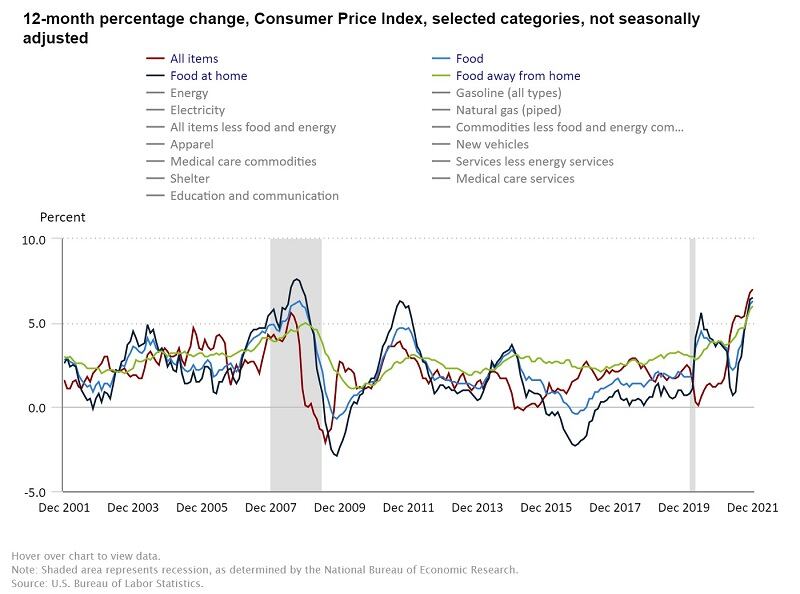

For the year, all categories were up, led by gasoline (up 49.6%), and used cars and trucks (up 37.3%), but the price of food also made a notable showing for the year – up 6.3% led by the price of food at home (up 6.5% compared to a 1.5% annual increase over the past 10 years) and followed closely by food away from home (up 6%).

Month-over-month, however, the rise of food prices appears to be slowing with the food index increasing 0.5% in December following a similar slow down to 0.7% in November compared to 0.9% in October and September. This could be cold comfort though considering many food manufacturers and grocery retailers announced additional price increases at the end of the calendar year that will go into effect over the next two quarters.

Could meat, poultry prices ease soon?

Within food at home for the year, “by far the largest increase was that of the index for meats, poultry, fish and eggs, which rose 12.5% over the year,” according to the Bureau of Labor Statistics. Although, it noted, the index dipped 0.5% month over month with beef and pork following the decline of the overall category in December, dipping 2% and 0.8% respectively.

Other fast-rising categories within food from home year-over-year including nonalcoholic beverages and beverage materials with an increase of 5.12%, fruits and vegetables up 5%, and cereals and bakery products up 4.8%. Dairy saw the smallest increase for the year at just 1.6%, according to BLS data.

Finger-pointing

The White House, which has very little control over inflation but often is held accountable by voters and, therefore, has been focused on it in recent months as mid-term elections near, touted the report as good news.

The report “shows a meaningful reduction in headline inflation over last month, with gas prices and food prices falling – [demonstrating] that we are making progress in slowing the rate of price increases,” President Joe Biden said in a statement.

“At the same time,” he added, “this report underscores that we still have more work to do, with price increases still too high and squeezing family budgets.”

One way that Biden has tried to ease inflation in recent months is by taking aim at what he characterized as monopolies, including within the meat and poultry industry, which he is trying to alleviate by dedicating $1b to support independent processors.

During Federal Reserve Chairman Jerome Powell’s confirmation hearing earlier this week, Sen. Elizabeth Warren, D-Mass, echoed this concern about the role of “concentrated corporate power” in “creating the conditions for price gouging.”

Tackling supply chain, labor challenges and offsetting higher costs

But not everyone is on board with the narrative that higher prices are due to corporations trying to pad their bottom line.

Rather, many point to lingering supply chain and labor challenges related to the pandemic that are raising the cost of production paired with increased spending by consumers, some flush with savings and others from stimulus, that is causing demand to outpace supply.

Indeed, many food manufacturers and grocery retailers have tried to shield consumers, at least partially, from the full brunt of the rising costs of producing goods by leaning heavily on cost reduction efforts, including adjusting pack-price architecture, increasing automation, scaling back SKU selections, pulling back on brand building and other strategies.

Still, the fast rising cost of goods – especially related to transportation and packaging of late – have spurred multiple rounds of price increases across categories and channels.

Additional future rounds of price increases could still be in the cards as analysts from Rabobank predict global supply chain challenges will persist through 2022.