Healthy snacking continues to gain popularity in the US, with an 18.4% year-over-year sales increase forecasted into 2026, a sign that the trend is more than just a passing fad, according to data analytics firm Spate.

Rapidly growing interest in the category has food manufacturers taking note of what Spate calls a “sustained consumer shift.”

Conagra Brands said in its Future of Snacking report in August that better-for-you snacks are among its top five trends in the industry, with protein-rich options like meat snacks and nuts among the biggest winners.

Portion size matters too, according to Mondelēz International’s 2024 State of Snacking report, which showed 69% of global consumers search for snacks that are portion controlled. The report also found that 96% of global consumers are engaging in mindful snacking behaviors and 79% appreciate snacks more when consumed mindfully.

Alyssa Williams, food and beverage category manager for Spate, said the shift toward healthy snacking has strong momentum, and consumer expectations are becoming more nuanced.

TikTok driving the conversation

Food manufacturers are not only seeing a rise in sales in better-for-you options, they’re hearing it from consumers – primarily on TikTok.

Williams said the healthy snacks category has enjoyed a 28.6% rise in searches on TikTok year over year, and the visual-first social media platform is driving much of the conversation. Nearly 80% of healthy snacks’ popularity comes from TikTok, she said.

“On TikTok specifically, interest in healthy snacks continues to climb 31.3% year over year, while Google search remains a steady indicator of consumer intent (up 19.2% year over year),” Williams said.

The trend is even more pronounced with younger consumers.

Half of all Gen Z TikTok users search for food-related content on the platform, compared to 5% of Baby Boomers, according to a survey in March by the National Frozen & Refrigerated Foods Association and Morning Consult.

Functional ingredients matter

Mindfulness in snacking doesn’t necessarily mean healthy, though.

“Consumers aren’t just looking for ‘healthy’ in general – they’re seeking functional benefits from their snack choices,” Williams explained.

Those benefits include major consumer trends such as the increasing desirability of protein, which remains a ”powerhouse” in functional snacking, with a year-over-year increase in searches of 99.2%, she said.

The International Food Information Council released survey results in July showing that one in three US consumers have increased their protein intake over the past year, and 80% prioritize protein intake during at least one eating occasion per day.

The US protein market is estimated to grow from $6.8 billion in 2025 to $8.36 billion in 2030, with a compound annual growth rate of 4.21%, according to data analytics firm Mordor Intelligence.

IFIC chronicled in its 2025 Americans’ Perceptions of Protein report, that a high-protein diet was the most common eating pattern for Americans for the third year in a row, and for the fifth straight year, protein was the top nutrient Americans were trying to consume.

That means big growth for categories like nutrition bars and meat snacks.

Data analytics firm Spins reports that 237 new nutrition bars have debuted in 2025 (as of the mid-July), and 541 launched in 2024. Meat snacks make up 19% of US retail snack sales, and have enabled rapid growth for companies like Archer, which is opening its second better-for-you meat stick and jerky manufacturing facility in metro Los Angeles in October.

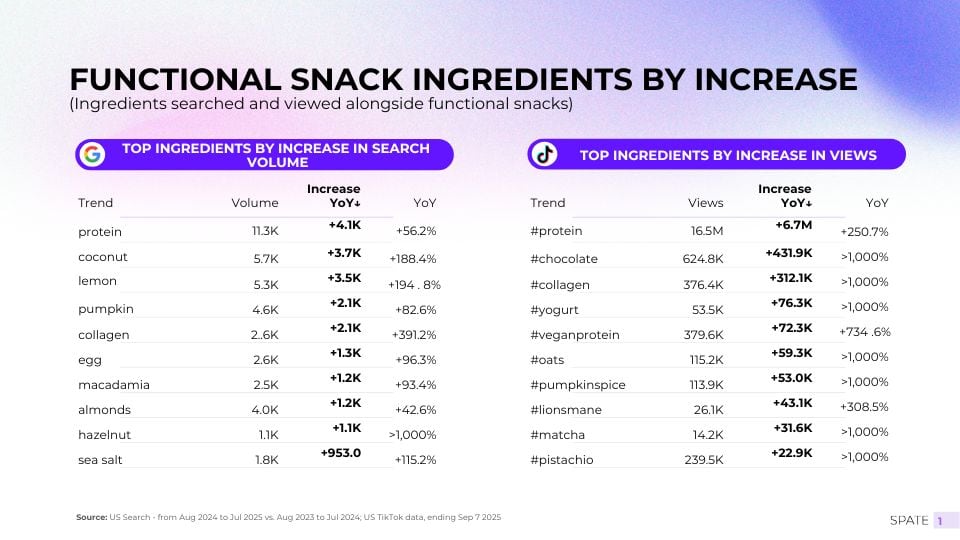

Some ingredients also are seeing a big boost from the snacking trend.

Collagen is among the breakout ingredients, migrating from supplements to snack foods and drinks like Pretty Tasty Tea, Vogel’s Collagen Granola and Rice Up’s Soft Collagen Cookies.

Williams said in a recent interview that online searches for collagen are up 1,000%.

Food products with naturally occurring collagen, like pork rinds, also are capitalizing on the collagen trend. Pork rind maker Rudolph Foods, for example, has leaned in on the high-protein, low-carb benefits of collagen to help shake the category’s reputation as a junk food.

Emerging snacking formats

The healthy snacking trend is also a windfall for newer formats, such as rice snacks, which Williams described as a “rising star,” with popularity up 451.3% year over year.

“A standout brand here is Drizzilicious, growing more than 546.3% year over year,” Williams said. “This highlights consumer appetite for lighter, crunchy options that balance health with indulgence.”

Drizzilicious announced in late July that its bite-sized rice cakes and popcorn, drizzled with chocolate, cinnamon and other dessert-inspired flavors, are now available at Costco locations in the Southeast US.

Ezaki Glico, known for its popular Pocky stick biscuits and Glico-brand soft candies, also is pivoting toward rice with its new soft candy made with sugar and a few rice-derived ingredients, including rice syrup, rice flour, rice protein and rice bran oil.

The Japan-based confectionery giant is distributing the new line of rice candy exclusively at Expo 2025, from May to October.

Shopper preference is not Glico’s only motivation for increasing its use of rice as an ingredient. In March, the Japanese government committed JPY11bn (US$) to help develop new rice markets, rice processing and rice flour.