Key takeaways

- Laurent Freixe was dismissed as Nestlé CEO due to an undisclosed romantic relationship with a direct subordinate, breaching company governance rules.

- Nestlé’s decision aims to mitigate potential reputational damage and legal liability issues.

- Philipp Navratil, a seasoned Nestlé executive, has been appointed as the new CEO

- He inherits cost-saving initiatives and faces the challenge of navigating economic headwinds impacting Nestlé’s financial performance.

Just over a year after replacing Mark Schneider at the helm of Nestlé, Laurent Freixe has lost his job in circumstances that have nothing to do with the food major’s performance on the market.

His dismissal follows an internal investigation into his conduct – specifically, an undisclosed romantic relationship with a direct subordinate – which was in breach of Nestlé’s governance rules.

The investigation was overseen by Nestlé’s top brass: chairman Paul Bulcke and lead independent director Pablo Isla, with the support of independent outside counsel.

Values rooted in respect

Bulcke said in a statement that the decision to remove Freixe was ‘necessary’ as Nestlé’s ‘values and governance are strong foundations of our company’.

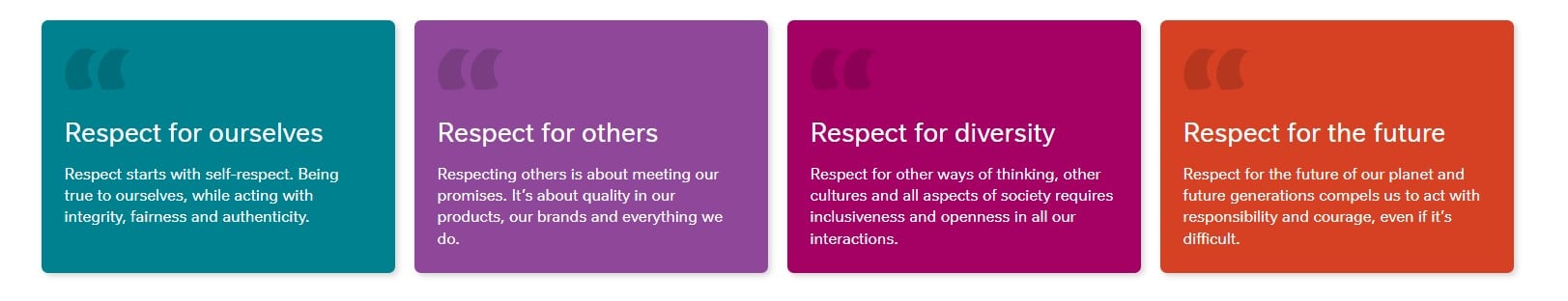

Nestlé’s values revolve around respect, which ‘has a special and powerful meaning’ according to the firm’s corporate website, where acting with ‘integrity, fairness and authenticity’ is among the four value pillars.

“[Respect] has a huge impact on the way we work and run our business,” says the company. “Our values are rooted in respect. A respect for ourselves. For others. For diversity. And for the generations who will follow in our footsteps.”

Reputational damage?

An undisclosed relationship between a chief executive and a direct subordinate presents a host of liability issues that can lead to lawsuits, impact culture, damage a company’s reputation and lead to questions about how a CEO’s decisions might be influenced. Nestlé would hope that its swift action would curb reputational damage. Investors typically consider the long-term outlook of businesses rather than get swayed by negative press.

Nestlé’s share price has been eroding since the end of May 2025, hitting its lowest level on July 31, in the aftermath of the company’s half-year results when CFO Anna Manz warned that the company’s margins ‘will be significantly lower’ in H2 2025 due to FX and tariff headwinds and the impact of higher input costs.

“As we progress into H2, pricing will be more than offset by the increase in input costs, we will see an increased tariff impact, and at current exchange rates, FX will be a further headwind,” Manz said. “So we expect the second half margin to be significantly below the first half.”

The company maintained its 2025 guidance and said it would deliver its medium-term guidance, however. It allso delivered improved organic sales growth with RIG of 0.2% and pricing of 2.7%.

Since news of Freixe’s dismissal broke, the company has recovered some of its share price but is nowhere near the highs of Q1 2025.

What’s next: CEO’s in-tray

Philipp Navratil is the new face at the helm of Nestlé, having been swiftly appointed following the completion of the investigation into Freixe’s conduct.

A Swiss and Austrian national who commands five languages, Navratil had been the CEO of Nestlé Nespresso S.A. since July 2024 and is a company veteran who joined the Swiss food and beverage major as auditor back in 2001.

Navratil held various commercial positions in Central America, he was appointed country manager for Nestlé Honduras in 2009. In 2013, he took on the leadership of the coffee and beverage business in Mexico.

In 2020, he was appointed senior vice president of Nestlé’s Coffee Strategic Business Unit, where he shaped the global strategy and innovation roadmap for Nescafé and Starbucks coffee brands.

Navratil inherits Freixe’s cost-savings program, which is ‘on track’ to achieve target of CHF 0.7 billion savings in 2025, with over CHF 150 million recognized in the P&L in H1 and an additional CHF 350 million already secured for H2, according to the company’s balance sheet.

There is also a drive internally to bolster efficiencies through digital transformation and AI uptake, as well as to strengthen the firm’s positions in Greater China. This is its second largest market, where under Freixe the company enacted a strategy reset as it looks to shift its model from driving distribution to driving consumer demand, with headwinds expected for up to a year as it pursues this.

The company is also looking to ‘sharpen’ its focus on Nestlé Health Sciences, particularly at the premium end.

The new CEO will have to make decisions regarding the firm’s Waters business - which was spun-off in a standalone entity this year - with Freixe telling investors in February that Nestlé was looking for ‘partnership opportunities’ to ‘realize the potential of the global premium brands and as well develop the new space, which is the space of premium beverages, which is massive and which requires investment’. The company is also embroiled in a water filtration scandal in France.

Navratil will also face a challenge in balancing investor expectations in difficult economic times.

Coffee and confectionery – core categories for the food giant – performed below expectations in H1 over input cost inflation, with CFO Anna Manz warning that ‘margins will get worse before they get better, as commodity cost increases impact the P&L in the second half’. The firm expects gross margins to recover ‘over time’ but the pace of that would be tied to commodity prices.

Among the positives for Nestlé has been the performance of milk products and ice cream, which delivered positive organic growth with price-led growth in ambient dairy and positive RIG in coffee creamers in H1 2025.

Coffee creamers – a growing category in North America, where Nestlé is among the category heavyweights – is poised for additional growth after the firm ‘resolved capacity issues, adjusted pricing, increased innovation, and reset shelves’, as Freixe told investors, adding that distribution, consumer demand and market share were all up. “This is our value proposition in action, and it’s a blueprint we are applying across our business,” he added.

Would Navratil continue to apply this blueprint – or would he take the company in a new strategic direction?

More answers are coming up as soon as September 3 (Wednesday), when Barclays head of European Consumer Staples Research Warren Ackerman will face Anna Manz – and possibly Navratil, if he replaces Freixe in the event’s program – in a fireside chat during the Barclays Global Consumer Staples Conference in London, UK.

A webcast will be live from 15:45 CEST / 09:45 EDT.