“Cocoa is critical to our long-term business resilience and success, and as such, we have dedicated resources and strong investments in place to ensure we have a resilient supply chain for future growth,” Hershey CEO Michele Buck told investment analysts during the company’s quarterly call May 3.

“We have robust processes in place to ensure continued supply and good visibility into our costs. We are well covered for 2024 and do not expect recent volatility to affect our financial outlook for the year,” she added.

However, 2025 may tell a different story.

Hershey considers price hikes, other measures to manage cocoa costs in 2025

Even though the company has “some coverage into ’25,” Buck warned that “sustained high prices will drive inflation in 2025.”

While the company was tight-lipped about its plans for next year as it is “in the midst of building the ’25 plan,” pricing is only one lever the company is considering, CFO Steve Voskuil said. Other levers include “some transformational” savings the company has been building “for the years to come, including 2025.”

For example, he explained, Hershey has “done a good job … over the years of really trying to diversify [its] supply chain footprint. And no doubt looking back at the last few years, we will continue to move that diversification forward, but that does give us some flexibility on sourcing.”

The company also has some wiggle room around its recipes and taste profiles that offer “quite a bit of flexibility on the sourcing side,” he added.

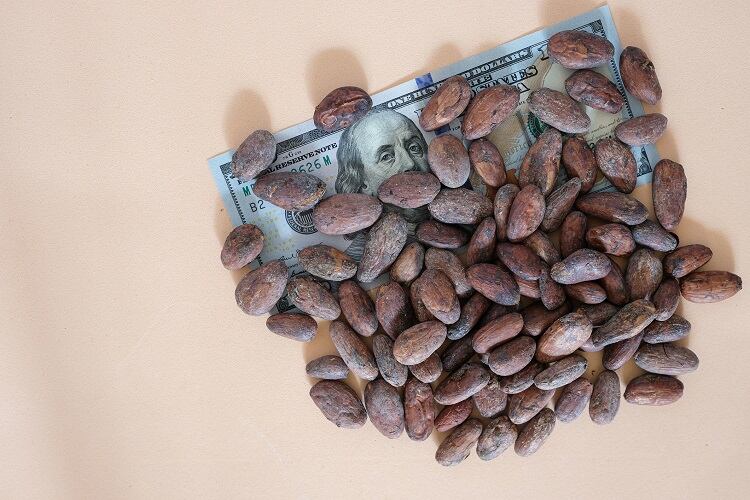

What is behind ‘tremendous volatility’ of cocoa costs?

Cocoa prices recently dropped to about a third of all-time high price of $11,000 per metric ton reported on April 19, but Buck warned the decline does not signal stability, rather is “further evidence of the tremendous volatility that we are seeing in the marketplace.”

She explained that it is “hard to peg” what is behind the most recent decline as “there are not new signals relative to supply and demand that are meaningful, yet,” beyond “perhaps some early signs about the mid-crop,” which “look good.”

She explained that “while the 2023/2024 crop in West Africa declined, we are encouraged by the growth in other regions around the world and steps being taken in West Africa to improve supply.”

For example, she said, farmer prices have increased, “which should enable them to make more investments in fertilizer, pesticides and other techniques to improve yields.”

However, she added, cocoa’s up-and-down pricing is not related solely to supply and demand.

“Lack of liquidity, new regulations and market speculation have all contributed to the record high prices we are experiencing,” she said.

Looking forward, Buck said, Hershey is focused on executing against what is within its control, and its business strategy remains to drive growth, improve share, innovate, enhance its capabilities and drive cost efficiency while it continues to monitor the cocoa environment.

With this in mind the company is optimistic about the coming quarter and reaffirmed its full year guidance including net sales growth of 2% to 3%.

Net sales for the quarter increased 8.9% to reach $3.3bn. Of this, most was attributed to higher prices and 3.4% to volume.