“It's frustrating that the category is kind of getting a bad rap, but some of the other players have their own issues that are not applicable to us,” said McGuinness, who was speaking to FoodNavigator-USA after unveiling new wording on Impossible Foods’ core 12oz beef brick and announcing formulation changes to slash saturated fat by 25% (see box below).

“I’ve said it before, but it’s a competition issue, not a category issue. We're growing at 65% year-on-year in [measured] retail [channels] according to the latest IRI data,* and it’s not just coming from distribution,” said McGuinness, who took the helm in April. “It’s a combination of new doors, new SKUs, and velocity gains, so we feel very good.

“We have a repeat rate of around 45%, so every two people I get to try our products, one in two repeat. So that says awareness and trial is a gift that keeps on giving, as we only have 5% household penetration.”

Shake out to come? ‘When buyers look at productivity on shelf, the math is in our favor’

In the short term, he said, there’s likely to be a shakeout at retail as buyers take out poor performers and me-too products: “Space isn’t increasing, so to get distribution, something has to come out. So they look at productivity on shelf, and here the math is in our favor.

“As you see in a lot of categories, there has been a proliferation of brands and SKUs and a lot of duplication, so buyers are going to look at the math and make an informed decision on what stays, what's get double faced, what gets triple faced, and what goes. And so we invite that math exercise.”

When it comes to pricing, he said, “We haven’t taken price. We’re growing at 65%, we're having economies of scale and fixed costs absorption and we've been able to keep our costs down. We also have long-term contracts when it comes to all of our top ingredients.

“The gap between us and meat has never been tighter. A lot of the stats being tossed around saying plant-based meat is twice the price are lazy and inaccurate. Compared to what? Private label? Or premium organic meats?”

Impossible Beef: Now with 33% less saturated fat than 80:20 animal beef

Impossible Foods is cutting the saturated fat in its plant-based beef from 8g to 6g per serving and increasing the protein quality by tweaking the amino acid profile to increase the %DV for protein from 31% to 38% with the same total protein content (19g), implying a PDCAAS or protein digestibility score of 1.0, the same as regular beef.

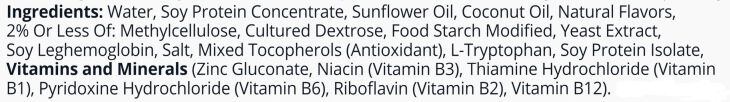

The soy-based recipe (see below) remains basically the same, but an amino acid (L-Tryptophan) has been added to increase the PDCAAS score, potato protein has been removed, and the soy protein content has been slightly increased.

“We’ve gone from eight grams to six grams of saturated fat, which is 33% less than the animal,” said McGuinness, who said the reduction came with no compromise in the taste, mouthfeel, or cooking experience.

The latest version pictured above delivers as much protein, with the same protein quality, as animal-derived beef, plus the same bioavailable iron and key micronutrients, with 33% less saturated fat, zero cholesterol, 20% fewer calories, and a dramatically lower environmental footprint, he added.

“But we're going to continue to improve so that the nutritional picture – which is already strong - becomes undebatable, because there's still confusion around, Hey, is it really better for me?”

- 80:20 ground animal beef 4oz: 290 calories, 19g protein, 23g fat, 9g saturated fat

- Impossible Beef (latest version) 4oz: 230 calories, 19g protein/38%DV, 13g fat, 6g saturated fat

- (Impossible Beef (old version) 4oz: 240 calories, 19g protein, 31%DV, 14g fat, 8g sat fat)

From Burger to Beef: ‘Words matter, and this was a deliberate change’

The product name is also changing from Impossible Burger to Impossible Beef, given that the company now separately sells Impossible Burger patties, said McGuinness.

“Words matter, and this was a deliberate change. We went from 'Burger' to 'Beef' to spark the imagination. You can use it throughout the day, from tacos to chili to bolognese. We also changed the wording on the back to 'cooks like ground beef' to highlight that versatility. It's much more than just a burger.”

Merchandising meat alternatives

Asked about merchandising – and whether the decision to stock meat alternatives in the meat case, where many are not delivering the kind of turns to warrant the space – he said: “I’ve been here for four months now and I’ve hit something like 170 stores and merchandising is all over the place to be honest.

“We're mainly in meat but I’ve seen it in frozen, in fresh, in the vegan and vegetarian section, in frozen meats, in fresh meats, and that's part of the challenge right now, because it has to be placed right and the consumer has to know where to go find it.”

‘You can’t just go put a bunch of things on the shelf and expect them to sell. It's not build it and they will come’

But what about the fundamental question preoccupying many stakeholders right now: Were projections about the pace of growth for alt meat – including Dr Pat Brown’s prediction that animal agriculture would be “eradicated” by 2035 – just wildly over-ambitious?

And is Impossible (which has raised almost $2bn to date) ever going to be able to deliver on such lofty expectations?

According to McGuinness, who started his career in advertising and marketing, there is no question that plant-based meat is a mass market proposition, the industry collectively just has to do a better job of selling it in the mass market, and the products have to deliver, he said.

“Our aim is not to be the best plant-based meat, which is a low bar, it’s to be the best meat. And it needs to be mass, it can't live on the coasts, it can't live in specialty stores, it can't live in academia.

‘But when you’re trying to reach a new consumer, you can’t just go put a bunch of things on the shelf and expect them to sell. It's not build it and they will come. It's not Field of Dreams.

“You've got to earn that demand, and we're prepared to do it. And financially, we're able to do it.”

Awareness levels of Impossible Foods – which entered the US foodservice market in 2016 and made an aggressive push into retail in 2020 – “are only 14%, so 86% of the country hasn't even heard of us because we haven't done any sustained advertising and marketing,” added McGuinness.

“So if we can grow 70% at 14% awareness and 5% household penetration, there's a lot more work to go do and a lot more growth to go get. That's what gets me really excited.”

‘The category has done a lousy job of explaining itself… and by the way, we haven't done a great job either’

And when it comes to selling meat alternatives to the mainstream, he claimed, “The category has done a lousy job of explaining itself. It's one of the biggest communication failures and food. And by the way, we haven't done a great job either, so I don't want to sit here and say that we're perfect because we're not. We've done little to no advertising.

“If you're going to even start to displace animal products, you have to go to the next level in terms of taste, texture, flavor, and nutrition and have frequent and sustained communication.”

No one, he claims, “other than in keynote speeches and lobbying efforts is saying, in a mass, compelling way, that these products are better for you and the planet.”

Sustainability and alt meat: ‘This is one of the biggest communication challenges in food’

When it comes to sustainability, he said, “When you talk to people about the planet, they still tend to talk about electric cars or recycling, rather than how their food choice impacts the planet, but it’s a complex issue. I honestly think this is one of the biggest communication challenges in food, so we have to crack the code on communication.”

*According to the company: “Impossible's retail sales are up roughly 65% according to data from Chicago-based analytics company Information Resources, Inc. over the most recent 4-week as well as the most recent 13-week period, and its dollar share is up 5 full share points over the same periods (L4 + L13).”