WK Kellogg Co saw a significant surge in its stock price recently, jumping 11% on 14 February on reports that Italian confectionery giant Ferrero is eyeing a potential takeover. According to sources familiar with the matter, Ferrero is reportedly in the early stages of considering a bid for WK Kellogg, though there’s no certainty that an offer will materialise.

The move has fuelled speculation about whether WK Kellogg will follow a similar path to Kellanova, which was acquired by Mars in a blockbuster $36 billion deal that shook up the industry last year.

In 2023, Kellogg Company had split into two, with WK Kellogg emerging as a pure-play North American cereal company, while Kellanova expanded its focus on the high-growth categories of snacks and frozen foods. With WK Kellogg’s stock is still trading at a steep discount compared to competitors, the possibility of another major sale has analysts and investors watching closely for the next move.

Nutella, Kinder and Ferrero Rocher brand owner Ferrero may not seem like an obvious buyer for a cereal company. However, the Italian conglomerate has history with Kellogg, having acquired Keebler and Famous Amos in 2019 for $1.3 billion. With WK Kellogg currently trading at just seven times its projected EBITDA, Ferrero might see an opportunity to strengthen its foothold in the breakfast market.

Although the takeover remains speculative, WK Kellogg remains an attractive investment, offering a 3.2% dividend yield and focusing on improving operational efficiencies.

Going beyond the cereal aisle?

Despite swirling buyout rumours, WK Kellogg made no mention of a sale at the recent Consumer Analyst Group of New York (CAGNY) Conference in Orlando, Florida. Instead, CEO Gary Pilnick and his leadership team laid out an ambitious roadmap designed to reinvigorate the company and push beyond its cereal roots.

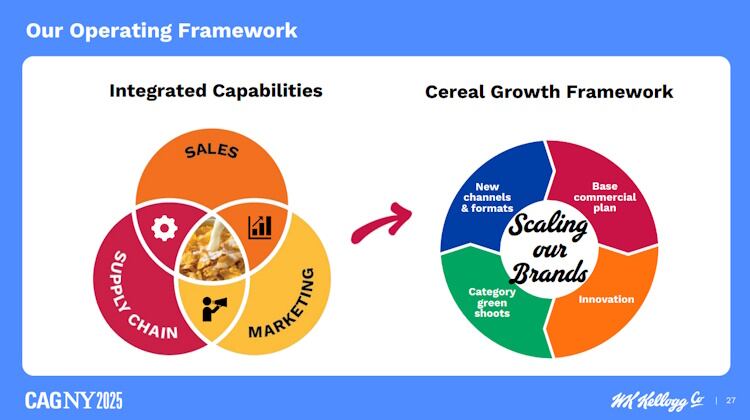

Speaking alongside CFO Dave McKinstray, chief growth officer Doug VanDeVelde and chief supply chain officer Sherry Brice, Pilnick made it clear that WK Kellogg isn’t just about staying in the game – it’s about winning it. The company’s ‘Horizons’ growth strategy is focused on stabilising revenue, significantly increasing margins and delivering strong returns to shareholders.

“You’re hearing that today we are focused on delivering Horizon 1; we know there is so much to play for, so much value to create as we do so,” said Pilnick. “As we do that, we’re also laying the groundwork and preparing for Horizon 2, which is our tomorrow.”

One of the biggest priorities is revitalising the cereal category and optimising its core brands. The Battle Creek, Michigan-headquartered company aims to overcome barriers by tapping into nostalgia, reinforcing ‘joy and connection’ through breakfast, and creating stronger relationships with customers. Cereal remains a major category in North America, generating over $10 billion annually and ranking as the number one breakfast food for kids and number two for adults. It also holds the third spot among all centre-store food categories.

Pilnick was particularly vocal about WK Kellogg’s ambitions to reclaim the top spot in US cereal sales, where it currently sits at No. 2 behind General Mills. His plan includes leaning into the company’s rich brand heritage, expanding into new retail channels such as e-commerce and convenience stores, and rolling out consumer-driven innovations.

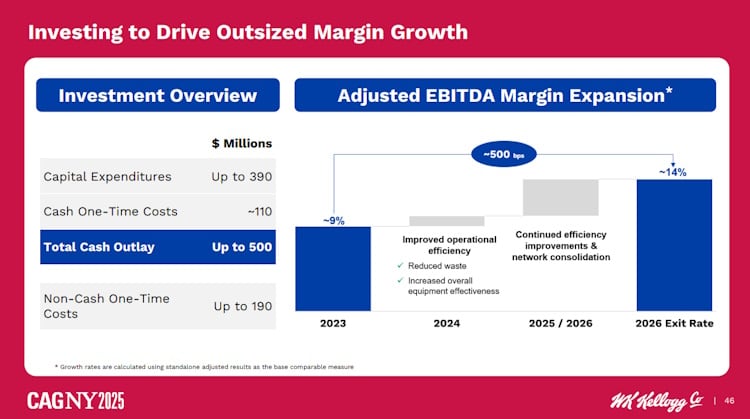

The company is also executing on its half-billion supply chain modernisation plan, with major investments funnelled into an independent warehouse network and IT infrastructure, along with a new state-of-the-art food development lab. These upgrades are part of a broader strategy to enhance agility and cost efficiency.

While better-for-you cereals remain a key focus, WK Kellogg is also looking to reignite consumer excitement with indulgent offerings. The company has introduced doughnut-inspired cereals under brands like Apple Jacks, Frosted Flakes and Krave. While not as out-there as General Mills' pizza-inspired breakfast cereal, this move underscores a broader trend: even as health consciousness grows, consumers still crave moments of indulgence.

Other WK Kellogg innovation ‘platforms’ include Cocoa Frosted Mini Wheats and Blueberry Bran Crunch under the brand platform; Go Packs for Frosted Flakes, Froot Loops and Pops cereal and Bear Naked granola To-Go Packs in the format platform; and Kellogg’s Extra and Bear Naked Oats & Honey in granola, Special K Triple Berry Blend and Kashi Organic Cocoa Clusters under the nutritional platform.

But the real surprise of the presentation came when Pilnick hinted at WK Kellogg’s long-term vision, which stretches beyond the cereal aisle.

“Our today is about cereal, and our tomorrow is about cereal and beyond cereal,” said Pilnick.

Changing consumer habits are shaping WK Kellogg’s strategy. More people are eating on-the-go, increasing the demand for portable breakfast options. While Pilnick remained tight-lipped on specifics, he suggested the company is exploring opportunities in snackable cereals, breakfast bars and frozen breakfast items. Licensing agreements and strategic partnerships may be key avenues for expansion, allowing the company to enter new categories without heavy internal R&D investment.

“This new framework focuses on effectively driving our core business and delivering exciting innovation, both of which are part of today’s playbook, but it includes new and different ways to drive growth,” said Pilnick. “What’s even newer would be capitalising on green shoots and expanding into underpenetrated white spaces in the category, such as certain channels and formats. We’re clear on what we need to do. We have the assets to do it and we also have the team to execute.”

Despite the takeover speculation, the CEO left the door open for WK Kellogg to make acquisitions of its own. He stressed that any merger or acquisition the company pursues will be carefully chosen to complement its existing portfolio and drive both top-line and bottom-line growth. Given the company’s robust supply chain and extensive retail relationships, it is well-positioned to integrate new acquisitions smoothly.

“We could license our brands into other categories,” Pilnick told analysts at CAGNY. “Perhaps our inorganic growth could come in the form of tuck-in M&A or joint ventures. I led corporate development for The Kellogg Co and saw the power of reshaping our portfolio through both of these frameworks. We share this with you today to give you a sense of where and how we can expand in the future.”

Financial check-up

WK Kellogg remains laser-focused on financial discipline and delivering shareholder value. CFO Dave McKinstray detailed ongoing efforts to cut costs through supply chain improvements and operational efficiencies, ensuring that capital allocation decisions prioritise innovation while maintaining a strong dividend policy.

The company’s latest financial results reflect both challenges and progress. Full-year 2024 net sales declined by 2.0% year-over-year, but adjusted EBITDA grew by 6.6% during the same period. For 2025, WK Kellogg expects EBITDA growth of between 4% and 6%, signalling confidence in its cost management strategy and long-term vision.

Pilnick was upbeat about the company’s direction, stating, “The team has done a great job executing our plan, advancing our strategic priorities and building for the future.” He also emphasised that WK Kellogg’s supply chain modernisation, commercial integration and product innovation investments will drive sustainable, long term growth, even amid market uncertainties.

Will WK Kellogg join Ferrero?

While WK Kellogg’s leadership remains focused on executing its growth strategy, the Ferrero takeover speculation adds an intriguing twist to the company’s future. The food industry has seen a wave of consolidation, with Mars’ acquisition of Kellanova being a prime example. Investors and analysts will be watching closely for any developments.

Whether WK Kellogg remains an independent cereal powerhouse or finds itself under Ferrero’s wing, one thing is clear: the company isn’t sitting still. With a bold plan for innovation, expansion and operational excellence, WK Kellogg is charting a new course for a new era - regardless of who’s holding the spoon.