The alcohol-free category is booming: forecast to grow 18% in volume CAGR from 2024 to 2028 in the US.

And as the moderation movement continues to see widespread adoption, consumers aren’t just looking for an alcohol-free product. They’re now looking for brands which resonate with their lifestyles and aspirations.

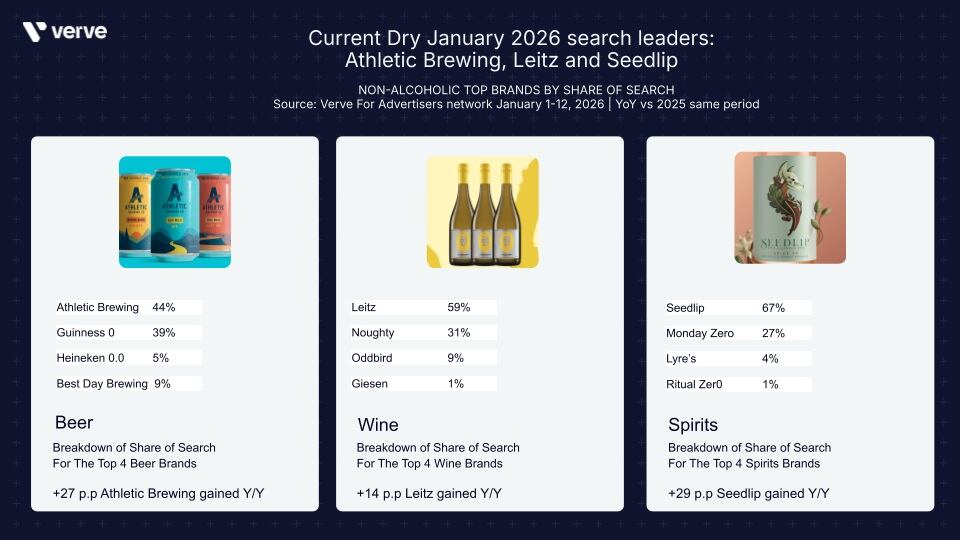

And brand leaders for the category are emerging.

With the global popularity of Dry January, searches for alcohol-free drinks boom during the month.

Searches for non-alcoholic drinks tripled in January 2025 compared to 2024, according to advertising tech specialist Verve.

January 2026 might have started slower: but interest surged by the second week of the month, suggesting a more concentrated engagement window for brands than in previous years.

However, January may be less relevant in yearly calendar than before: searches for non-alcoholic drinks are now more evenly distributed year-round (interest in September 2025, for example, was up 81% YOY).

Fan favorites in beer

So which are the brands winning over today’s consumers?

Alcohol-free beer is the largest and most established category in the alcohol-free market. And Athletic Brewing is going from strength to strength: taking a 44% share of search in the category and gathering more search interest year-on-year, according to Verve’s data.

The brand was founded in 2017 and has built itself up to become America’s largest dedicated non-alcoholic brewer, with a 52% market share.

Athletic Brewing has built up a lifestyle-orientated brand around fitness, sporting events and live events (including collaborations with Live Nation, Ironman and Arsenal).

And it’s attracting way more search attention than brands built by national and multinational beer giants.

However, Guinness 0.0 and Heineken 0.0 also rank highly in search data: enjoying strong brand recognition thanks to the reputation of their flagship alcohol counterparts.

Meanwhile, California non-alcoholic beer brand, Best Day Brewing, is also trending this month.

Wine and spirit winners

Germany’s alcohol-free brand Leitz has been gathering the most interest in the wine category this month, according to Verve’s search data, with a 59% share of search.

Premium brand Noughty is another alcohol-free wine resonating with US consumers.

In alcohol-free spirits, category pioneer Seedlip maintains its long-term momentum, taking a whopping 67% share of search in this category.

Year-round, consumers are also searching for brands such as premium alcohol-free wine Oddbird, New Zealand specialist Giesen, alcohol-free spirit pioneer Lyre’s, California alcohol-free spirit Monday Zero and Ritual Zero Proof, according to Verve’s data.

The alcohol-free category is still one of discovery for most consumers. But the search data shows that brands are building up power: with Athletic, Leitz and Seedlip all benefiting from increased search activity year on year.

And as more and more entrants come into the category, it’s going to be important to think beyond the quality of the liquid alone, says Mishel Alon, CBO of Verve and head of Verve for Advertisers.

“Building a distinctive and compelling brand narrative early is critical to establishing notoriety and cutting through the market noise,” he told us.