Founded by Michael Smolyansky in the 1980s, Lifeway Foods has been run by his daughter Julie as CEO since Michael's death in 2002, while Ludmila Smolyansky (Julie's mother) serves as chair of the board (her consulting contract with the company was terminated at the end of last year). Julie's brother Edward was COO until January 4 but remains a board member.

In a 13D form filed with the SEC on February 25, Ludmila and Edward argue that Julie should be replaced as CEO, although they do not provide any explanation.

“On February 21, 2022," says the form, "the reporting persons [ie. Ludmila and Edward] notified the Board of Directors of Lifeway Foods, Inc. of their belief that the company should replace the chief executive officer, and commence an exploration of the company’s strategic alternatives.”

While Lifeway is a publicly listed company, the Smolyansky family collectively still holds a controlling stake in the business. According to the Feb 25 SEC filing, Ludmila owns a 21.9% stake, while Edward owns 16.2%. According to a Sept 1, 2021 SEC filing (in which Ludmila and Julie were described as having "an excellent working relationship"), Julie owns 16.43%.

The other major shareholder in the company is Danone, which owned 22.38% of Lifeway as of September 1, 2021, giving it significant leverage in any upcoming negotiations. It did not immediately respond to requests for comment.

Julie Smolyansky: 'I am grateful and appreciate the board’s support through these challenging times'

In a statement issued Tuesday afternoon, the independent directors of the Lifeway board said they "fully support" CEO Julie Smolyansky.

"Her execution of the Lifeway 2.0 strategy and transition into Lifeway 3.0 has already delivered significant results for our stockholders including eight consecutive quarters of year-over-year net sales increases."

As fiduciaries to stockholders, the board would however "consider all ideas to deliver long term value," they added.

“I am grateful and appreciate the board’s support through these challenging times. My loyalty lies with our company, our brand, our customers, our employees, our shareholders, and my father’s legacy,” said Lifeway CEO Julie Smolyansky.

Announcement 'effectively puts Lifeway up for sale'

In a post about the filing on investing site seeking alpha, investor Jeremy Blum said he believed the Feb 25 announcement "effectively puts Lifeway up for sale" given that two shareholders holding more than a third of the shares say they want the CEO removed and strategic alternatives pursued. "Danone is likely an interested party but there are sure to be many others.”

He added: “Everything hinges on Danone... If Danone is neutral or sides with Edward/Ludmila, the die is cast for a sale or change in ownership.”

Lifeway Foods sales +13.5% YoY in Q3

So how is Lifeway Foods – which is listed on NASDAQ as LWAY – performing?

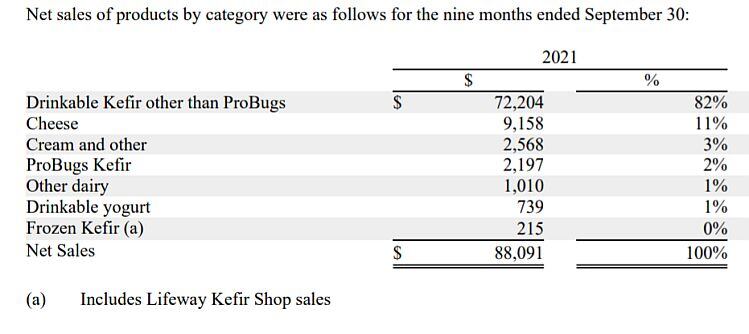

After several years of strong growth driven by its core kefir business, Lifeway Foods’ revenues plateaued at around the $120m mark between 2014 and 2017, dropped to around the $100m mark between 2018 and 2020, and picked up again in 2021, with sales in the first nine months of the year up 15.2% YoY to $88.1m suggesting the full year will end somewhat higher than 2020.

According to the firm's most recent 10Q filing, the net sales increase was primarily driven by higher volumes of Lifeway's branded drinkable kefir, while 29% of the increase came from participating in USDA's Farmers to Families Food Box program, which began in Q1, 2021 and ended in May 2021. Around 7% of the net sales increase came from the August 2021 acquisition of GlenOaks Farms, Inc., a probiotic drinkable yogurt brand, which notched up sales of $6.9m in 2020.

Net income was up 3.9% to $3.4m over the same period.

While Kefir still represents the vast majority of sales (82% of revenues in 2021), Lifeway has expanded its portfolio in recent years, with some success in cheese, which now accounts for 11% of sales, although other innovations introduced in recent years have been dropped, such as plant-based functional beverages under the Plantiful brand, Lifeway Elixirs, and kefir bites.

Most recently, it has moved into probiotic cultured oat drinkables under the Lifeway Oat brand and developed a new line of adaptogenic functional mushroom beverages.