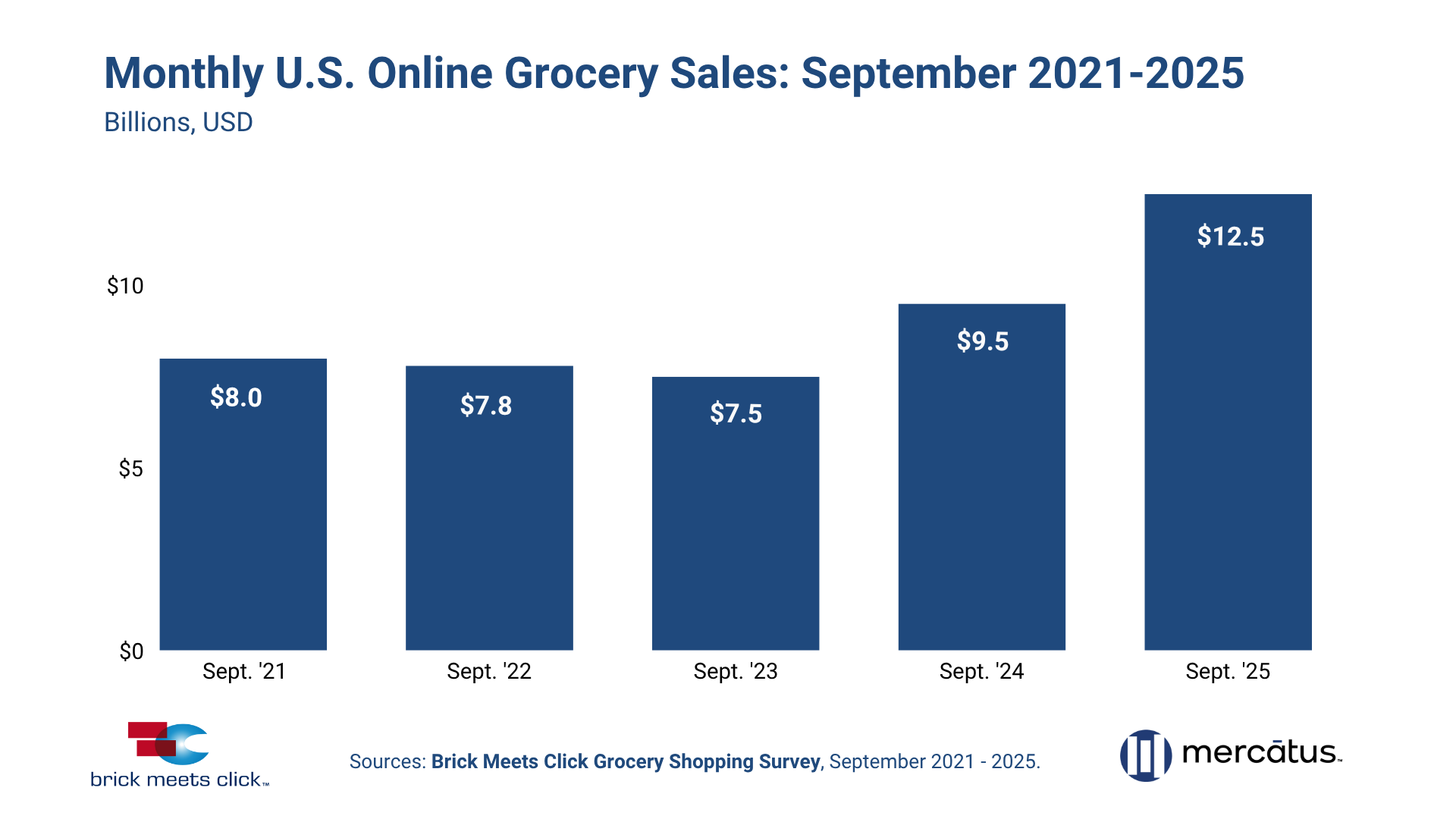

US online grocery sales set a new record in September, reaching $12.5 billion and climbing 31% year over year for the second month in a row, according to the Brick Meets Click Grocery Shopper Survey.

The gains were driven by a record-setting number of monthly active users (MAUs), order frequency and average order value, as online spending “captured its highest share since very early during the pandemic,” according to the report sponsored by Mercatus.

“A sign of the growing challenges facing regional grocers is the sharp increase in the share of grocery MAUs that also completed at least one eGrocery order with mass during September versus the two prior years,” said David Bishop, partner at Brick Meets Click. “The results reveal cross-shopping rates with Walmart continued to expand significantly in 2025, and the rate for Target also increased YOY, even though it remains significantly lower than Walmart.”

Online grocery shoppers spike

Monthly active users jumped 13% year over year in September, as shoppers who most recently made online grocery purchases two to three months ago returned.

All three fulfillment methods – delivery, pickup and ship-to-home – increased in September, as did purchases from all age groups. Shoppers over the age of 60 drove nearly half of the year-over-year gains, according to the report.

Frequency of orders from users also jumped 9% year over year for the month – marking 13 straight months of gains – with small metro markets reporting nearly double the rate of other market types. The surge was driven largely by an increase in monthly active users placing three or more orders, Brick Meets Click noted.

All fulfillment methods up

Combined delivery and pickup average order volume grew at nearly 8% in September, with increases recorded by supermarkets, dollar stores and mass merchandisers like Walmart. Order volume increases were even larger for warehouse clubs and hard discounters, the report added.

That is a trend that continued from August, when Brick Meets Click reported that shoppers are increasingly using multiple fulfillment methods throughout the month.

“A notable trend is the decline in the number of shoppers using only one fulfillment method,” the August report said. “More households are using a combination of two or three methods for receiving their eGrocery orders compared to last year.”

The ship-to-home fulfillment method, which includes orders received by a common carrier or contract courier such as FedEx, UPS and USPS, spiked 11% year over year, primarily due to Amazon’s pure-play services and expansion of same-day fresh grocery service.

Online chipping away at brick and mortar

Spending that moved over from brick-and-mortar locations to online increased 400 basis points year over year in September and ended the month at 19%, nearly eclipsing the record set at the beginning of the pandemic in May 2020, according to the report.

This growth continues to chip away at brick-and-mortar grocery sales. In-store sales continue to grow but at a slower rate. Year-over-year in-store growth has dropped to under 1.5%, about half of the 3% growth rate from the same period a year ago.