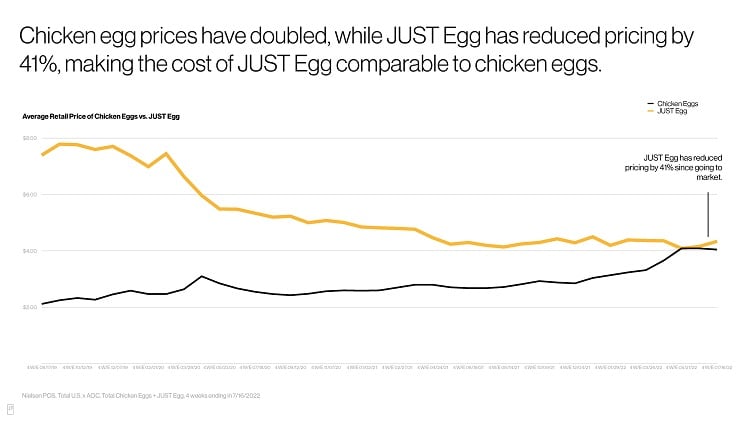

The price for JUST Egg has dropped to $3.99 for a 12-ounce bottle of plant-based liquid egg, matching the average retail price of a comparable premium 12-count egg product, claims the firm.

Across the food-at-home category, chicken eggs have been among the hardest hit by inflation. According to July 2022 IRI data, the retail price for refrigerated eggs increased +46.8% in July 2022 vs. July 2021. On a month-by-month basis (July 2022 vs. June 2022), prices increased +5.9%.

And while most food manufacturers have had to introduce multiple rounds of price increases to their products to combat inflation, JUST Egg has managed to stay on track with its price reduction efforts and has no plans to increase pricing for its products, said Josh Tetrick, co-founder and CEO of Eat Just, Inc.

The company attributes its ability to fend off inflation to its early and ongoing efforts to scale its production, including the acquisition of a US-based 30,000-square-foot dedicated facility in 2019 to produce mung bean protein isolate, the star ingredient of JUST Egg products, at scale.

"Inflationary pressures have not been so significant as to knock us off our approach to reducing pricing over time as we scale and costs come down," Tetrick told FoodNavigator-USA.

"JUST Egg’s steady price decline since our national retail launch in 2019 is a result of several factors, chief among them is our work to continue to drive down costs of the protein separation process and the increase in manufacturing and production capacity to meet growing customer demand domestically and internationally.

"Raw material costs also decline when more of those ingredients are purchased and that has an impact. Additionally, we have increased the amount of finished product that is being produced at our downstream partners’ facilities."

Looking at the path of pricing for JUST Egg and the average retail price of premium chicken egg competitors over a three-year period (2019-2022), the price point gap is now miniscule (see chart below), said Tetrick.

"The point remains that the sticker shock consumers are feeling with chicken egg price hikes isn't felt with JUST Egg. It's an opportunity for trial by consumers who may have been on the fence before," he said.

"It’s worth noting that our JUST Egg Folded MSRP is $3.99, the same as our retail pourable product."

Household penetration of JUST Egg products (liquid, folded, and sous vide bites) has reached 2 million households, a significant increase from 122,000 homes in May 2019.

Retail big leagues

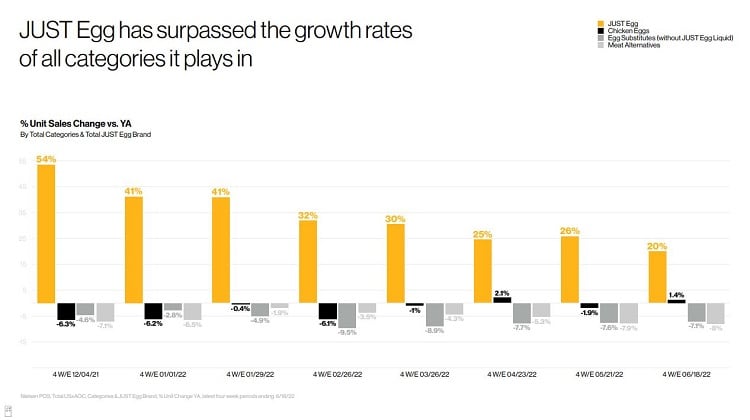

JUST Egg has joined the ranks as one of the only four egg brands (Eggland's Best, Vital Farms, Pete & Gerry's are the others) to have a nationally distributed egg SKU and has surpassed the year-over-year growth rates of all categories it plays including chicken eggs, egg substitutes, and meat alternatives.

JUST Egg brand products are available at 44,000+ points of distribution.

JUST Egg's 12-ounce liquid egg product is the 13th best-selling branded egg product in the total egg market (17,000+ SKUs), the second-fastest growing egg brand in the US (behind Vital Farms), and has the #4 fastest-growing egg SKU, per Nielsen Total US xAOC sales data.

In frozen breakfast, an emerging category for JUST Egg, its folded egg product has become the #5 highest-selling frozen breakfast item, growing 60% in dollar sales in the past year, competing neck and neck with the likes of category heavyweight Jimmy Dean (Tyson Foods).

JUST Egg is also making a branded appearance in products from other plant-based focused brands including Field Roast breakfast sandwiches, Mikey's plant-based breakfast pockets, Crepini eggless wraps, and Alpha Foods breakfast sandwiches, which has contributed to further consumer adoption.

Foodservice continues to be a significant driver of growth for JUST Egg where it is currently available in over 2,200 points of distribution including national distribution and a permanent menu placement with Peet's Coffee.

'The objective is for JUST Egg to be below the price of conventional eggs'

As prices for food at home show little sign of slowing down in the near term, JUST Egg has a clear path to further price reductions, said Tetrick.

"Longer term, the objective is for JUST Egg to be below the price of conventional eggs and our cost structure advantage is that over 50% of the cost of chicken eggs come from the feed given to chickens. As feed prices go up, egg prices go up. Down the road, more efficient protein separation, monetizing starch byproducts and other advances will help us reach that goal," added Tetrick.