According to data from Nutrition Business Journal and SPINs presented by New Hope Network content team lead Carlotta Mast March 2, sales of functional foods and beverages grew 9% to nearly $78b in 2020 – and while strong, the category “did not fare quite as well from a growth standpoint” as organic foods and beverages, which NBJ estimates grew 13% to $47.9b.

Combined, sales of natural, organic and functional foods and beverages jumped 13% to $186b in 2020, helping to push the overall natural and organic products industry’s sales up a record-breaking 12.7% to $259b across all categories – far outpacing the 9.5% growth to $252b predicted in August, Mast said.

Much of this growth came from the “dramatic shift to eating more meals at home, through the quarantine, and surging consumer interest in healthier foods and beverages, and health and wellness products,” she explained.

And while Mast said these numbers suggest a “bright future” for the natural and organic industry overall, she noted the growth difference between organic and functional products was stark and likely related to the types of offerings available.

Decline in grab-and-go categories drag down functional product sales

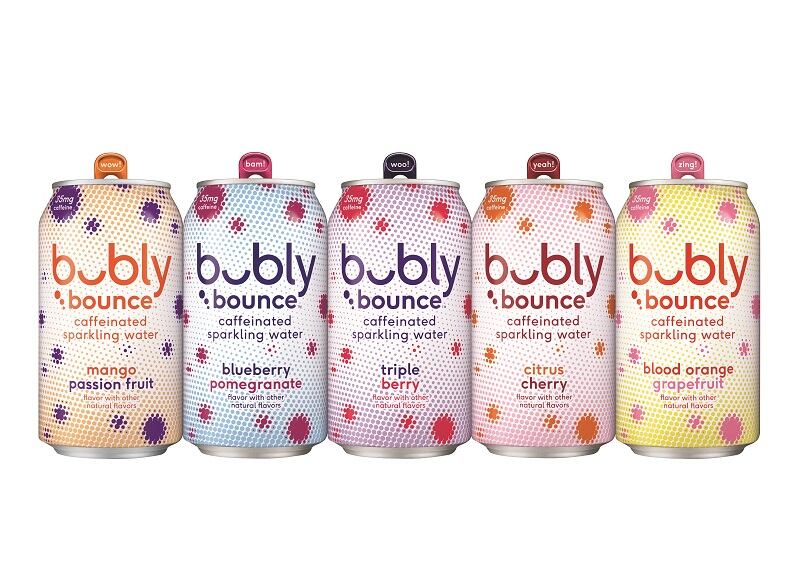

Functional ingredients often are incorporated in ready-to-drink beverages and single-serve, grab-and-go offerings where their higher costs can be offset by smaller pack sizes or selected for specific life moments, such as feeling under the weather, needing a brain boost to make it through the afternoon at the office or a shot of energy for after school or work fitness activities.

Mast explained as COVID-19 fears kept many people at home, fewer opted for functional beverages and grab-and-go functional offerings.

Strong, but slower growth predicted for coming years

Still, she remained optimistic that the 9% sales increase in functional products was a sign that consumers are embracing food as medicine, and predicts that sales of functional food and beverages will continue to grow in coming years – albeit at a slower pace of 7% in 2021 and 5.5% in 2022 into 2023.

Despite the hit the grab-and-go section inflicted on functional sales, Mast added the top categories for functional food and beverage sales were shelf-stable, frozen and snacks.

According to SPINS data presented in the session, top selling functional ingredients include collagen, sales of which climbed 32.4% to $236m, elderberry, which rose 130.3% to $355m in sales, and MCT up 42.8$ to $154m. Other fast-growing functional ingredients include ashwaganda, which increased 81.5% to $49m, mushrooms, which climbed 37.9% to $46m and moringa, which increased 18.3% to $8m.

Hemp sales fall 6%

Another notable negative impact in the natural and organic sector was on sales of hemp and CBD products, which were “the hot story of the moment and were experiencing unbelievable sales growth and consumer interest” in 2019, Mast said.

Based on the ingredients’ wild popularity before the pandemic, Mast said sales were predicted to double in 2020, “but the category saw a lot of headwinds, product launches stalled in 2020 and we saw consumer buying behavior in this category decrease pretty significantly,” pulling sales down 6% for the year.

“Our consumer research also shows that there are shifting consumer perceptions around the efficacy of CBD products,” Mast cautioned.

Like with functional ingredients, though, Mast remains optimistic about hemp and CBD, noting that “we still see a lot of potential … but its not the over-hyped, very, very hot category that we saw in 2019.”