Burger King – which is owned by Restaurant Brands International – first started testing the waters with Impossible Foods in April 2019 with a trial of the Impossible Whopper, rolling it out nationwide just four months later after encouraging results.

By October 2019, company executives said the soy-based patty - which is cooked on the same broiler as its regular beef patties - had “become one of the most successful product launches in Burger King's history” that was attracting new guests and delivering “highly incremental sales.”

In January 2020, the Impossible Whopper was added to the chain’s two-for-$6 discount menu on a temporary basis, with execs at the fast food chain noting that the premium price point had deterred trial, although it continued to generate “healthy levels of incrementality.”

In October 2020, Burger King said the burger “continued to perform,” although it has not been referenced on any earnings calls since then.

However, the Impossible Whopper remains on the core menu, while Burger King has recently added two new variants: the Impossible King and the Impossible Southwest Bacon Whopper.

Asked how the Impossible Whoppers are performing, a spokesperson told us: "For strategic and competitive reasons, we’re not able to share product performance metrics for Impossible-branded menu items."

Impossible Foods has struck a variety of high-profile partnerships in the foodservice arena beyond its deal with Burger King, with brands including Starbucks, White Castle, Red Robin, Qdoba, and Fatburger.

It has also teamed up with Buitoni Food Company, which features Impossible beef in new Buitoni filled ravioli products; and Denver-based Custom Made Meals, which manufactures entrees and appetizers for Kroger’s Home Chef brand, to develop plant-based protein products, although it has not provided details about the scope of the collaboration or the timing of the launch.

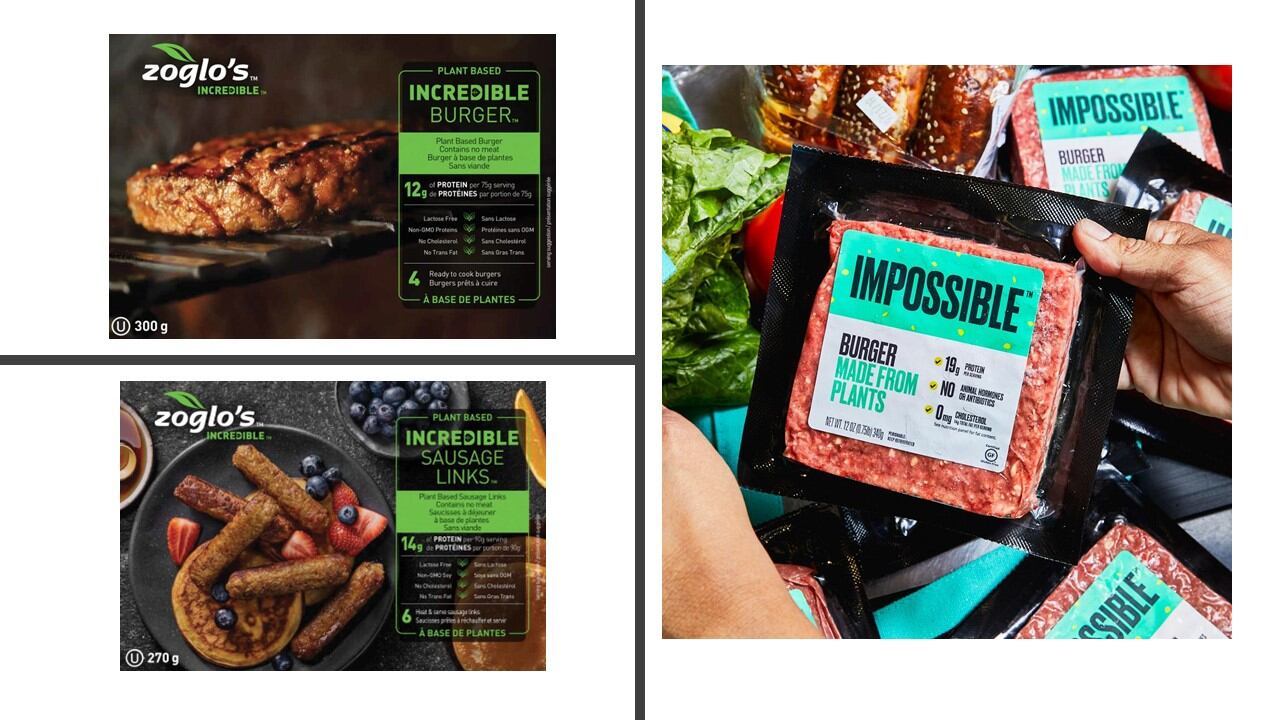

Image credit: Impossible Foods

Peter McGuinness: ‘The cash position is very strong’

As a private company, San Francisco-based Impossible Foods – which has raised jaw-dropping sums (almost $2bn) since its founding in 2011 – has not faced the same kind of scrutiny as rival Beyond Meat, which went public in 2019 and has been having a pretty torrid year.

However, with US retail sales of refrigerated plant-based meat going backwards in recent months and analysts questioning whether the addressable market for meat alternatives is as large as it appeared a couple of years ago, Impossible is under pressure to deliver.

Speaking to FoodNavigator-USA in March, as he prepared to take the reins as the firm’s new CEO in April, former Chobani president Peter McGuinness said his immediate priority was to “increase awareness and trial of Impossible products and increase distribution.”

Asked about the company’s plans for an IPO, he acknowledged that the environment had changed, adding: “I don’t think it's a good time for anyone right now as the markets are so incredibly volatile. And in the case of Impossible, the cash position is very strong, so there's plenty of investment to fuel all the growth, so there's no urgency on going public right now.”

Founded by Dr Pat Brown in 2011, Impossible Foods entered the US foodservice market in 2016 and made an aggressive push into retail in 2020. It does not disclose revenues, but its products are now sold in 25,000+ grocery stores and 40,000+ foodservice locations across the US, the UK, Australia, Canada, Hong Kong, and Singapore.

New fully-cooked Impossible Chicken Patties Made From Plants begin rolling out to the frozen aisles of retailers including Safeway and Sprouts this month, with thousands more to follow this fall including Kroger and Albertsons, says the firm.

Made from soy protein concentrate with added zinc and B vitamins, the patties contain 10g protein per 77g serving, 0 mg cholesterol, and 50% less saturated fat (1.5g v. 3g) and 30% less total fat (9g v. 13g) compared to the leading animal chicken patties, claims the company.

Image credit: Impossible Foods

Plant-based meat by numbers, US retail: July 2022

According to 210 Analytics, which analyses IRI data in measured US retail channels, dollar sales of plant-based meat rose 7.6% in July 2022 vs July 2021, although volumes dropped -5.1%.

The growth was entirely driven by frozen products, however, helping to offset double-digit declines in refrigerated meat substitutes:

- Refrig. meat alternatives, July '22 vs July '21: Dollars -14.6%, volumes -15.3%

- Frozen meat alternatives, July '22 vs July '21: Dollars +9%, volumes -0.3%

- Conventional meat, July '22 vs July '21: Dollars +5.6%, volumes -1.3%