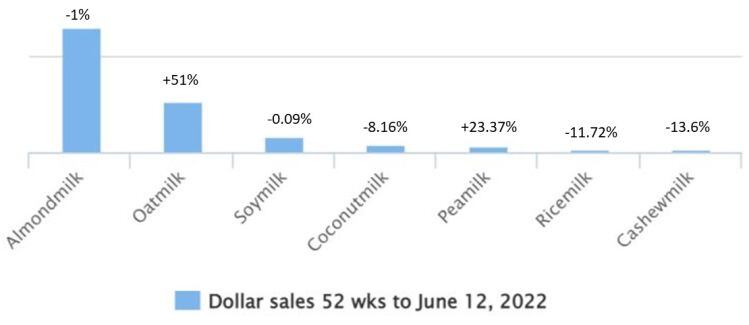

US retail sales of oatmilk - which barely registered in the US market five years ago - rose 50.52% to $527.44m, while sales of pea milk rose 27.37% to $60.13m (both figures exclude blends, and don't include data from certain key retailers not captured in SPINS data, including Whole Foods and Trader Joe's, and convenience stores).

US retail sales of soy milk - which was once the clear market leader in the segment - landed at $165.09m in the same 52-week period to June 12, representing a slight drop (0.09%) vs the previous 12 month period, but a precipitous decline from a decade or so ago, when they topped $1bn.

Almond milk, meanwhile, experienced a small decline (-1.02%), but remains the clear category leader with US retail sales of $1.277bn, well ahead of #2 player oat milk at $527.44m.

The vast majority of the category is occupied by refrigerated products, dollar sales of which were up +6.5% to $2.067bn, while shelf-stable products were up +6.2% to $232,000.

The key segments 52 weeks to June 12, 2022:

- Total plant-based milk: +6.4% to $2.299bn

- Refrigerated plant-based milk: +6.5% to $2.067bn

- Shelf-stable plant-based milk: +6.2% to $232,000

The key sub-segments 52 weeks to June 12, 2022:

- #1 Almond milk: -1.02% to $1.277bn (excludes blends)

- #2 Oat milk +50.52% to $527.44m (excludes blends)

- #3 Soy milk: -0.09% to $165.09m (excludes blends)

- #4 Coconut milk: -8.16% to $82.1m (excludes blends)

- #5 Pea milk: +27.37% to $60.13m (excludes blends)

- #6 Rice milk: -11.72% to $37.15m (excludes blends)

- #7 Cashew milk: -13.6% to $29.01% (excludes blends)

Top blends 52 weeks to June 12, 2022:

- Almond and coconut: -10.23% to $60.55m

- Almond and cashew: -32.1% to $17.05m

Latest 12 weeks

Looking at the latest 12 week data to June 12, 2022, sales are a little higher, especially in shelf-stable categories, reflecting inflationary pressures, with dollar sales of almond milk in the positive territory year-on-year (+2.8% refrigerated, +5% shelf-stable) along with soy milk (refrigerated +3.5%, shelf-stable +0.8%).

- Total plant-based milk: +9.5%

- Refrigerated plant-based milk: +8.7%

- Shelf-stable plant-based milk: +17%

Unit sales:

According to SPINS data for the 52 weeks to July 10, 2022 (natural enhanced and multioutlet channels), units of plant-based milks were in the positive territory, +1.9% year-on-year.

Units of refrigerated almondmilk - the biggest segment - were down -3.7%, but refrigerated oatmilk units were up +40% and pea milk up +24.2%. Refrigerated soy units were down -4.8%.

Shelf-stable almondmilk units were down -8.5%, while shelf-stable oatmilk units were up 83.8%, and shelf-stable pea units were up 43.4%. Shelf-stable soy units were down -19.4% year-on-year.

*Source: SPINS natural enhanced and conventional (IRI multi-outlet) channels, 52 weeks to June 12, 2022, excludes Whole Foods, Trader Joe’s, and convenience stores