The firm, which posted a net loss of $30m in Q2 on sales up 19.4% to $1.198bn, said the deal – expected to close in Q4 – would help reduce debt and strengthen the balance sheet.

“This transaction strengthens our balance sheet, improves execution consistency and accelerates our ability to invest across snacking and beverage categories that present attractive growth opportunities,” said CEO Steve Oakland.

The divested business is expected to generate 2022 net sales and adjusted EBITDA of approximately $1.6bn and $70m, respectively. The categories to be divested include pasta, pourable and spoonable dressings, preserves, red sauces, syrup, dry blends and baking, dry dinners, pie fillings, pita chips and other sauces.

Activist investors and portfolio re-engineering

In November 2021, amid pressure from activist investor hedge fund Jana Partners, Illinois-based TreeHouse Foods said it was exploring a sale of some or all of the business.

Four months later, however, citing changes in the macro-economic and financing environment, the board concluded that it wasn’t the right time to pursue a sale of the whole company, and said it would continue to explore divestitures, including the sale of portions of its meal prep business in a single deal or in a series of transactions.

TreeHouse – which operates in 29 product categories across two divisions (meal prep and snacking & beverage) - has been cutting SKUs (and jobs) and reengineering its portfolio in recent years, acquiring the majority of Ebro's Riviana Foods US branded pasta business for $242.5m in December 2020, and selling its ready to eat cereals business to Post Holdings for $85m in June 2021.

Private label gaining share as inflation bites

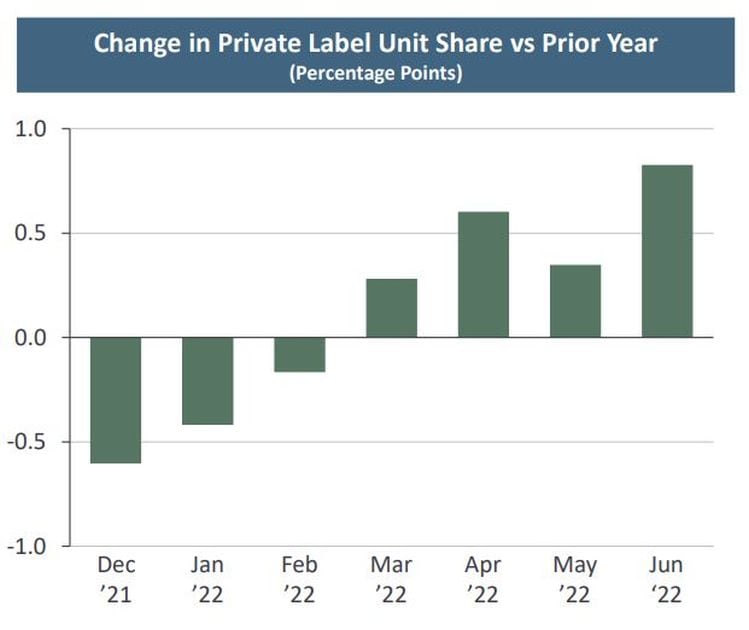

Speaking on the firm’s second quarter earnings call Monday, Oakland said private label share gains had been accelerating since March as shoppers dealt with surging inflation.

And while we’ve seen this behavior before, notably during the 2008/9 recession, he said, this time it could be more sticky, as the landscape is quite different: “I think the quality and assortment [of private label products] is dramatically different than what the consumer saw in past recessions.

“Today, private label is positioned significantly better than in past periods of economic downturn. None of us can forecast how long this will last… but I think we're going to do better,” predicted Oakland, who raised guidance for the full year from 11%+ net sales growth to “mid-to-high teens.”