Highlighting “transitory” issues including ongoing COVID-19-related challenges in Asia, operational problems in the US, and foreign exchange headwinds, Oatly is also lowering its outlook for the full year to $700-$720m (it had previously revised estimates down from $880-$920m to $800-$830m).

However, demand for Oatly’s products remained strong, claimed Petersson: “We continue to see strong velocities, year-over-year sales volume growth, and minimal price elasticity globally, which we believe demonstrates the power and resilience of the brand.”

Overhead and headcount reduction

As part of a cost-cutting plan, Oatly is “executing an overhead and headcount reduction impacting up to 25% of the costs related to the group corporate functions and regional EMEA layers” in a bid to save $25m annually, taking effect in the first quarter of 2023.

It has also identified “incremental opportunities in the rest of the organization” to take effect over the same period that could save an additional $25m a year, but said it was “unable to make a reasonable determination of an estimate of the severance and other costs associated with its organizational restructuring plans at this time.”

Asked how the move would impact headcount, a spokesman told FoodNavigator-USA: "These changes include some proposed redundancies initially focused on our corporate and EMEA organizations. We are currently in discussions with unions and are working diligently to minimize the total impact.

"We are unable to disclose any specific numbers on proposed redundancies until our consultations with the unions are complete. Any personnel changes like these are difficult and we are committed to treating all departing employees with respect and empathy."

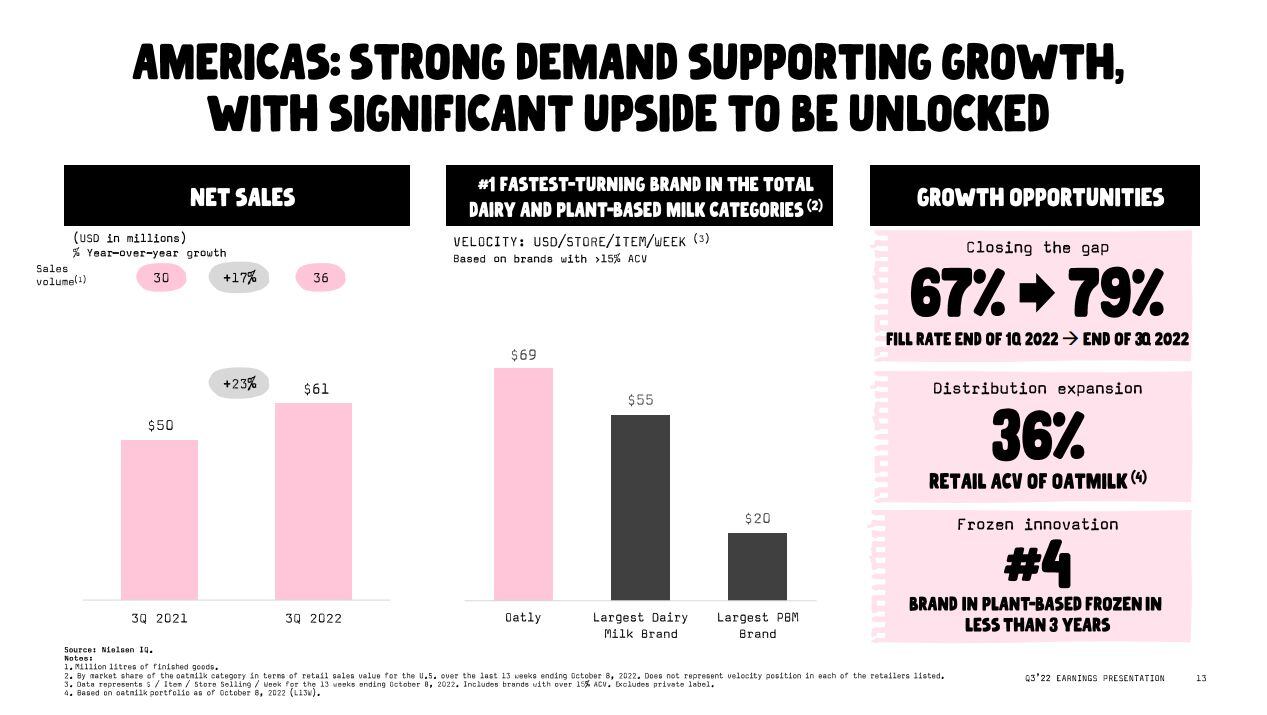

US revenues up 22.7% to $60.7m

Oatly - which entered the US market via the coffee shop channel in 2016 and claims it is the fastest-turning brand in plant-based or dairy milk in US retail – said US revenues rose 22.7% to $60.7m in the quarter (three months ended Sept 30), primarily due to higher production output and price increases “with growth in existing retail and foodservice channels across mainly oat drink product offerings, partially offset by production challenges.”

Fill rates also increased from 67% to 79% during the quarter with an ACV of 36% for oatmilk in US retail.

Increased losses in the region were blamed on “continued challenges in the scaling of production capacity” at the new plant in Ogden, Utah, where a "technical issue" shut down a production line for three weeks, revealed Petersson. "It has since been resolved and production is stabilizing so we can start rebuilding inventory."

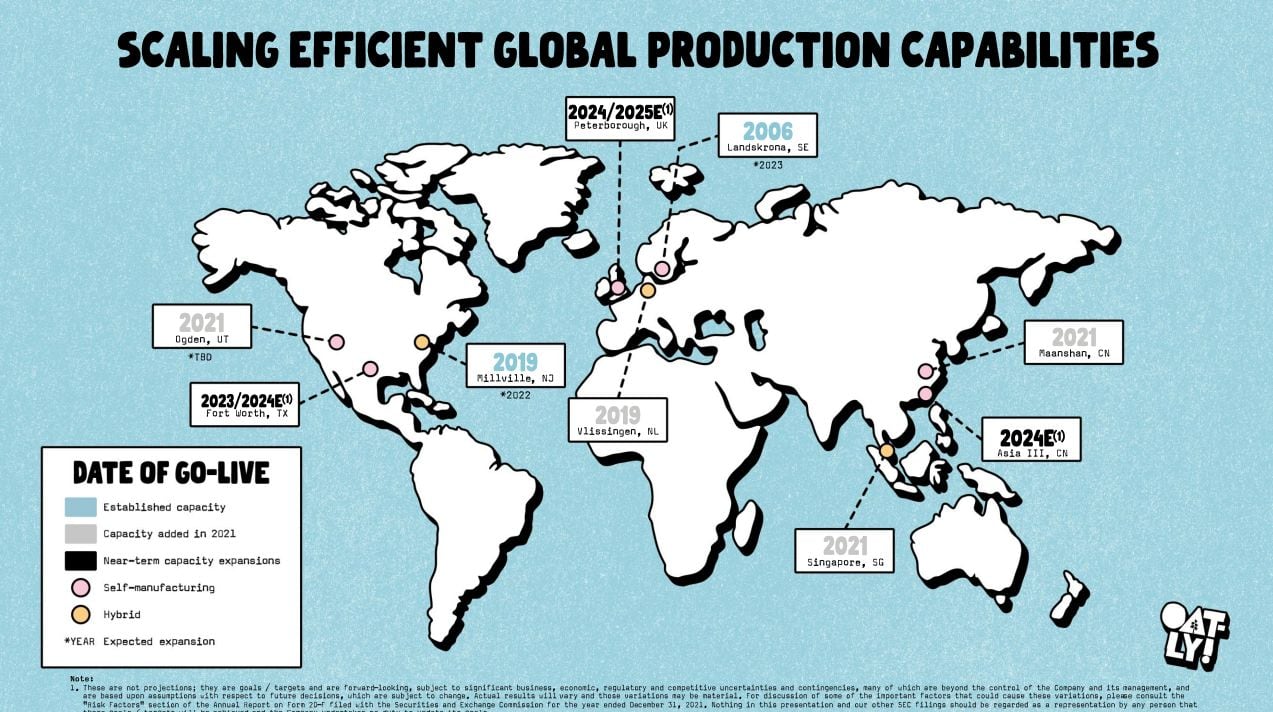

Shift to 'hybrid' production model

The firm - which is also building new capacity at its plant in Millville, New Jersey, said a third US plant in Fort Worth, Texas, would move from an 'end to end' facility, where Oatly makes its own oat base and finished products on site, to a 'hybrid' facility, where Oatly transports its oat base through pipelines to an adjacent plant operated by a third party partner for filling and mixing, explained Petersson.

"This is expected to significantly reduce our future capital expenditures and have a positive effect on cash flow."

Given that self-manufacturing has been billed as key to improving margins by executives on recent earnings calls, the shift raised some eyebrows on the earnings call Monday, with Andrew Lazar from Barclays asking: “The shift to self manufacturing was the key factor in the longer term margin improvement story. So how does this margin improvement come about now?”

Petersson responded: “In terms of us transitioning into hybrid, this will potentially have a small concession on margins. This... is outweighed by simplifying supply chain operations and execution. So I can't give you any clear updates on the margin."

Ken Goldman from JPMorgan added: “I do appreciate the need to conserve cash right now and I do understand that companies can pivot, but I'm just curious how comfortable you are with some of the choices you have to make?”

Petersson added: “We are continuously adapting to our environment, and this is just one example of that… This gives us flexibility to add capacity faster.

“The hybrid [model] enables us to put more focus on our proprietary oat base production and other value-driving items such as you know, innovation, branding, sales, etc. So we simplify and remove complexity. Second, strategic co packers are easier to find now… we have more qualified partners to work with now…”

Plant-based milk by numbers at US retail, 52 weeks to June 12, 2022:

US retail sales of plant-based milk rose +6.4% to $2.299bn in measured channels* in the year to June 12, 2022, driven by double-digit growth in oat milk and pea milk, according to SPINS data.

Dollar sales of oatmilk - which barely registered in the US market five years ago - rose +50.52% to $527.44m, while units of refrigerated oatmilk were up +40% and shelf-stable oatmilk units were up +83.8%.

- Dollar sales total plant-based milk: +6.4% to $2.3bn

- Unit sales total plant-based milk: +1.9%

Dollar sales, key sub-segments 52 weeks to June 12, 2022:

- #1 Almond milk: -1.02% to $1.277bn (excludes blends)

- #2 Oat milk +50.52% to $527.44m (excludes blends)

- #3 Soy milk: -0.09% to $165.09m (excludes blends)

- #4 Coconut milk: -8.16% to $82.1m (excludes blends)

- #5 Pea milk: +27.37% to $60.13m (excludes blends)

- #6 Rice milk: -11.72% to $37.15m (excludes blends)

- #7 Cashew milk: -13.6% to $29.01% (excludes blends)

*Source: SPINS natural enhanced and conventional (IRI multi-outlet) channels, 52 weeks to June 12, 2022, excludes Whole Foods, Trader Joe’s, and convenience stores

Image credit: Planet Oat

Interested in dairy alternatives?

Tune into the opening session of Futureproofing the Food System, starting tomorrow (Nov 15) at 11am Central, which features a panel on dairy alternatives including Califia Farms, Miyoko's Creamery, New Culture, and IFF Nourish: REGISTER HERE! IT'S FREE

11am- 12.45pm CT FOOD TECH IN FOCUS: Sustainable Sourcing for Colors, Flavors, and Sweeteners; and plotting a future for dairy… without cows

PANEL: Biosynthesis: Fermentation and the future of flavors, colors and sweeteners Does it always make sense to extract flavors, colors, sweeteners and other food ingredients from plants if you can produce them more efficiently - and more sustainably – via microbial fermentation, ‘cell-free’ approaches or plant cell culture?

- Dr Joshua Britton, founder and CEO, Debut Biotech

- Nusqe Spanton, founder and CEO, Provectus Algae

- Dr David Welch, CSO and co-founder, Synthesis Capital

- Ricky Cassini, CEO and co-founder, Michroma

- Dr Erin Marasco, global biology lead, Cargill

- MODERATOR: Elaine Watson, senior editor, FoodNavigator-USA

PANEL: Dairy 2.0: Plant-based milks now account for more than 15% of the fluid milk market, while plant-based cheese, creamers, yogurts and ice cream continue to gain traction. So where is the market going next, where’s the white space in the category, and what is the potential of a new wave of ‘animal-free dairy’ products made with real milk proteins and fats, minus the cows?

- Miyoko Schinner, founder and CEO, Miyoko’s Creamery

- Dave Ritterbush, CEO, Califia Farms

- Matt Gibson, co-founder and CEO, New Culture

- Sonia Huppert, global innovation marketing leader, re-imagine protein, IFF

- MODERATOR: Elaine Watson, senior editor, FoodNavigator-USA