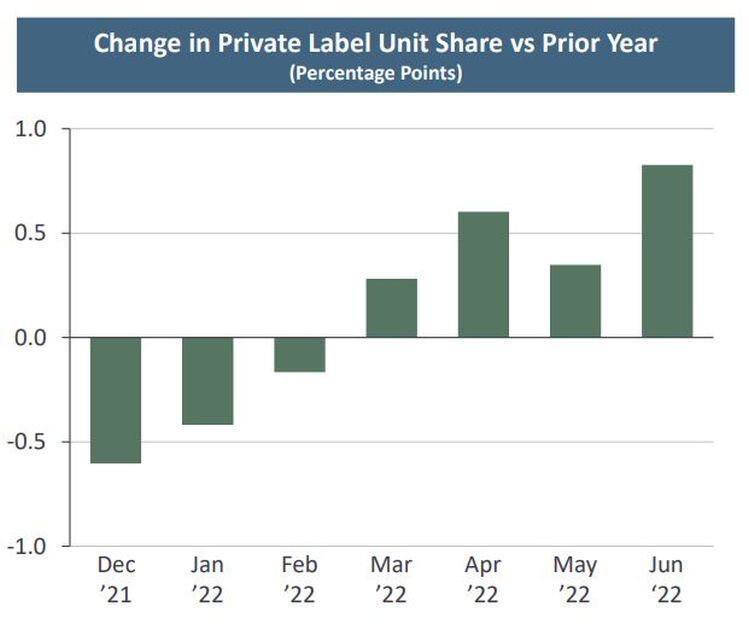

Speaking on the Illinois-based firm’s second quarter earnings call Monday after posting a 19.4% increase in net sales to $1.198bn (and a $30m net loss blamed on labor and supply chain disruption and commodity and freight cost inflation), Oakland said private label share gains had been “accelerating since March” as shoppers dealt with surging inflation.

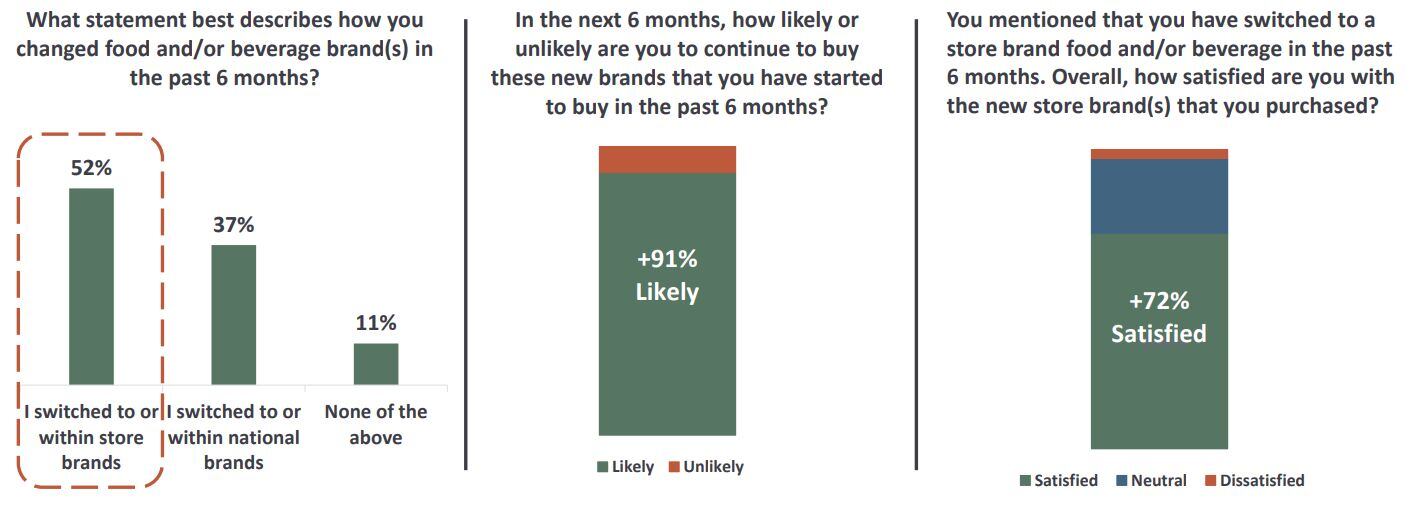

And while we’ve seen this behavior before, notably during the 2008/9 recession, he said, this time it could be more sticky, as the landscape is quite different: “I think the quality and assortment [of private label products] is dramatically different than what the consumer saw in past recessions.

“Today, private label is positioned significantly better than in past periods of economic downturn. None of us can forecast how long this will last… but I think we're going to do better,” predicted Oakland, who raised guidance for the full year from 11%+ net sales growth to “mid-to-high teens.”

First, said Oakland, who said the firm will be raising prices late in the third quarter, “The quality and assortment of private label has improved dramatically… and second, the retail landscape has changed dramatically. Growth in terms of number of outlets has been driven in a large part by private label-focused discount retailers. Today, there are also retailers whose private label programs not only drive traffic but play a key role in their store image.

“And finally, retailers are more committed than ever to their private label strategies and are making meaningful investments to support their store brands.”

IRI: 'Private label is gaining across all retailers, not just value retailers'

Asked for his take on Oakland’s analysis, K. K. Davey, president of client engagement at IRI told FoodNavigator-USA: “I agree in general. Dollar General has increased its footprint substantially. Aldi too. Walmart is stronger this time around. So, lots of pointers to this prediction. And inflation is unprecedented."

While private label’s dollar share of the US CPG market (for food and beverage) has hovered stubbornly under 20% in recent years, it dropped during the COVID-19 pandemic. However, it has started to make steady gains in recent weeks, said Davey.

“Private label is clearly gaining in commodity categories such as fresh eggs (+5.8 share in latest 4 weeks in large format stores), sour cream (+3.6), butter/butter blends (+3.3), nut butter (+6.2), sugar (+5.1), shortening & oil (+3.1), frozen meat (+2.4), bottled water (+3.5).

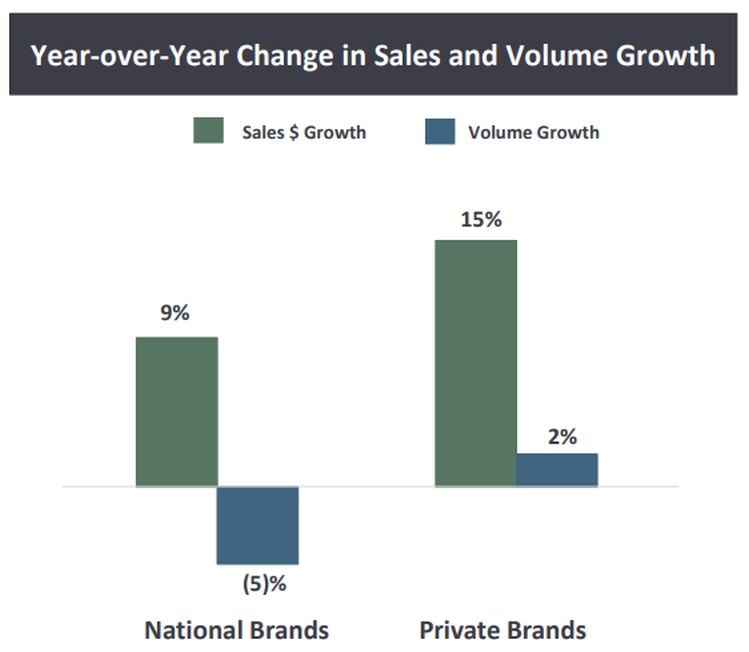

“Private label is gaining across all retailers, not just value retailers. Grocers, mass merchandisers such as Walmart and Target, club stores and dollar stores, both in terms of unit sales and dollar sales.

“So, we do expect that in this environment, private label is going to do very well.”

How are consumers responding to inflation?

According to IRI, prices for food at-home were up 14.4% in July 2022 vs July 2021.

"Consumers are responding to rising prices by shopping promotions, prioritizing value options, and trading down to avoid going without,” said Davey, who noted that promotional activity in many food and beverage categories is returning to pre-pandemic levels, that consumers are trading down to more affordable brands within a category, but still enjoying "small luxuries, including both premium and super-premium imported beer."

Portfolio re-engineering: 'We continue to work very diligently to reshape the TreeHouse portfolio'

In November 2021, amid pressure from activist investor hedge fund Jana Partners, TreeHouse Foods said it was exploring a sale of some or all of the business.

Four months later, however, citing changes in the macro-economic and financing environment, the board concluded that it wasn’t the right time to pursue a sale of the whole company, and said it would continue to explore divestitures, including the sale of portions of its meal prep business (dressings, sauces, jellies, pasta and pickles etc), either in a single deal or in a series of transactions.

TreeHouse – which operates in 29 product categories across two divisions (meal prep and snacking & beverage) - has been cutting SKUs (and jobs) and reengineering its portfolio in recent years, acquiring the majority of Ebro's Riviana Foods US branded pasta business for $242.5m in December 2020, and selling its ready to eat cereals business to Post Holdings for $85m in June 2021.

The current plan is to focus on the higher growth snacks and beverages business (cookies, crackers, frozen waffles, pita chips, pretzels, bars, powdered drinks, broths, ready-to-drink beverages, coffee and tea concentrates and bagged specialty tea), which generated 36% of its sales in Q2, said CEO Steve Oakland.

“We continue to work very diligently to reshape the TreeHouse portfolio through a divestment of a significant portion of our meal prep business so that we can build leadership and depth around a focused group of categories in our higher-growth snacking and beverage businesses. We are encouraged with the progress we have made on this process thus far but will not be providing further comments on that topic unless and until we have definitive information to share.”

In Q2, 2022, the firm posted a 19.4% increase in net sales to $1.198bn, with snacks & beverages +21.4% to $431.7m and meal preparation +18.3% to $765.9m. Net losses were $30m.