Keychain, an AI-led platform that connects brands with manufacturers, raised $10 million in funding from W23 Global – a venture capital fund backed by Tesco, Ahold Delhaize, Woolworths Group, Empire Company Limited/Sobeys Inc. and ShopRite Group.

The $10 million raise, announced today, follows the company’s $30 million Series B fundraise announced in August that allowed it to reach business in Ireland and the UK with its KeychainOS platform for manufacturers.

The more recent infusion of $10 million supports the launch of Keychain360, a supply chain and product management operating system designed to help retailers organize private-label products, vendor relationships, compliance and RFIs/RFPs/RFQs.

According to CEO and Founder Oisin Hanrahan, Keychain360 aims to reduce product launch times by 25–30%.

An end-to-end ecosystem for private label and emerging brands

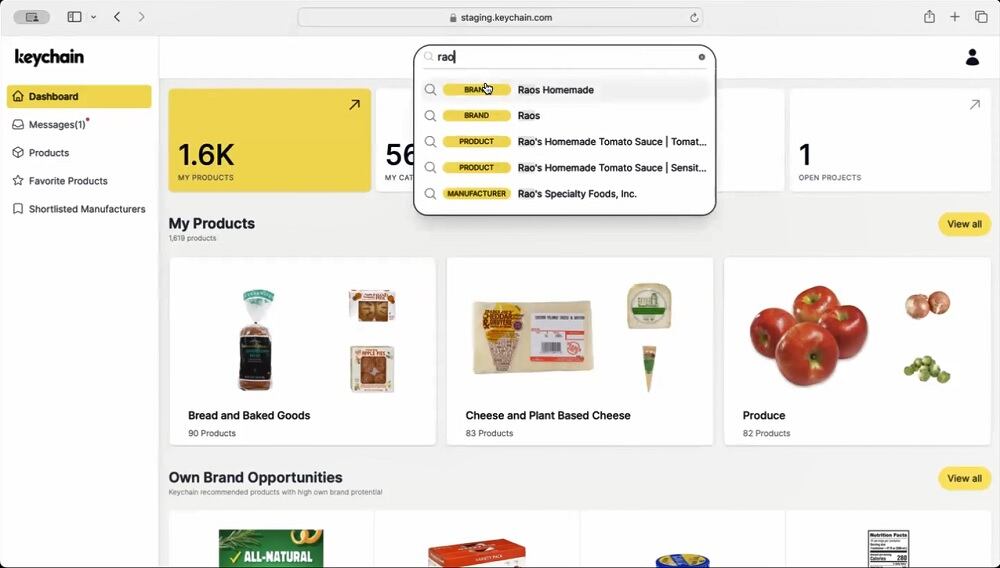

Keychain’s platform indexes more than 37,000 manufacturers and 2.5 million products, with a focus on clean-label trends and efficient supply chain operations, according to Hanrahan. Keychain360 complements the company’s existing offerings:

- Search and Discovery – helps brands and retailers find manufacturers

- KeychainOS – manages production, food safety, and procurement

“If you’ve got Search and Discovery in the middle, you’ve got an OS for manufacturers on the left, the piece that’s missing is the bit on the right – how do retailers and brands actually interact and manage their products?” Hanrahan said.

Together, these three products create an end-to-end ecosystem for product lifecycle management, from sourcing and manufacturing to retail execution, Hanrahan explains.

Why speed to market is the new competitive advantage

As large CPG brands face structural challenges, private-label and emerging brands are gaining an edge thanks to their agility and ability to scale and innovate faster, according to Hanrahan.

“They are getting products that people want into their hands faster, and that has created an environment where the speed to innovate and the speed to get product on shelf is a key determinant of success right now,” Hanrahan said.

Private label growth

Private-label sales grew 4.4% across all retail channels in what time period, according to the Private Label Manufacturers Association.

For the 52 weeks ending June 15, store-brand dollar sales reached $57.7 billion in refrigerated, $51.7 billion in general food and $14.4 billion in beverages – up 7.5%, 4.3% and 4%, respectively, PLMA reports.

Consumers see store brands as high quality – here’s why

Private label products have evolved significantly from decades past, when they were viewed as lower quality compared to national brands.

Today, they appear in unboxing videos across social media, blurring the line between premiumization and value for consumers across economic segments. Nearly 70% of consumers perceive store-brand products as high quality, according to Sprouts Farmers Market. The boost in store brands is attributed to retailers’ advantages over name brands, including better margins, lower prices, direct relationships with manufacturers and ecommerce – appealing to consumers looking for high quality, high value products.

Editor’s Note: A previous version of this story incorrectly named Keychain’s operating system as ManufactureOS - it is called KeychainOS.