Protein bar newcomer David acquired food-tech company Epogee in a move to reinforce its supply chain and tee up future growth, with the help of $75 million in Series A funding on May 29, including participation from investment firm Greenoaks and Valor Equity Partners.

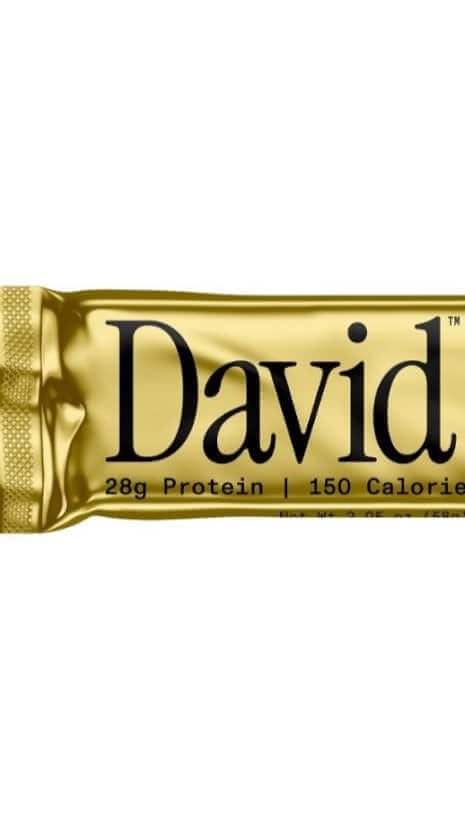

Launched last September, David offers snack bars that contain 28 grams of protein – including from Epogee’s plant-based fat alternative esterified propoxylated glycerol (EPG) – and zero grams of sugar. The bars are modeled after the iconic Power Bar that pioneered the category, David CEO Peter Rahal said.

Vertically integrating a supplier into a CPG company comes with risk, but the bigger risk would be scaling a business and not having the ingredients needed to create a product, Rahal noted.

“Vertically integrating a business can be difficult. It takes a lot of time and resources – something we do not want to underestimate,” Rahal elaborated.

He added, “On the other side of that, something that is equally – if not a greater risk – would be a single point of failure. So, the dependency on a single source of supplier is a huge risk, so de-risking that situation by acquiring Epogee and having full control over the production and supply of a patented ingredient was paramount to us to ensure that we could grow the brand, and we did not have meaningful out of stocks."

Epogee continues as a standalone company

Epogee will continue to operate as a standalone organization, while David’s team will assist in optimizing and supporting logistics, manufacturing and regulations, he said.

EPG can be used across various product categories to cut calories from fat by 92%, as previously reported. By using this ingredient, David can deliver more calories through protein as opposed to fat, Rahal noted.

David sets sight on $140 million in revenue for year one

David splashed onto the market, generating $1 million in sales one week, and is projected to generate $140 million in revenues within the first year of its operation, he added.

Rahal is no stranger to scaling snack bar brands, launching RxBar in 2013 alongside co-founder Jared Smith, before selling the brand to Kellogg for $600 million in 2017.

David is building out its distribution across medium-sized retailers, while supporting the brand‘s current retail footprint of more than 3,000 stores, Rahal said.

David will use the Series A funding to scale its business and accelerate product development, the company shared. David launched a red velvet flavor of its snack bar in May and currently is exploring further indulgent flavors to launch later in the year, Rahal said.

Despite ongoing flavor innovation, Rahal credits a lot of David’s early success to its branding – a reflective wrapper, simple claim callouts and elegant font.

“If you look at David, you can tell the brand. It is not flavor-driven. It is brand-driven. And the inspiration for that was the greatest brand of all time in the bar space, which is Power Bar,” he elaborated.