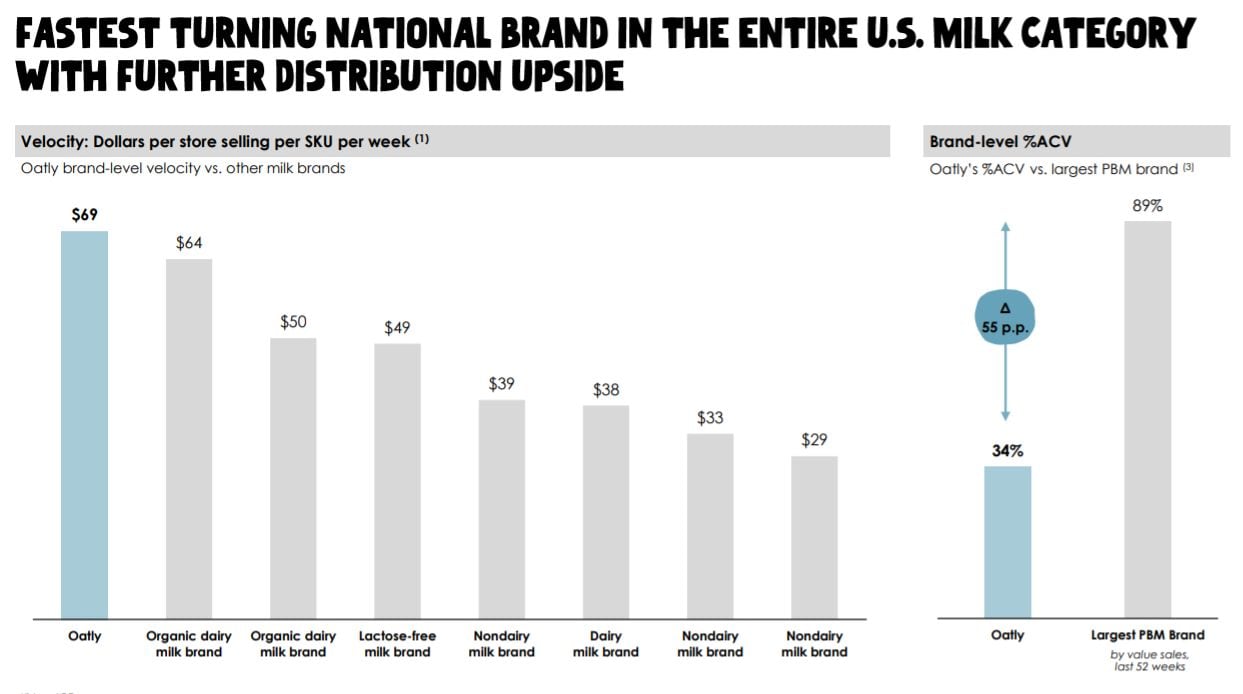

“According to Nielsen data for the 24 weeks ended October 16, Oatly is the #1 fastest turning brand in total dairy, plant-based dairy, and oatmilk.

“In Walmart, Oatly original is the number one velocity oatmilk SKU and the #2 velocity plant-based milk SKU, with an additional 1,200 stores planned in April 2022.”

Oatly frozen novelties will arrive on shelves starting mid-December, with over 8,000 points of distribution confirmed so far, added Petersson.

Inflation: 'Major increase in the cost of oats...'

Asked by analysts about inflation, CFO Christian Hanke said: “In terms of outlook for the fourth quarter, we see oats and rapeseed oil to be relatively flat versus Q3, except for the US where we see a 20% increase in rapeseed oil. We also see some increase in packaging material costs for the fourth quarter in Europe.

“Next year, we do expect inflation to hit our total costs by an increase of 5-6% in 2022… driven by a major increase in the cost of oats in the range of 10-35% depending on the region… We see a further increase for rapeseed oil of 20-25% and also packaging materials between 4-10%.” Meanwhile, higher freight costs will also add to costs, he said.

Oatly and Starbucks

Asked about Oatly’s relationship with Starbucks, Petersson said: “We're both excited and thrilled about the success of our oatmilk launch there. We will serve 100% of the Starbucks network from December and January, and white label will enter the market in February and stay through the end of calendar 2022.

“So during 2022, we will serve approximately 85-90% of the total Starbucks network after white label returns.”