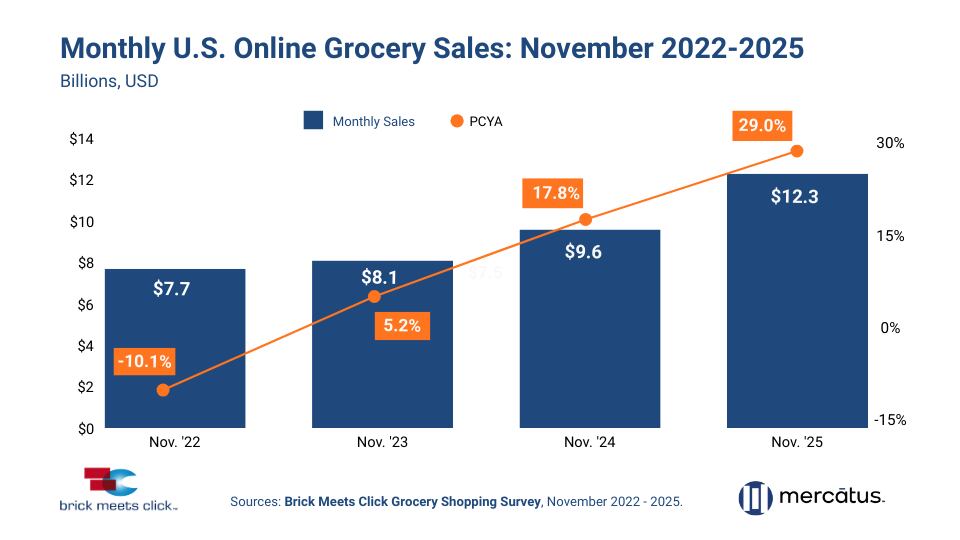

Following tempered online grocery sales growth in October, November saw a boom, with total sales surging 29% year over year to $12.3 billion, according to a Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

The sales rebound came in slightly below the all-time high of $12.5 billion in September, and was a substantial turnaround from October’s $11.6 billion in online grocery sales.

The month-over-month drop in October was due in part to the longest federal government shutdown in US history, while Amazon’s same-day grocery delivery service, launched in August, helped boost online sales in November, according to Brick Meets Click.

“November 2025 results mark a strong rebound versus the moderate growth reported for October when the US government was shut down during the entire month,” said David Bishop, partner at Brick Meets Click, adding that online grocery sales growth has accelerated every November since 2022.

Online grocery sales made up 17.1% of all grocery spending in November, up 340 basis points year over year.

Millennials driving order boost

Order frequency increased 12% compared to November 2024, with grocery shoppers placing an average of 2.8 orders online, marking the 15th consecutive month of year-over-year growth, according to the report.

Meanwhile, nearly half of online shoppers placed three or more orders in November, setting a new record in order frequency.

Shoppers between the ages of 30 and 44 led the increase, up 20% year over year with 3.1 orders on average.

That’s compared to the marginal year-over-year growth of less than 1% in October, when online sales in large metro markets declined and all other markets experienced gains ranging from 7% to 15%.

“The October 2025 results are a reminder that online grocery sales growth is not on autopilot,” Bishop said in the October report. “Customers choose how to receive online grocery purchases based on many factors, including cost and convenience, and the impact of Amazon’s same-day grocery service – which offers customers a lower-cost alternative – is becoming visible.”

Amazon same-day delivery

Amazon launched free same-day perishable grocery delivery for orders over $25 in more than 1,000 cities in August for members of its Amazon Prime loyalty program.

The service is exclusive to grocery products purchased on Amazon’s Same-Day Store portal and does not include online orders from Amazon Fresh or Amazon-owned Whole Foods Market.

Amazon said in August that it plans to expand to 2,300 cities by the end of 2025, and that rollout is beginning to show up in the Brick Meets Click data.

The ship-to-home category of order fulfillment, up 12% year over year in November, provided a sign that Amazon’s new grocery delivery option is working.

The Brick Meets Click report defines ship-to-home as orders that are fulfilled by a common carrier or contract courier like FedEx, UPS or USPS. Delivery orders, on the other hand, are fulfilled by first- or third-party providers, such as Instacart, or the retailer’s in-house delivery drivers.

While consumers might not discern the difference between delivery and ship-to-home, Bishop said Amazon solved two major friction points for consumers with the same-day service: service fees and driver tips.

“What Amazon has effectively said is, ‘Hey, Prime member, as long as you don’t spend less than $25, there’s no delivery service fee. And because this is coming out of the ship-to-home model, there’s not even an opportunity to tip,’” Bishop said in September. “So, they’ve, in essence, removed the friction points of those two explicit data points that we have always talked about as being a hurdle for broader adoption.”

Double-digit basket growth

Along with order volume and frequency, the value of online grocery orders was up in November, posting an 11% increase from a year ago.

The biggest boost came from shoppers between the ages of 30 and 44 earning $100,000 or more in large metro markets, the report noted.

“Today’s grocers face a very competitive environment marked by fundamental changes in shopping behavior,” Bishop said. “The online grocery customer pool continues to expand, order frequency has steadily grown for over a year and spending remains resilient, which shows that eGrocery is evolving from just a convenient option to the preferred way to get groceries for many.”