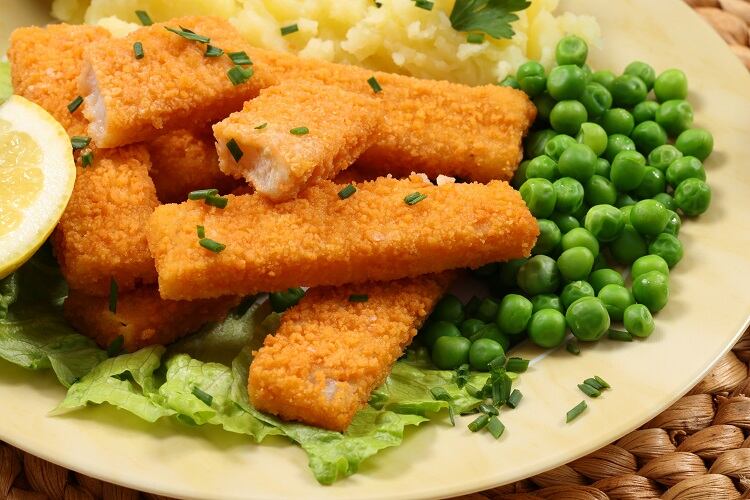

Nomad Foods’ revenue spread is dominated by frozen fish and vegetable products (40% and 20% respectively), sold under brands ranging from Birds Eye to Findus and iglo. As it stands, around 93% of the company’s net sales can be attributed to ‘healthy’ meal choices.

But the European frozen food major does not play in traditionally ‘healthy’ categories alone. Across Europe, Nomad owns ice cream and frozen food brands in Serbia and Croatia, and in 2018 acquired Goodfella’s Pizza in the UK and Ireland.

As a nutritionist, the Goodfella’s acquisition presented an obvious challenge, revealed Lauren Woodley, group nutrition leader at Nomad Foods. But the company is working to make all products across all categories HFSS-compliant (not high in fat, salt and sugar) where possible, and pizza is no exception.

Nomad’s reformulation journey

Nomad Foods was formed in 2015 following the acquisition of iglo Group. At that time, roughly 85% of its net sales could be attributed to ‘healthy’ meal choices.

‘Healthy’ for Nomad means non-HFSS as per the UK Government’s nutrient profiling model. It uses a scoring system which balances the contribution made by beneficial nutrients that are particularly important in children’s diets with components in the food that children should eat less of.

“The UK Government’s nutrient profiling model has been our model as a business since inception,” explained Woodley at FoodNavigator’s Positive Nutrition Summit in central London last week. “We’ve always been developing products to be non-HFSS. That is our definition of ‘health’.”

Nomad has since improved its proportion of ‘healthy’ net sales by around eight percentage points and is committed to increasing the proportion of sales of ‘healthy’ products year-on-year.

Such figures indicate Nomad has been reformulating since inception. But the group ‘still has a way to go’, we were told. “We’re trying to make sure that every single one of our brands – and as an M&A business, we’re always buying up new brands – [are healthier] if we can do it.”

Rebuilding pizza ‘from the base up’

Frozen fish and vegetables have proven easy wins for Nomad over the years. “Fish and veg are always going to be healthy,” Woodley explained. The group’s plant-based Green Cuisine brand, too, helps boost Nomad’s non-HFSS profile. “Every single Green Cuisine product is a fully healthy meal choice. It is a non-HFSS brand. At most recent count, we have over 60 products, and they’re all healthy meal choices.”

But other categories, particularly those traditionally perceived as ‘indulgent’ – whether that be ice cream, Yorkshire puddings, roast potatoes, or pizza – can contain higher levels of fat, salt and sugar from the outset, making them more challenging to reformulate.

Despite the risk that reformulation could reduce consumer acceptance of HFSS products, Nomad is tackling the challenge ‘head on’.

“In our first year of ownership [of Goodfella’s Pizza], less than 20% of sales came from healthy products,” recalled Woodley. “So we set very strong KPIs (key performance indicators) for pizza and looked at [the product] in a different way.”

Nomad took pizza ‘back to the basics’, stripping the product back to its component parts. From there, the group assessed all the nutrients linked to the HFSS algorithm: protein and fibre on one side; salt, saturated fat, and sugars on the other.

Pizza bases were ‘completely reformulated’ with the addition of high-fibre flours that provide the organoleptic profile of a standard pizza dough. Sauces, too, were reformulated and fibre added. And finally, the group changed its toppings to better align with the nutrient profiling model.

“By doing that, we’ve effectively innovated or renovated 18 pizzas. By the end of this year, or very beginning of next, 100% of the pizza range will be non-HFSS,” revealed Woodley.

Health through stealth

Such progress is the result of being ‘very single minded’ and, as Woodley put it, ‘recreating the blueprint’ for pizza.

Nomad is a proponent, in certain categories, of a ‘health through stealth’ approach to reformulation, whereby products are made healthier without making overt claims on-pack. This is the approach Nomad has taken to salt reduction.

“From a nutrition point of view, [we’ve] always wanted to bring down salt levels slowly to help people readjust their taste buds. Of course, it would be great to put a [salt reduced] claim on a product, but a lot of the time if you tell people you’ve reduced salt, they presume it’s not going to be as tasty and don’t eat it.”

In response, Nomad has intentionally been more overt about nutritional credentials on its ‘everyday foods’, and taken a ‘health through stealth’ approach to indulgent or occasional food products, such as pizza.

“Consumers want to feel like they’re indulging themselves, so we stealthily put the health in. We don’t want to tell them that it’s as good for it as is it.”

In saying that, the company takes transparency seriously, not only in the reporting of its financial data through a health and nutrition lens, but also in terms of front-of-pack (FOP) labelling.

Nomad uses relevant FOP labels in different geographies, ranging from Keyhole symbols in the Nordics to traffic light labelling in the UK. The group is also a ‘huge proponent’ of Nutri-Score, which it applies across eight of its markets.

“As food systems become more integrated, we think a harmonised mandatory system for Europe would be very positive,” Woodley told delegates at the Positive Nutrition Summit. “Having nutrient profiles [established] at a European level would help to even out the playing field and know that consumers are going to be consistently given the ability to make informed choices.”

The HFSS ‘opportunity’

In the UK, many food and beverage makers are working to reformulate products to reduce fat, salt and sugar levels, as well as overall calories, to comply with incoming HFSS laws.

In October last year, rules limiting the location of unhealthy foods in shops came into play. Others were delayed: rules banning multibuy details on HFSS foods and drinks are expected to come in later this year, and restrictions banning HFSS adverts on TV before 9pm and paid-for adverts online have been pushed back until 2024.

From Woodley’s perspective, HFSS regulations present an opportunity for the company. Since Nomad has been using the UK’s nutrient profiling model since inception, the group already knew close to 90% of its products were HFSS-compliant. “We were already in a great position,” the nutritionist recalled.

Increased regulatory pressure allowed Nomad to ‘unlock resources’ and ‘unlock buy-in’ for the reformulation of more challenging products, including pizza. “We saw it as a really great opportunity to say we can achieve healthy pizza, and really healthy roast potatoes.

“[It also allowed us to] push ourselves in R&D and push our commercial partners to go for the ‘moon-shot of health’ in traditionally more indulgent categories.”

Nutrition sits as a ‘firm pillar’ of the business, Woodley stressed, which could be perceived a ‘bold decision’. But in so doing, it opens up opportunities to take action on more challenging products.