The two biggest threats to the decline of impulse snack purchases have been the rise of e-commerce grocery and the growing prepared foods section that has captured shoppers' attention away from center store aisles and checkout displays, two traditional hot spots for unplanned snack purchases.

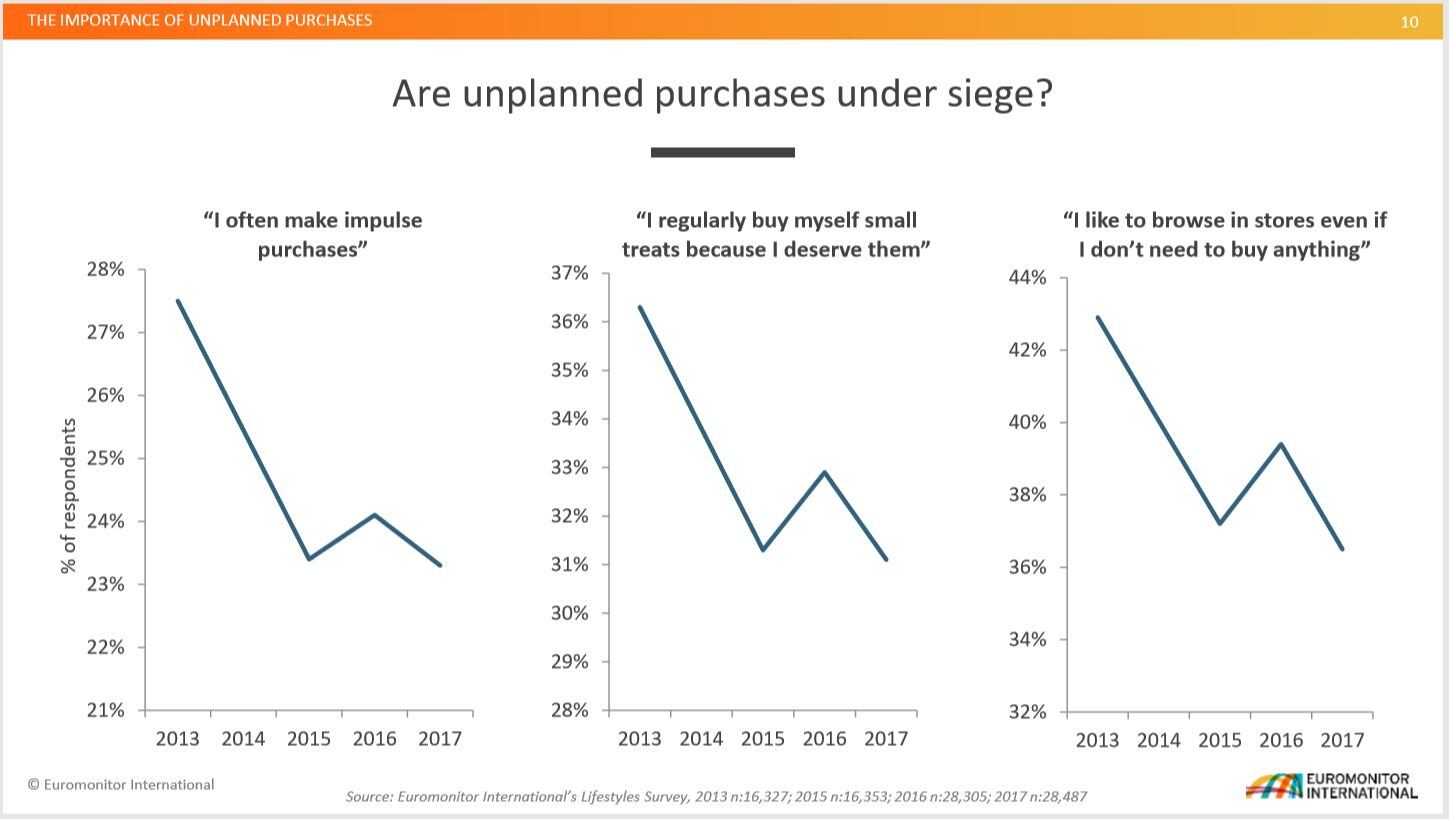

"You can see a pretty striking and significant decline in all of these questions. People are essentially making these purchases less frequently. If I was a snack manufacturer and I understood how important this unplanned or impulse based purchase was to my total business this would make me pause and make me think what’s happening in the broader retail landscape?," said Jared Koerten, industry manager of food & nutrition at Euromonitor International.

"E-Commerce is really a threat to these unplanned store purchases because of declining trip frequency. People are just going to the store less often and we see that younger consumers are really driving this trend."

According to Euromonitor research, millennials and Gen Z are most likely to purchase groceries online.

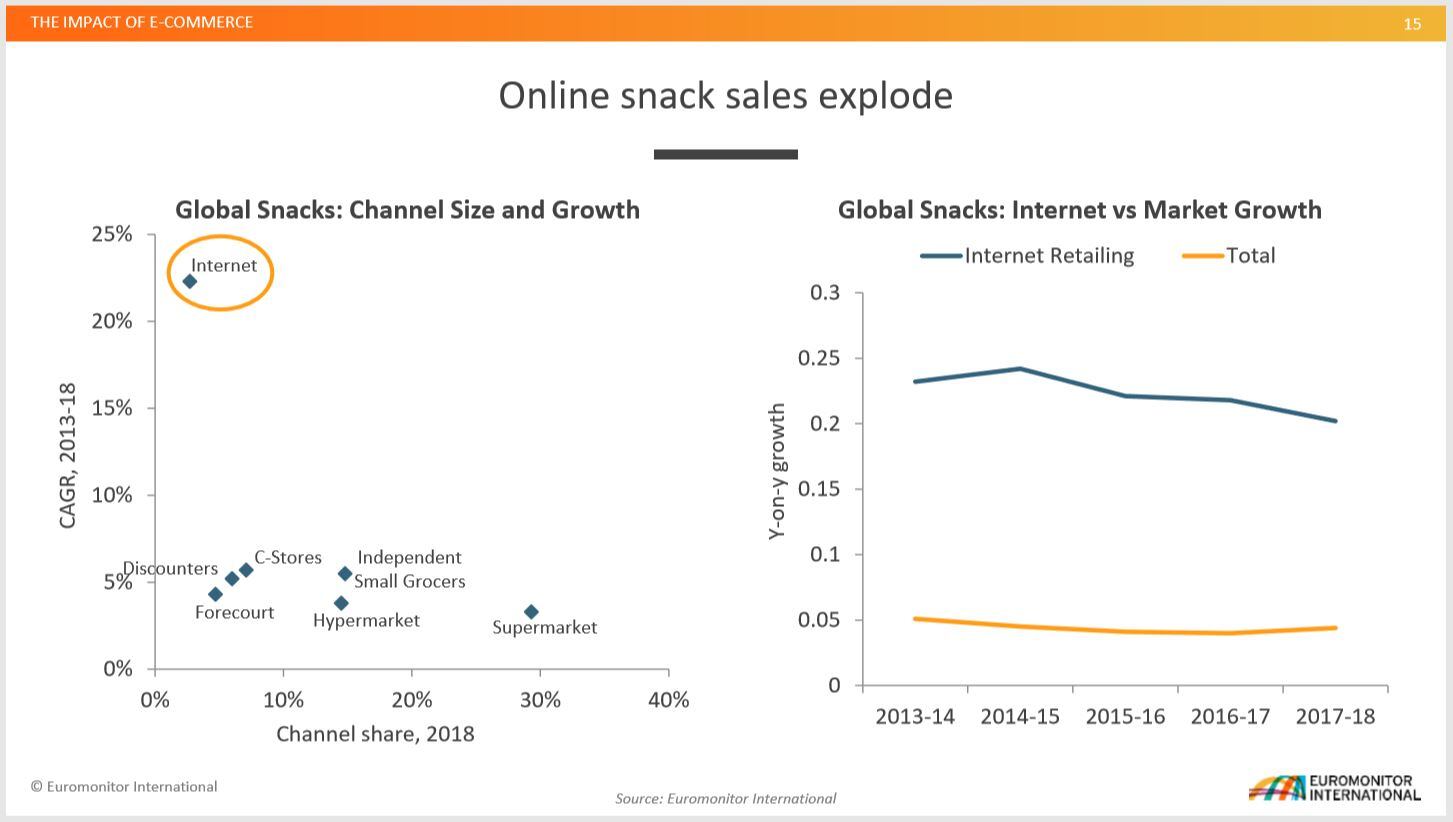

"Supermarkets are still the largest channel for snacks, but nothing is even in the ballpark when it comes to internet, it’s leaps and bounds above all other channels for snack sales over the last five years," Koerten said.

Third-party delivery services such as Amazon, Instacart, and Shipt as well as 'click & collect' curbside or in-store pickup services have really driven the adoption of online grocery shopping, according to Koerten.

"Essentially they’re helping consumers become more accustomed to the concept and convenience of buying online," he said.

The rise of click & collect services offered by retailers including Walmart, Target, and Kroger, has grown significantly over the last five years, Euromonitor market research shows.

"We’ve gone from 200 to 5,000 click & collect locations between 2014 and 2018. It changes the game on impulse," Koerten noted.

Koerten added that Amazon will continue to make major investments into online grocery.

"The acquisition of Whole Foods was really a shot across the bow to say, ‘we are targeting grocery in a major way’," said Koerten.

"What’s really interesting to me is this move to use Whole Food stores as local distribution centers to overcome the last mile challenges with online grocery. Essentially, you have with Whole Food stores hundreds of local distribution centers that are located in high income neighborhoods that tend to be [full of] Prime members.

"The whole idea is essentially convenience -- getting consumers closer to their Prime accounts and making it easier than ever to order."

Fresh and prepared foods

Since the recession occurred over ten years ago, there has been a rise in away-from-home food spending spurring retailers to offer restaurant quality food and fully prepared or assembled meals in the outer aisles of the store, driving traffic away from the center-store aisles.

"Center store aisles are really important for impulse sales as well for many snack categories. There are several trends working to limit that time in the center store. We’re seeing retailers really pouring investments into the store perimeter often at the expense of the

center store," Koerten said.

The rise of the grocerant can be seen across retailers via concepts such as Whole Foods' gourmet mac and cheese bar or Mariano's gelato and cold-pressed juice counters.

"In many cases these prepared foods serve as direct competitors to packaged snacks. Why would I buy a packaged candy bar when I can have a freshly made truffle?" Koerten explained.

Tangentially, in-store meal kit offerings have also contributed to the decline in impulse snack purchases, according to Koerten.

"I think the potential for in-store meal kits presents a very real threat to the traditional center store. We’ve seen a ton of activity here. It has all of the ingredients in one box so that 30-40 minutes I would spend in the center store turns into a five minute trip."

Position to win in e-commerce

But it's not all doom and gloom for the packaged snacks category, Koerten stressed, noting that snack brands have a real opportunity to compete in e-commerce and that their marketing dollars would be wisely invested in search engine optimization and paid search results.

"You need to position your brands to win in e-commerce. You need to make sure that your merchandising and logistics models are aligned with this new reality," he said.

For snack brands selling online, the element of storytelling should come across as clearly as it does on physical store shelves -- no easy task, acknowledges Koerten.

"We’ve spent many years and a lot of money figuring out how to master the package. This needs to be communicated in an online way. Create bold imagery, strong storytelling," he added.

New online models including subscription based services and auto-ship where customers can set it and forget are other key strategies to recapturing some of those impulse snack purchases.

Within the grocery store where self check out aisles are requiring a shopper's full attention, Koerten suggests making snacking more of a destination and rethinking the layout.

"We’ve spent many decades and millions of dollars studying the planogram," Koerten said. However, retailers and brands should consider creating new touchpoints outside of endcaps and check-out aisle coolers such as creative vending options and dedicated 'snack zones'.