Despite economic uncertainty, Americans continue to buy snacks– in fact, nearly half (48.8%) of consumers are snacking three or more times a day, according to Sally Lyons Wyatt, Circana’s global executive vice president and chief advisor, consumer goods and foodservice insights.

“Even given the macroeconomic headlines that consumers have faced … we have been seeing heavier snacking for the last two decades,” Lyons Wyatt during Sweets & Snacks Expo last month said. “But, I was really curious to see if consumers still felt that snacking was part of their lifestyle, and in the US, the answer is absolutely yes.”

While the frequency of snacking remains high compared to last year, what consumers are snacking on is shifting, with both indulgence and better-for-you options playing significant roles.

Indulgence still dominates, while ‘better-for-you’ grows

While yogurt, shelf-stable yogurt and meat snacks are gaining traction, indulgent snacks still command the lion’s share of the market, said Lyons Wyatt.

That said, consumer motivations are leaning toward functional and nutrient-dense options. More than half (64%) of consumers “state that they want snacks that provide an energy boost,” while “61% state that they want snacks high in protein,” with a higher percentage for younger generations, she added.

Emerging growth areas include:

- Yogurt and yogurt drinks

- Dried meat snacks

- Nutritional bars

- Frozen handheld entrees and appetizers

Lyons Wyatt noted that these snacks “are definitely more healthy,” and as consumers aim for a more “harmonized well-being,” they are selecting options that better support their personal health goals.

GLP-1 medications reshaping snack preferences

Another key factor reshaping the snacking landscape: GLP-1 weight loss drugs.

“From a snacking perspective, the GLP-1s actually are more apparent,” said Lyons Wyatt.

Lyons Watt continued: “You’ve got some more savory options, with pretzels and sushi and appetizers, meat – so not as many sweet. They are leaning into higher protein, higher fiber, the things that they’re told to lean into.”

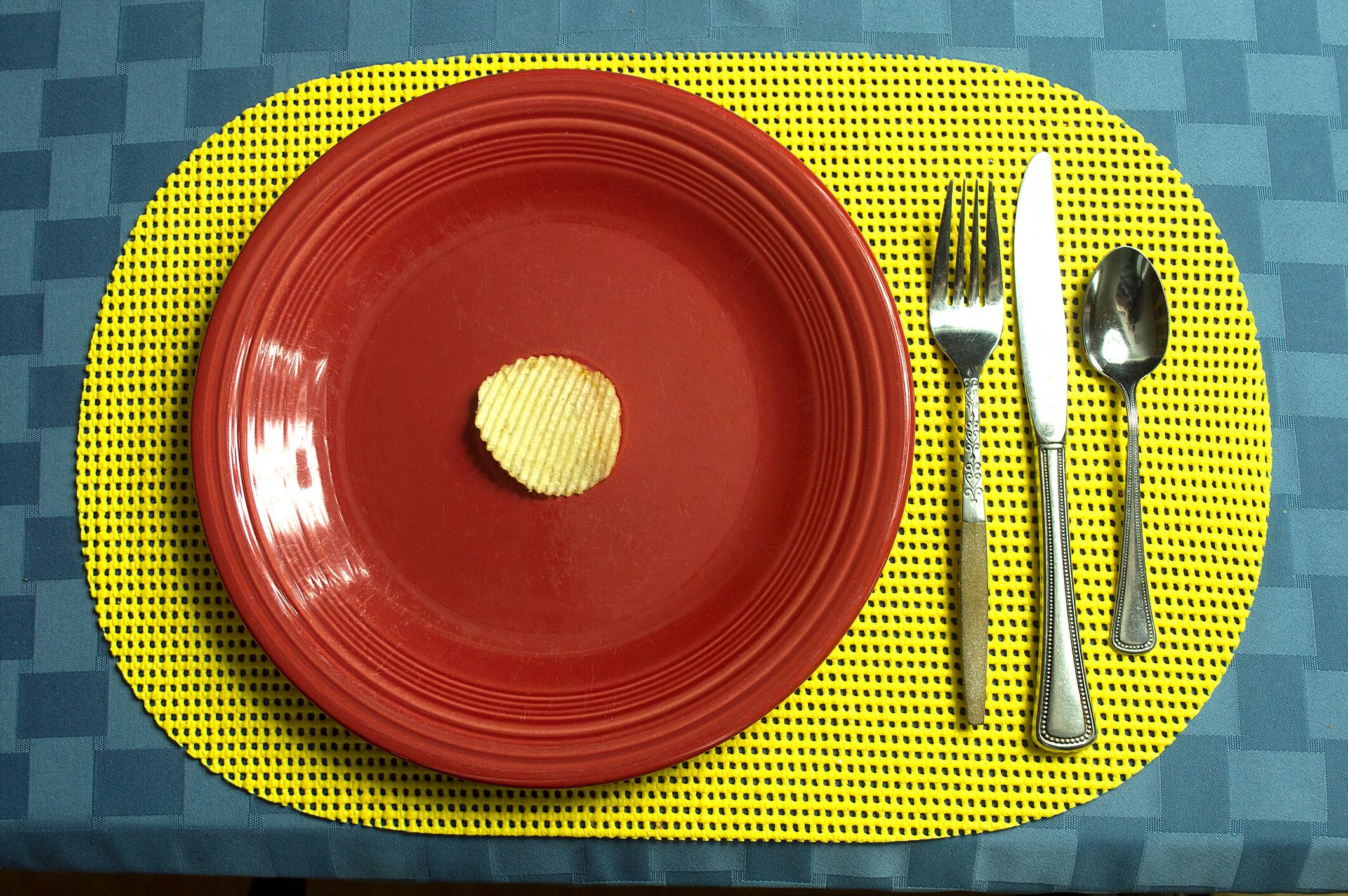

Even so, indulgence is not disappearing entirely: “You can still eat sweet, you just don’t eat as much. It makes you feel awful,” she added.

Regulation, claims and shopper priorities

Regulatory and policy changes also likely will influence product development and claims.

“Make America Healthy Again will have all the different things – changes to the front-of-package nutrition labels, all the allergens, and then the pending SNAP [policy] will have a huge impact,” she said.

Claims on-pack increasingly influence purchases, with demand growing for attributes such as fiber and organic.

A third “of consumers want high fiber to be called out on packages,” while “47% want organic labeled snacks,” which is up three percentage points from the year before, she added.

While growth in organic foods may feel stagnant in some regions, Lyons Wyatt stressed that it is still meaningful to a sizable segment of the population. “For some people, it’s table stakes now. You want to have something organic and you won’t buy unless it’s that.”

Although snacking frequency is high, core snack sales are down 1%, Lyons Wyatt said, citing more declines than increases as of early 2025. “It’s just showing that there are some discretionary foods and beverages that consumers are having to make tough decisions on.”

Still, industry stakeholders may find reason for cautious optimism.

“We’ve been here before,” she said. For core snacks, “we have seen worse years in 2022 and ’23 – that was when we were going through the double-digit price inflation.”

With consumer values evolving, manufacturers will need to strike the right balance between indulgence, functionality and affordability to stay relevant in today’s complex snacking environment, Lyons Watt added.