Consumers are cutting their restaurant budgets in search of quality, affordable meals, and they’re increasingly finding them in the prepared foods sections of grocery stores, according to FMI – The Food Industry Association.

FMI’s The Power of Foodservice at Retail 2025 report shows that shoppers are using a hybrid approach to meal preparation by combining cooking with semi- or fully-prepared deli items and leftovers.

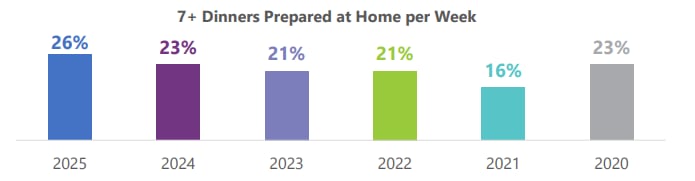

Shoppers preparing seven or more dinners at home per week rose to more than one in four (26%), eclipsing the record of 23% set in 2020 – the first year of the pandemic.

More consumers are seeing deli-prepared foods as an alternative to restaurants, according to Allison Febrey, senior manager, research and insights at FMI.

“This shift reflects how shoppers are redefining value in food: They want meals that deliver on quality and variety but also save time and money,” she said.

Deli meals by the numbers

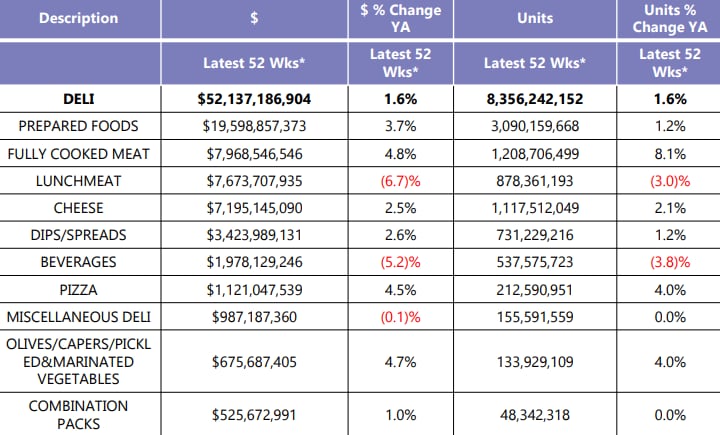

The report shows the grocery deli foodservice segment grew 1.6% to $52.1 billion over the 52-week period ended Aug. 9.

The dollar sales of the prepared meals and items made in those delis also grew 3.7% to $19.6 billion over the same period, while unit sales were up 1.2%.

Fully cooked meat was up 4.8% in dollar sales and 8.1% in unit sales, while pizza (up 4.5% in dollar sales), olives and marinated vegetables (up 4.7% in dollar sales) also showed strong growth, according to FMI.

Some categories took a hit at the deli counter, with lunch meat continuing its decline from the previous year, dropping 6.7% in dollar sales and 3% in unit sales. Deli-prepared beverages sales also declined by 5.2%, and unit sales fell 3.8%.

Shoppers need help

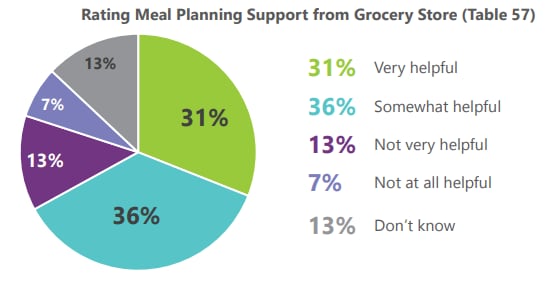

Shoppers gave better reviews to their grocery store for being helpful in meal planning compared to last year, with two-thirds of survey respondents saying grocers are at least somewhat helpful, but one in five say their grocer is not helpful.

That could be an opportunity for grocers looking to court shoppers, 38% of whom said they would like more help in meal planning.

The most popular requests on shoppers’ wish lists include: the ability to purchase a combination of prepared foods for a set price, a special section of the store dedicated to prepared foods and more heat-and-eat options.

Grocery retailers also can capture shoppers with enhanced lunch options.

The report noted that 42% of consumers buy grocery deli-prepared foods for lunch at least once a week, and 60% of survey respondents choose their lunch the same day as the meal.

“With more than half of Americans shopping for hybrid meal occasions, there’s a real opportunity for retailers to support lunches and dinner time,” said Rick Stein, vice president of fresh foods at FMI. “Shoppers are purchasing deli-prepared options most frequently between noon and 5 pm, and want the flexibility to pair fresh, high-quality prepared items with ingredients at home, creating meals that balance time savings and meet their well-being goals.”

Fast casual vs. deli-prepared – price matters

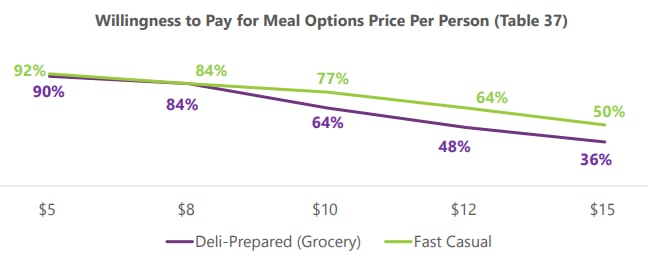

While deli-prepared is increasingly the go-to for consumers choosing not to cook, fast casual restaurants still have an edge on customers willing to spend more.

At the $8 meal price point 84% of survey respondents said they are willing to make a purchase at both a grocery deli counter or a fast casual restaurant. When the cost reaches $10, only 64% say they will buy the deli-prepared meal, while 77% still will purchase the restaurant meal.

At $15 per meal, 50% still will eat at a restaurant, but only 36% will purchase a deli-prepared dish.

Everybody’s favorite

Reputation is critical for the grocery deli section, because half of all survey respondents reported that the deli-prepared foods at their store are only somewhat appetizing. Meanwhile, 40% said their store is not known for selling a signature deli item.

“Having a signature item helps retailers ground their value proposition to the consumer,” said Andrew Brown, senior manager, industry relations at FMI. “This helps reduce decision fatigue, and if you deliver on quality and taste, you will have customers coming back again and again for that exact item.”