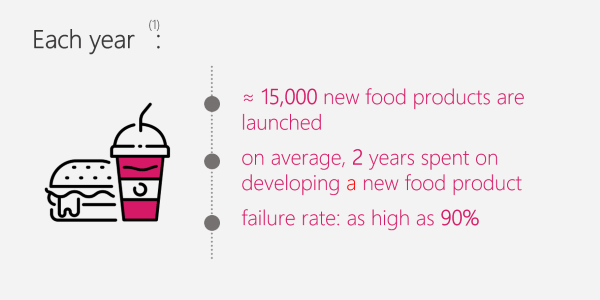

Reports from academic studies, market surveys and consulting firms all show a failure rate between 70% and 90% of new products in the Consumer Packaged Goods industry[1]. In this mercilessly competitive landscape, what better way to put product success on the chopping block than missing the first critical stage of design?

As a Product Lifecycle Management (PLM) software developer, we have accompanied a diverse range of food and beverage accounts in their new product development challenges. We want you to take advantage of the best practices for accelerating new product development that we have identified in the field over the past 20 years. But first, it is essential to understand the challenges and obstacles of the design chain.

First come, first served!

A core principle of any market - the product must satisfy consumer needs which are temporary and continue to evolve and vary from one market to another.

The food and beverage industry tends to suffer from a wide range of changing consumer needs and demands. The avocado craze, charcoal, glitter drinks, paleo diets, truffle oil etc. Over the past few years, we have seen ephemeral trends driven by the new importance of social media. “If it does not help me make a difference, what’s the point?” The short-term nature of Consumer Packaged Goods (CPG) lifecycles provokes quick market saturation and thus boredom for consumers.

However, other trends have become firmly established: free from, vegan, probiotics and nutraceuticals while some like cannabis-based products appear to be the new El Dorado for the coming decade. According to Zion Market Research[2], “the global cannabis market was valued at approximately $1.613 million US dollars in 2018 and is expected to generate around $4.464 million by 2025”.

If you want to stay ahead of your competitors, you must be able to clearly identify these new needs and answer them as fast as you can.

Legislation as a key success factor

Whenever the viability of a brand new category of products is confirmed, regulatory institutions tend to hover over it to prevent any deviation, especially on controversial ingredients like cannabis. Moreover, multiple reasons cause regulations to never stop evolving: scientific advancements (additives newly recognized as health-threatening), political and economic considerations (Transatlantic Free Trade Agreement), pressure from lobbies (meat and beverage lobbies influencing US Dietary Guidelines[3]) or scandals (multiple occurrences of horse-beef meat), etc. Legislation protects consumers, setting limitations on manufacturers, which is paradoxically one of the most powerful drivers of innovation.

Collaborate or suffocate

This has inevitably shaped the food and beverage industry ecosystem as it has become almost impossible to market products without external help. There was a time when entrepreneurs could easily transform their ideas by experimenting and producing in their garage. Today, even big food and beverage companies with entire teams dedicated to strategic missions (marketing, procurement, research and development, regulatory affairs, etc.) may lack the expertise to fully address business requirements: seeking certified suppliers, providing numerous complex documents, running mandatory sanitary and quality tests and so on. Surrounding themselves with experts and service providers is the most common solution. Other phenomena, such as the increasing complexity of product formulas compelling companies to work with a multitude of suppliers, have increased the number of involved stakeholders.

Any food and beverage company must be able to simultaneously orchestrate both their internal teams and external partners.

Data is the new competitiveness leverage

Whereas consumers’ data has been a major concern over the past years for the CPG industry, many companies have not yet realized the value of another kind of data already in their possession: product information. Indeed, all the stages of new product development processes - ideation, formulation, prototyping, procurement, regulatory compliance, quality testing etc. - entirely depend on reliability and continuity of information. How can the R&D team properly formulate if the marketing/product brief is not up to date? How can the regulatory affairs team verify a product’s compliance if it lacks specifications from suppliers? Pitfalls like these punctuate the whole design chain.

Conclusion

Rapidly changing consumer tastes, stricter food and beverage regulations and an increasing number of stakeholders result in a fast moving environment. Really fast. Through these 4 best practices to speed up new product development, we invite you to take a step back to question your present methods and processes and then explore the different existing IT solutions tailored for these major issues, with a side-by-side comparison of specific versus cross-company software. Dive into this guide and get the keys to transform your design chain into a strategic advantage that will set you apart from your competitors.

References:

[1] What percentage of new products fail and why? – Lonny Kocina for Media Relations AGENCY, 05/03/2017 https://www.publicity.com/marketsmart-newsletters/percentage-new-products-fail/

[2] Global Cannabis Beverages Market Will Reach USD 4,464 Million By 2020 – Zion Market research, 02/14/2019 https://www.globenewswire.com/news-release/2019/02/14/1725129/0/en/Global-Cannabis-Beverages-Market-Will-Reach-USD-4-464-Million-By-2025-Zion-Market-Research.html

[3] New US food guidelines show the power of lobbying, not science https://www.theverge.com/2016/1/7/10726606/2015-us-dietary-guidelines-meat-and-soda-lobbying-power