Although its profit margins were hit by cost inflation, Nestlé witnessed continued retail growth and a recovery in out-of-home and said organic growth reached 7.5%, with internal volume growth of 5.5% and pricing of 2%.

Total reported sales increased by 3.3% to CHF87.1bn, with foreign exchange reducing sales growth by 1.3% and net divestments by 2.9%.

Walid Koudmani, chief market analyst at financial brokerage XTB said: "Nestlé's results managed to reassure investors with organic growth reaching 7.5% and total reported sales increasing by 3.3% while indicating that the company expects organic sales growth around 5% for 2022. While the stock price may see a short term positive reaction, potential supply chain issues and overall rising costs could hinder performance down the line if these issues are not addressed appropriately."

Confectionery

Sales in confectionery grew at a high single-digit rate, the company reported, while dairy saw mid single-digit growth.

Sales in vegetarian and plant-based food grew at a double-digit rate, to approximately CHF800m, while Nestlé Health Science recorded double-digit growth reflecting strong demand for vitamins, minerals and supplements, along with healthy-ageing products.

“In 2021, we remained focused on executing our long-term strategy and stepping up growth investments, while at the same time navigating global supply chain challenges. Our organic growth was strong, with broad-based market share gains, following disciplined execution, rapid innovation and increased digitalisation,” said Schneider.

“We limited the impact of exceptional cost inflation through diligent cost management and responsible pricing. Our robust underlying earnings per share growth shows the resilience of our value creation model. The entire Nestlé team demonstrated exemplary perseverance and agility in a challenging environment.”

Speaking of Nestlé's sustainability agenda, Schneider said it had made further progress “as we enhance the wellbeing of our consumers, help regenerate the environment and strengthen the farming communities in our supply chains.”

Business as a force for good

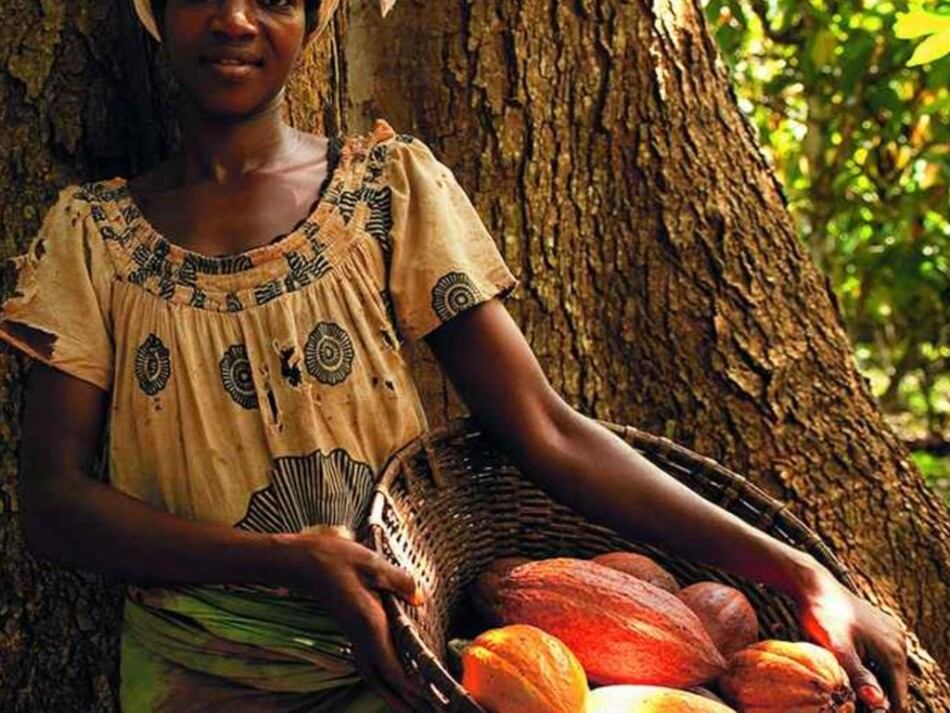

Last month, Nestlé unveiled an innovative plan to tackle child labour risks in cocoa production. The company said it plans to invest a total of CHF1.3bn by 2030, more than tripling its current annual investment.

The programme, which builds on the Nestlé Cocoa Plan, rewards practices that increase crop productivity and help secure additional sources of income. “By engaging in these practices, families can earn up to CHF500 in additional annual income for the first two years of the programme levelled at CH 250 as the programme starts delivering tangible results.

"As the incentive is not paid based on volume of cocoa sold, it also provides smaller farmers meaningful support, 'leaving no one behind', Nestlé claimed.

Schneider told journalists the company is supporting cocoa families, supporting sending their children to school and with income diversification, to achieve a living income.

He said it goes hand in hand with a several-year effort that's underway to make Nestlé's supply chain fully traceable, “because only with the fully traceable supply chain you can generate consumer trust.”

In its financial statement, Nestlé said it will introduce a range of products with cocoa sourced from its innovative programme offering consumers the opportunity to support improvement in farmer family livelihoods and protection of children. This will start with a selection of KitKat products in 2023.

On Nestlé's carbon initiative, Schneider said the key message is that from 2019 when the company’s output peaked at 96, 97 million tons, it's been going down, even though the company continues to grow.

“The key issue here is that we are able, with our reduction initiatives, to overcome the upward trend that comes from growth and hence the whole notion of growth adjusted reductions. That is something that we strongly pointed out in our Net Zero roadmap and is now fully borne out.”

Nestle said it is fully on track for its targeted 20% reduction by the year 2025 and a targeted 50% reduction by the year 2030.

Results snapshot

Nestlé reports full-year results for 2021

- Organic growth reached 7.5%, with real internal growth (RIG) of 5.5% and pricing of 2.0%. Growth was supported by continued momentum in retail sales, steady recovery of out-of-home channels, increased pricing and market share gains.

- Total reported sales increased by 3.3% to CHF 87.1 billion (2020: CHF 84.3 billion). Foreign exchange reduced sales by 1.3%. Net divestitures had a negative impact of 2.9%.

- The underlying trading operating profit (UTOP) margin was 17.4%, decreasing by 30 basis points. The trading operating profit (TOP) margin decreased by 290 basis points to 14.0% on a reported basis, largely reflecting impairments related to the Wyeth business.

- Underlying earnings per share increased by 5.8% in constant currency and by 5.1% on a reported basis to CHF 4.42. Earnings per share increased by 41.1% to CHF 6.06 on a reported basis, mainly reflecting the gain on the disposal of L’Oréal shares.

- Free cash flow decreased by 14.9% to CHF 8.7 billion, reflecting temporarily higher capital expenditure and inventory levels.

- Board proposes a dividend of CHF 2.80 per share, an increase of 5 centimes, marking 27 consecutive years of dividend growth. In total, CHF 13.9 billion were returned to shareholders in 2021 through a combination of dividend and share buybacks.

- Continued progress in portfolio management. Portfolio rotation since 2017 now amounts to around 20% of total 2017 sales.

- 2022 outlook: we expect organic sales growth around 5% and underlying trading operating profit margin between 17.0% and 17.5%. Underlying earnings per share in constant currency and capital efficiency are expected to increase.

- Mid-term outlook: sustained mid single-digit organic sales growth. Continued moderate underlying trading operating profit margin improvements. Continued prudent capital allocation and capital efficiency improvements.