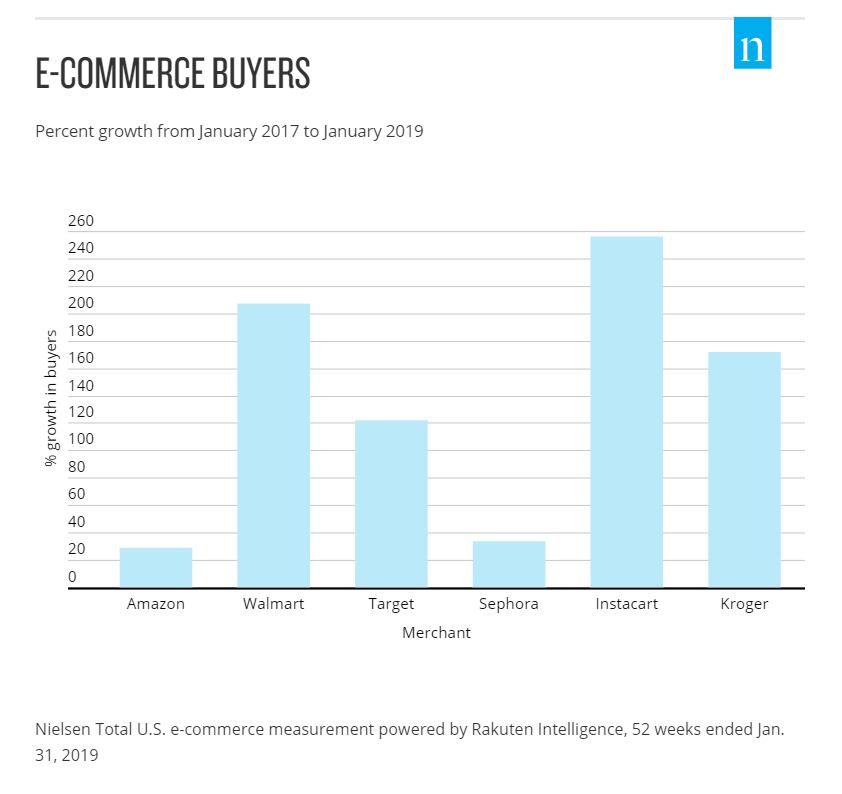

Amazon still has a much broader consumer reach (nearly 10 times more) than its competitors, according to Nielsen, but other retailers are experiencing much more rapid growth in customer acquisition.

"While it's no secret that traditional brick-and-mortar retailers have ensured e-commerce is part of their overall strategy, Nielsen data shows that some of the biggest brick-and-mortar players have turned strategy into reality, and have posted incredible growth along the way. In fact, key retail players like Walmart, Kroger and Target have grown their online customer base—all by at least 90% more than Amazon—over the past two years," noted Nielsen.

Walmart has increased its number of online customers by 207% between January 2017 and January 2019, Kroger saw a 172% increase, and Instacart stole the lead with a 256% increase in online shoppers in the past two years. Amazon saw its online shopper base increase by 29%, albeit off a much larger base than its competitors.

Retailers such as Walmart, Kroger, and Target have grown their online CPG business, in part, by embracing the click-and-collect model where shoppers purchase an item online then pick it up at a physical store, turning a lengthy grocery store trip into a five to 10 minute errand.

Nielsen estimates that click-and-collect sales nearly tripled (from 4% to 11% of all online CPG sales) in two years with grocery and gourmet food items registering the fastest compound annual growth rate (CAGR) of nearly 50% over the past three years (just behind pet supplies).

Hosting a webinar earlier this month, Euromonitor industry manager of food & nutrition, Jared Koerten, said click-and-collect curbside or in-store pick up services have driven the adoption of online food shopping. In fact, the number of click-and-collect locations increased from 200 in 2014 to more than 5,000 in 2018.

Instacart, for instance, announced in November 2018 that it would be rolling out its click-and-collect service nationwide to hundreds of more stores.

"Essentially it's helping consumers become more accustomed to the concept and convenience of buying online," added Koerten.

According to a survey on 2,000 US shoppers by Offers.com, grocery pickup adoption rates are still relatively low with 23% of respondents surveying that they have used a grocery pickup service within that past year, compared to 19% of respondents that have used grocery delivery. Among all the retailers offering click-and-collect grocery pickup, Walmart is leading usage rates due to its immense footprint and waived service fee for orders over $30, according to the survey.

Barriers to online CPG

Online CPG sales have increased 30% year-over-year, according to Nielsen sales data, which also shows that consumers are regularly purchasing grocery items online: 60% of shoppers have browsed and ordered CPG online and more than one-quarter (28%) have purchased CPG online a few times per month.

"Twenty-nine million people began shopping for CPG products online in the past two years, yet only two-thirds of all e-commerce shoppers buy CPG products through the internet," said Nielsen.

"Among the barriers that deter them, food quality tops the list," said the market research firm.

Amazon's move into brick-and-mortar

To stay one step ahead of its competition, Amazon announced a few weeks ago that it would be opening brick-and-mortar stores in shopping centers in major cities. Despite its robust operations and logistics, Nielsen noted that Amazon can expect to rely on its online supremacy to win in brick-and-mortar.

"While it’s too premature to predict how Amazon will fare with its brick-and-mortar grocery store rollout, the company is certainly in unfamiliar territory as an underdog," said Nielsen.

More than three-quarters (76%) of online shoppers say their biggest barrier to online food shopping is food quality, followed by 42% who don't like the additional costs and fees associated with some retailer services, 32% say that they "don't trust the process", 30% noted it was not as fun as visiting the store, and 27% surveyed say it takes to long.

"With Walmart’s successful push toward online migration, the rapid rise of grocery delivery players like Instacart, complemented by Amazon’s foray into physical stores, the stage has been set for a battle royale—and it’s really anyone’s game to win," added Nielsen.