One of the most common pitfalls in product development is failing to truly understand the consumer. Despite investing heavily in R&D, many companies stumble at the final hurdle by relying on gut instincts or outdated methodologies. This often results in products that miss the mark. In a landscape where consumer preferences evolve rapidly, such errors are increasingly unsustainable.

Foodpairing cofounder Bernard Lahousse – a recognised authority in gastronomy and consumer science – is unapologetic in his critique, “We’re saying what no one else dares to say – consumer panels are outdated, inefficient, and unnecessary.

CEO Nick Poels builds on this, emphasising the inefficiencies in traditional methods, “Why spend weeks on costly, biased panel testing when you can get instant feedback from thousands of virtual consumers? Companies are struggling to create product innovations that guarantee success, and they can no longer afford to launch products only to watch them fail within a year.”

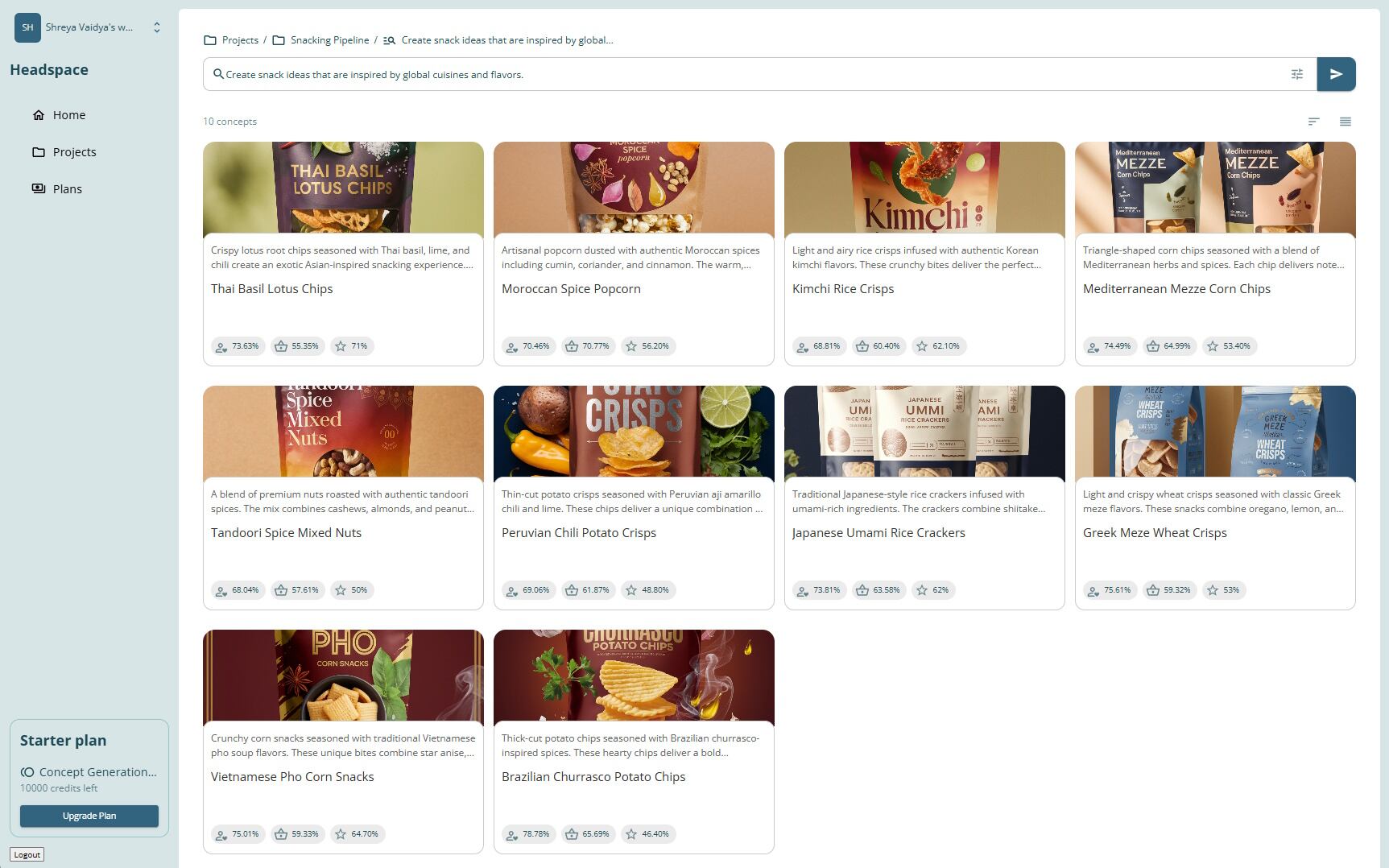

What Foodpairing is advocating for is nothing short of a transformation in how brands approach consumer validation. At the forefront of this shift is Headspace, Foodpairing’s AI-powered platform designed to revolutionize the innovation process. Leveraging a vast database of consumer Digital Twins and advanced machine learning, Headspace allows brands to generate, explore, and validate product concepts in minutes rather than months. By eliminating the need for expensive, time-consuming consumer panels, it provides actionable insights early in the process, ensuring concepts align with consumer preferences from the start.

“Headspace provides clarity on not just whether consumers will like or buy a concept, but why - down to specific sensory drivers like aroma, taste, and texture,” adds Lahousse.

“Marketers and R&D teams no longer need to argue over ‘what consumers might like’ – the data drives teams to the right decisions.”

We caught up with Poels to discuss how this further.

What are the most common mistakes producers make when launching new products?

A common pitfall is failing to truly understand the consumer. Too often, teams rely on gut feelings, or are overruled by senior management, instead of leveraging real data and insights to guide their product decisions.

Another issue is overcomplicating product concepts. Adding too many flavours or features can confuse consumers instead of exciting them. Keeping concepts focused and clear is key to marketplace success.”

Speed to market is also critical. If a company drags its feet, the trend window might close. Opportunities in the snack and bakery sectors are fleeting, so timing and efficiency really matter.

Finally, there’s the issue of product validation. Skipping trials or consumer testing is a big mistake, because it can lead to a final product that doesn’t match what people actually want.

Most of these challenges can be avoided by early-stage validation of product ideas. There are many ways to do this, of course: From consumer panels to focus groups or HUTs, each of which have their pros and cons. We take a different route by embracing a digital twin approach. This allows us to simulate real-world performance and gauge consumer reactions virtually – providing faster, more precise insights. We can ensure new products align with consumer preferences right from the start.

What role does data play in predicting consumer preferences and developing successful products?

“Data is the backbone of modern product development. It helps identify emerging trends before they peak, rather than just reacting once it has already become mainstream. It also predict consumer purchasing behaviour, and optimise everything from flavour combinations to packaging design and marketing strategies. Having access to the right kind of data helps take the guesswork out of innovation and boosts the chances of real market success.

So how can Headpace help?

The journey of Foodpairing began in 2007 with the idea of helping chefs use science to create new pairings and recipes. Our first SaaS product, called Inspire, was designed to inspire chefs, offering them exciting new pairing ideas. Chefs in 140 countries now use Inspire to get creative in their kitchens.

This combination of science and culinary expertise caught the attention of the food industry. With the rise of adventurous consumers seeking bold flavours, Foodpairing became an essential tool for brands looking to innovate. As consumer behaviour evolved, so did the need for faster and more efficient validation processes. One of the industry’s largest bottlenecks has always been consumer validation, leading us to ask: Could we instantly generate and validate millions of product concepts in minutes?

We initially used digital twins of consumers to help our clients access validated concepts through technology-enabled services. Over time, we perfected this approach and developed Headspace, a SaaS solution that allows companies to frontload consumer validation early in the product development process, eliminating the need for expensive and time-consuming consumer panels.

What trends in consumer preferences are shaping the bakery and snack industries in 2025?

We’re observing a fascinating evolution in consumer tastes and expectations. First and foremost is the growing love for ‘swavoury’ and ‘swicy’ flavours, combining sweet with savoury or spicy. People are genuinely excited by the contrast these dual profiles bring.

Another major trend is the demand for functional foods. Consumers are seeking out baked goods and snacks that deliver specific health benefits, such as supporting gut health, boosting energy, or strengthening immunity. It’s not enough just to taste good anymore; there’s an expectation for snacks to contribute positively to overall wellbeing.

We’re also seeing a surge in global influence, like Korean gochujang or Middle Eastern-inspired pastries. Consumers are hungry for new culinary experiences, and they’re more open to bold, internationally influenced tastes than ever before.

Texture is becoming a key differentiator. Whether it’s a soft, indulgent centre or a dramatic crunch, texture plays a crucial role in delivering a multisensory experience.

In a similar spirit of adventure, mash-ups and hybrid foods – like stuffed crackers or filled pretzels – are capturing attention because they merge familiar formats into something completely new.

And finally, there’s what we refer to as the ‘hi-lo’ trend: premium ingredients meeting everyday products. It’s about taking a simple baked good or a classic snack and elevating it with gourmet touches – at a price point that’s still accessible.

All of these trends point toward a consumer base that’s increasingly curious, health-minded, and willing to explore. It’s going to be an exciting journey for the bakery and snack industries as we head into 2025.

How can producers balance the demand for innovative flavours with cost-effective product development?

Striking the right balance can be challenging, but leveraging the right data is key. By validating concepts early in the innovation process, producers can reduce the risk of costly missteps. Another effective strategy is modular innovation, where proven product bases are repurposed with new flavours or slight formulation tweaks. This approach reduces production complexity while delivering fresh experiences to consumers.

You’ve touched on texture but just how important are sensory factors in determining a product’s success?

Multisensory factors are absolutely critical. Consumers form impressions within seconds of trying a product. Taste drives repeat purchases, but aroma sets the stage and often dictates perceived quality. Texture, meanwhile, delivers surprise and satisfaction, elevating a product from acceptable to memorable. A harmonious sensory profile is foundational to market success.

With growing interest in sustainability, how can bakery and snack producers incorporate eco-friendly practices into product innovation?

Sustainability should be integrated into the innovation process from the start. For example, reducing waste by minimising physical prototypes or sourcing ingredients responsibly can make a big difference. Producers should also explore byproduct utilisation and locally available ingredients to reduce environmental impact. Ultimately, products that are both delicious and thoughtfully produced resonate strongly with today’s consumers.

How can smaller producers compete with larger brands in terms of innovation and market reach?

Smaller producers have distinct advantages, including agility and the ability to collaborate seamlessly across functions. They’re also more likely to focus on niche markets or emerging trends that larger players might overlook. However, they often face higher risks with limited resources, making it essential to embrace tools that reduce the likelihood of failure.

By leveraging data-driven insights and focusing on consumer alignment, smaller brands can compete on a level playing field and bring unique products to market quickly and efficiently.