In June 2022, the retailer reported that its distribution center (DC) network peaked at well over 90% capacity and the company has reduced inventory levels to 80% as of August 2022.

"With these reductions, we're projecting our DCs will remain at/or below 85% capacity through the remainder of the year even after the seasonal increase in holiday inventory that is set to occur over the next two months," said Cornell on the company's Q2 2022 earnings call.

While it may seem counterintuitive to shed some of its inventory especially in an industry fraught with supply chain challenges and retailers still dealing with out-of-stock items, Cornell said the approach will benefit the retailer in the long term and improve the shopping experience for customers and the work environment for its employees.

"Consider the alternative, we could have held on to excess inventory and attempted to deal with it slowly over multiple quarters or even years. While that might have reduced the near-term financial impact, it would have held back our business over time," said Cornell.

"Much more importantly, it would have degraded the guest experience. It would have cluttered our sales force and hampered our ability to present new, fresh and fashionable items, the ones our guests expect from Target," he added, noting how the decision to right-size its inventory levels provides a valuable uncluttered store experience for customers and workers.

"For our team, this quarter's inventory actions will enable them to focus on doing what they do best, providing a great guest experience, while reducing the strengths and distraction from overly crowded store backrooms and distribution facilities. After we announced the right-sizing effort at the beginning of June, I have heard from countless leaders across the company, who wanted to relay their gratitude for the decision to move quickly and face the issue head on," added Cornell.

In addition, downsizing inventory levels allows the retailer to focus on key categories that are driving the most growth for the company including Food & Beverage, Beauty, and Household Essentials, noted Cornell.

Food & Beverage sales up 50% on a 3-year basis

Target saw net sales grow +2.6% in Q2 2022 on top of strong +8.9% growth seen in Q2 2021. Food & Beverage led the way for the quarter with growth in the low double digits. On a three-year basis (Q2 2022 vs. Q2 2019), Food & Beverage sales increased by 50% or $1.8bn.

Along with increased sales, Target saw an increase in store foot traffic, which grew by +2.7% in Q2 2022 compared to double-digit growth the year prior. Over the past three years, store traffic has increased by more than 20% since 2019 or looking at raw numbers, Target has added over 90 million guest visits over a three-year period.

Leaning into value

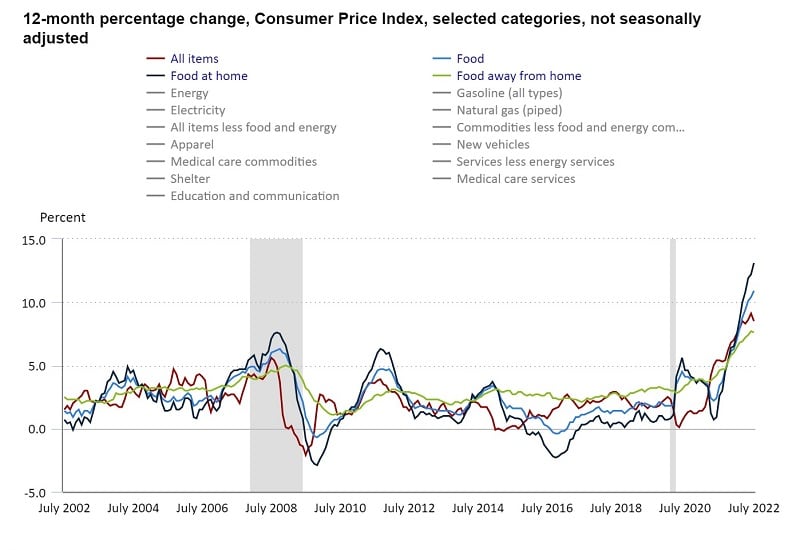

"What we're seeing in our results and hearing from our guests is that they still have spending power, but they're increasingly feeling the impact of inflation. And while the recent reduction in prices at the gas pump have been encouraging, guest confidence in their personal finances continues to wane," shared Target chief growth officer Christina Hennington.

In order to keep its momentum as a one-stop shopping experience for consumers, Target is leaning heavily into added more value options to its portfolio.

"We're focused on providing great everyday pricing and strong opening price points across every category, including in our own brands," Hennington said.

In the past two years, Target has launched multiple new private label lines including Good & Gather (now a $2bn brand) and Favorite Day, the latter of which was the fastest-growing private label brand by household penetration, according to a recent report from Numerator.

Interest in sales and deals has increased with more than 1.5 million shoppers signing up for Target Circle and Ultimate Rewards accounts to take advantage of in-store promotions.

"We want to make sure the guests can find great value on shelf, online and the way that we're priced, and we feel good about where we've struck that value equation. And I think the traffic we're seeing speaks to the fact that guests see it too," said Target chief financial officer Michael Fiddelke.